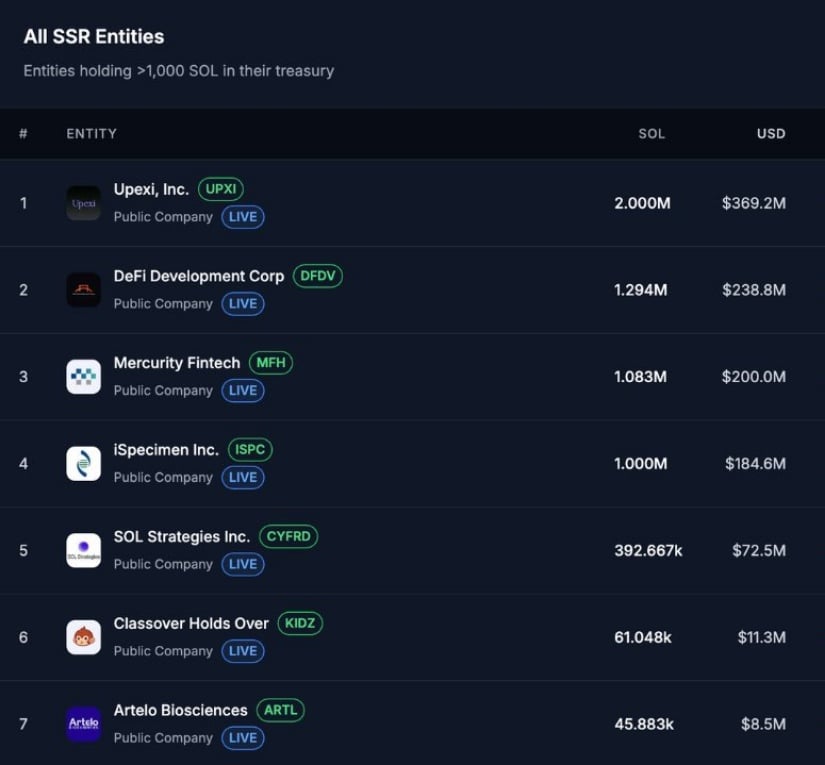

In a spectacle worthy of Nabokov himself, Solana pirouettes through the financial ether, garnering the adoration of the corporate world. An army of publicly traded entities, those titanic arbiters of risk, now hoard nearly 6 million SOL, amounting to a dazzling over $1.1 billion. With such grandiose figures, one might indeed expect a price ballet soaring above $200-a climb both audacious and electric, reminiscent of a papery moth ascending a Volkow library window in the silvery moonlight.

Institutional Accumulation of Solana: A Financial Waltz in the Moonlight

Underneath the flickering belfry of market trends, Solana conducts its own orchestral crescendo, whispering sweet nothings to institutional investors who caress millions of SOL into their vaults. Among these titans, we find Upexi Inc., DeFi Development Corp., and Mercury Fintech-names that, like melodies in Vladimir Nabokov’s mind, contribute to a symphony of stable abundance. With each murmur of accumulation, the currency waltzes towards a realm of beleaguered stability.

The worth of this grand rendezvous extends far beyond the mundanity of numbers. In Solana’s theatre, listed entities carve a path of stability and strength, the kind that reverberates with the certainty of a poised manuscript, destined to command an elevated sum.

Solana’s Graceful Assay Towards $240: Lines of Ascension

The astute Jesse Peralta, a Machiavellian maestro of crypto, notes Solana’s meticulous foray within an ascending channel-a Wall Street sonnet that has unfurled itself over several months. Each dip is greeted with the resolute embrace of buyers, while the upper boundary of the channel stands, steadfast but pipe-dreamy as ever. This fiendish cycle sets the stage for piquant momentum steering SOL towards the $240 enclave.

The setup becomes a lustrous bauble in the sky: the channel, like a lark ascending, lays down the blueprint for Solana’s elevation. By keeping its vows, Solana may gravitate ever higher towards $215 and, in a fit of financial aspiration, towards $240.

Solana’s Lustre Against Bitcoin: A Fiery Reversal Tale

While Solana’s USDT pair hums elegantly within its well-worn ascending channel, the SOL/BTC pair exhibits the flair of a romantically rebellious underdog-a potential harbinger of outperformance against Bitcoin. The astute Daniel Ramsey discerns a double-bottom formation on the 3-day chart, a scenario akin to a dramatic crash on a stage, where a flip of the neckline’s fate could unleash impending regency over Bitcoin.

Such triumph, a geometric mirage confirmed, may escort the ratio to loftier altitudes around 0.021, elevating the narrative of institutional delight that cradles Solana. With SOL threading toward $240 and BTC flirting with bullish rhythms, we are but spectators in a dual narrative drenched in strength, a tale that lends hesitation even to the most stubbornly gloomy predictions.

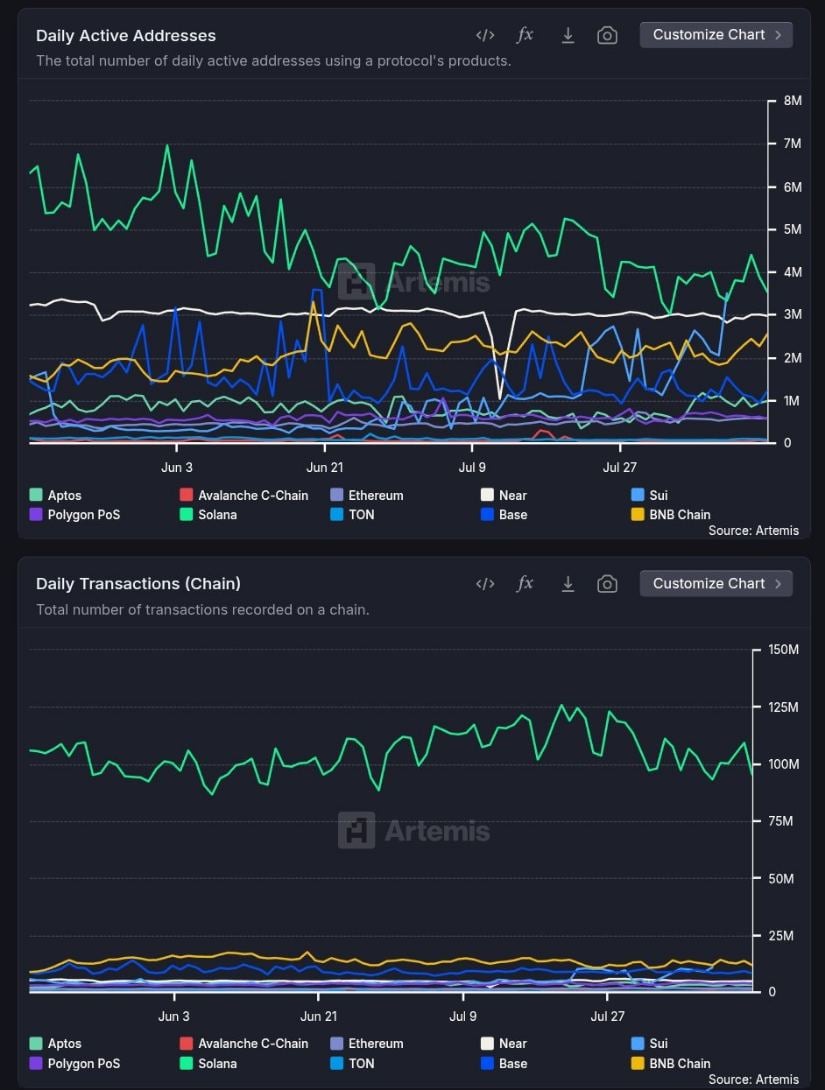

On-Chain Dominance of Solana: Beyond Just Numbers

In polished, contemporary analysis reminiscent of Nabokov’s dazzling intellectual wiles, The Solana Post shines a spotlight on the network’s on-chain debonair performance. The chain sails undaunted with daily active addresses and flourishing transaction counts, outstripping the usually languid moves of chains like Ethereum and its compatriots.

This feverish activity serves not merely as a statistical flourish but as a cornerstone for Solana’s long-term valuation ascension-a symphonic overture to perpetuity.

Solana Price Prediction: A Riddle in Fibonacci Sequences

A marvelous envisioning of the Elliott Wave unfurls, as price action delicately makes its terminus through the quintessence of a five-wave impulse. Splendidly having leaped from the corrective chasm of wave (4), the movement genuflects towards its projected destiny, whispering whispers of ultimate culmination in the wave (5), notedly targeting the lofty citadel of $260 to $280.

Epilogue: Can Solana Continue its Vain March?

Amid the crescendo of institutions holding millions of SOL and price action mirroring a decorous ascending channel, the narrative of Solana edges ever closer to the persistent rhythm of reliability. An alliance of on-chain sovereignty, potent technical frameworks, and the whims of corporate demand orchestrates a composition where $240 dawns as a tangible reality. If the serpentine paths of Elliott Wave come to pass, $260 to $280 may unravel from fantasy to clear forecast.

Thus, Solana dances both with confidence-against the shekels-and potentially, with dominant grace in its BTC encounters. Will it maintain its mesmerizing ballet?

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-17 16:29