Ah, the absurd ballet of the financial world! Behold, dear reader, as the illustrious Vitalik Buterin, the maestro of Ethereum, spins a tale so ludicrous it could only be birthed from the mind of a man who has gazed too long into the abyss of blockchain. In a recent soliloquy with the Bankless podcast, our hero jestingly crowned the U.S. government as his most cherished “treasury company,” a title as fitting as a top hat on a clown. 🌟🤡

“Ah, the times when the authorities, those noble custodians of order, have snatched the ill-gotten Ethereum from the clutches of scoundrels!” he exclaimed, his voice dripping with the honeyed sarcasm of a man who has seen the absurdity of it all. 🕵️♂️💎

The Treasury Tightrope: A Dance of Folly and Fortune

Ethereum treasuries, those peculiar creatures of corporate finance, have emerged as both saviors and specters. Companies, in their infinite wisdom, allocate their reserves to Ether (ETH), offering investors a roundabout embrace with the cryptocurrency. Buterin, ever the pragmatist, acknowledges the boon: “Different vehicles for the masses to clutch at ETH? Splendid!” Yet, his brow furrows at the specter of over-leverage, a beast that could unravel the tapestry of Ethereum’s glory. 🧵🧨

“Imagine, if you will, a future where the Treasury, that grand edifice of fiscal prudence, becomes the harbinger of ETH’s doom!” he mused, his tone a mélange of jest and foreboding. “Over-leveraged games, my dear friends, are the quicksand of the financial world.” 🏜️💸

Yet, fear not, for Buterin places his faith in the “responsible people” of Ethereum’s realm, those stalwart souls who would sooner part with their limbs than allow treasuries to destabilize the network. 🛡️🦸♂️

Ethereum ETFs: A Carnival of Capital

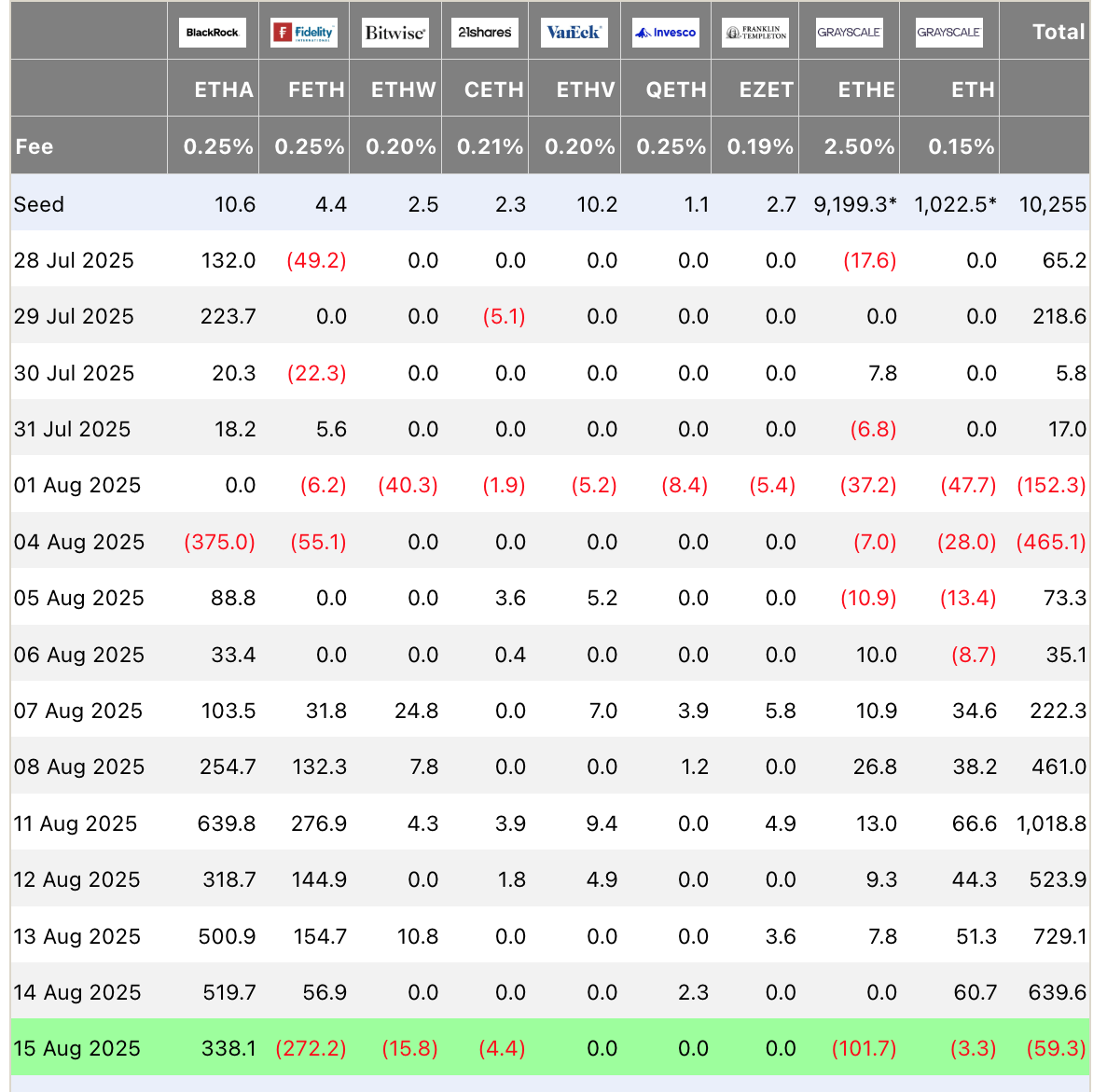

Meanwhile, in the grand bazaar of finance, Ethereum ETFs have unleashed a frenzy of unprecedented proportions. This week alone, net inflows soared to a staggering $2.85 billion, with trading volumes eclipsing $17 billion. Behold the tweet of Eric Balchunas, a herald of the financial age:

Spot Bitcoin + Ether ETFs did about $40b in volume this week, biggest week ever for them, thanks to Ether ETFs stepping up big. Massive number, equiv to a Top 5 ETF or Top 10 stock’s volume. 🎢💹

– Eric Balchunas (@EricBalchunas) August 15, 2025

On Monday, the ETFs achieved their zenith, with single-day net inflows reaching $1.01 billion. The first fortnight of August has witnessed over $3 billion in inflows, making it the second-most glorious month in their brief yet illustrious history. 🏆📈

BlackRock, that titan of asset management, has led the charge with its iShares Ethereum ETF, amassing a $519 million inflow on August 14. Though the week concluded with a modest net outflow of $59 million across all funds, BlackRock remained undeterred, adding another $338 million on August 15. By the end of July, the behemoth had already hoarded $11.4 billion worth of Ethereum, a testament to its unshakable faith in ETH, even as the market danced to the tune of volatility. 🕺💪

And so, dear reader, we leave you with this tableau of the absurd: Vitalik, the U.S. government, treasuries, and ETFs, all twirling in a mad waltz of finance and folly. What will the future hold? Only the blockchain knows. 🌌🔮

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

2025-08-16 15:42