Hold onto your wallets, folks! Ethereum (ETH) is strutting its stuff and getting dangerously close to its all-time high, while Bitcoin is left wondering where it went wrong! According to the latest gossip from Cryptoquant, investors are throwing their hats in the ring for ETH like it’s a hot new dance craze! 💃🕺 But wait! Researchers are waving their arms like they’re at a rock concert, warning that rising selling pressure could rain on this parade! 🎤🎸

Institutional Investors Jump on the ETH Bandwagon via ETFs, Data Shows

Ethereum (ETH) hit a jaw-dropping $4,743 on August 14, its highest since November 2021, and just a hop, skip, and a jump away from its previous peak of $4,865! Cryptoquant researchers are practically throwing confetti! 🎉 But here’s the kicker: the ETH/BTC price ratio has crossed above its 365-day moving average! Historically, that means Ethereum is ready to party like it’s 1999! 🥳

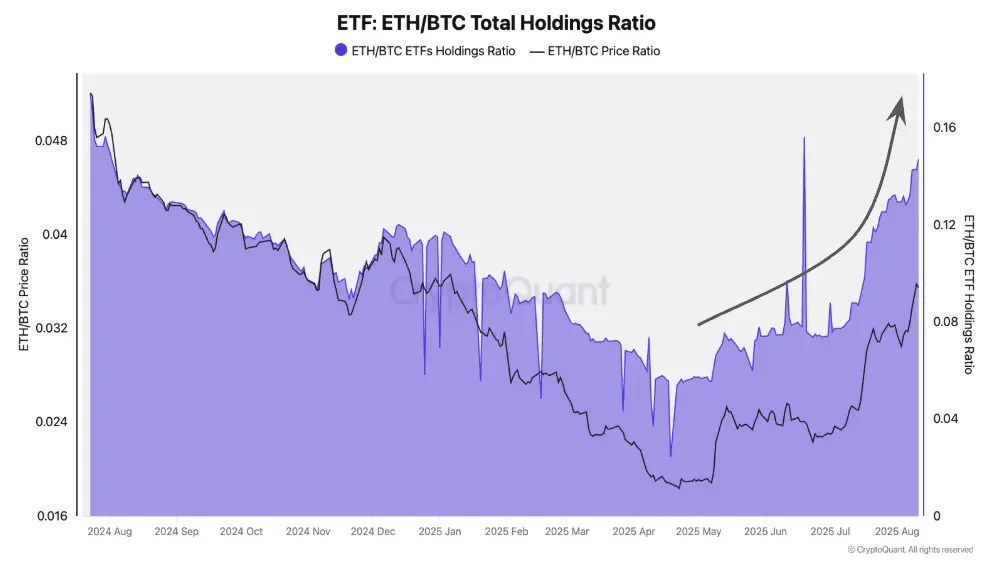

And guess what? Institutional interest is surging like a caffeinated squirrel! 🐿️ Thanks to spot exchange-traded funds (ETFs), cryptoquant.com data reveals that the ETH/BTC ETF holdings ratio jumped from 0.05 to 0.15 in just three months! That’s like going from a kiddie pool to the Olympic-sized one! 🏊♂️ Meanwhile, ETH open interest in perpetual futures markets is growing faster than a teenager’s appetite, with the ratio soaring from 0.57 to 0.76! 🍕

Spot trading volume is showing ether’s momentum like a contestant on a game show! 🎲 ETH’s weekly spot volume has outpaced Bitcoin’s for four weeks straight, recently by a whopping $10 billion ($24B vs. $14B)! The ETH/BTC trading volume ratio hit 1.66, its highest since June 2017! Talk about a comeback! 🎊

But hold your horses! 🐴 Despite all this excitement, Cryptoquant analysts are playing the role of the party poopers. Daily ETH inflows to exchanges are now outpacing Bitcoin’s, which means holders might be ready to cash in their chips! 💸 The ETH/BTC exchange inflow ratio has gone from low to high selling pressure faster than you can say “sell, sell, sell!”

And if that’s not enough, the ETH/BTC MVRV ratio – which measures how much you’re getting for your buck – has jumped from 0.4 to 0.8 since May! It’s nearing the 0.9 threshold where Ethereum historically becomes about as overvalued as a Hollywood starlet’s ego! 🎬 Researchers are cautioning that this could limit near-term gains if sentiment takes a nosedive! 🚀

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

2025-08-16 21:28