Ah, Bitcoin, that capricious digital diva, has once again donned its sequined gown of volatility and pirouetted to a fresh all-time high. But alas, dear reader, this was no Swan Lake-more like a clumsy cha-cha as the price tripped over itself, reversing with such alacrity it left latecomers clutching their metaphorical pearls (and possibly their wallets). We now find BTC waltzing within the $116K-$124K range, performing what can only be described as the “Sideways Shuffle.” 🕺

Technical Analysis

By ShayanMarkets (who may or may not moonlight as an oracle)

The Daily Chart

Behold, the daily chart-a veritable canvas of chaos painted in candlesticks! Buyers, those valiant fools, managed to propel Bitcoin above its previous peak at $124.4K. Yet, like Icarus flying too close to the sun, they were promptly scorched by heavy selling pressure. A classic bull trap unfolded, ensnaring hopeful longs in its sticky web of despair. Now, BTC teeters on the edge of a key support zone around $118K, where destiny hangs precariously in the balance. Will it rebound like a rubber ball? Or plummet like a poorly aimed dart? Only time-and perhaps some tea leaves-will tell. 🎯📉

The 4-Hour Chart

Zooming into the 4-hour timeframe, we witness a spectacle worthy of Shakespearean tragedy: liquidity hunters galore! Price surged tantalizingly above recent highs, triggering breakout buys and stop-loss orders alike before executing a dramatic U-turn faster than you can say “margin call.” This left traders gasping for air as the asset cascaded below the most recent swing low, hinting at a potential shift in market structure. For now, Bitcoin languishes in purgatory between $116K and $124K, teasing traders with promises of clarity while delivering nothing but choppy indecision. Choppy indecision, I might add, served with a side of existential dread. 🍴🎲

On-chain Analysis

By ShayanMarkets (still waiting for that Nobel Prize nomination)

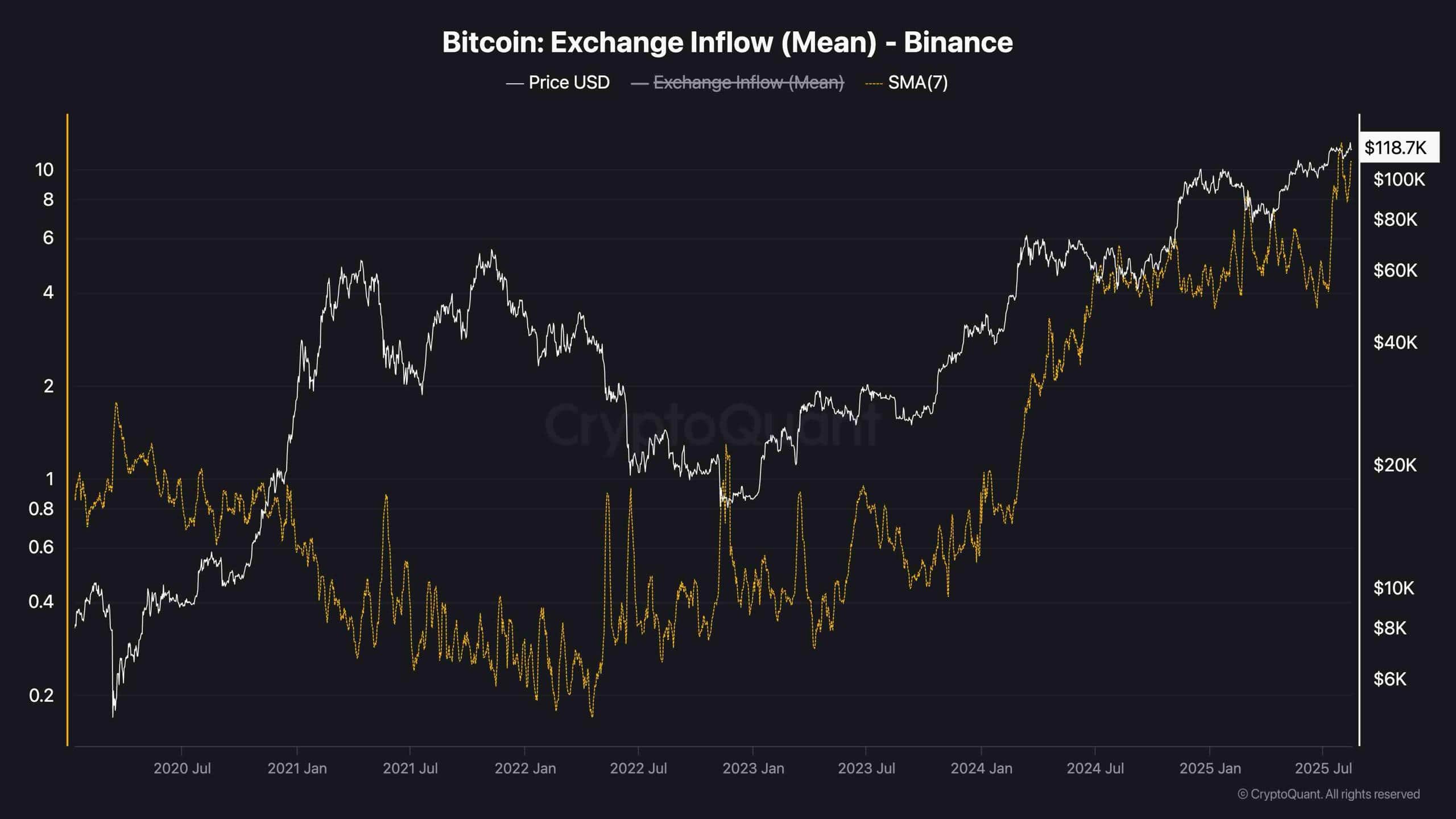

Let us turn our gaze to the blockchain, that immutable ledger of truths and half-truths. Recent data reveals a sharp spike in Binance’s Mean Inflow, reaching levels not seen since Bitcoin last wore bell-bottoms. Such inflows often signal preparation for selling, collateral maneuvers, or institutional portfolio rebalancing-activities one might describe as “financial Feng Shui.” Unfortunately, when inflows outpace buying demand, the result is akin to inviting guests to a party but forgetting to order snacks. Spoiler alert: things get awkward fast. 😬💸

Adding insult to injury, positive netflow-the difference between inflows and outflows-has also swelled, suggesting that more BTC is being funneled into exchanges than withdrawn. Without robust spot demand to counterbalance this influx, large holders appear poised to either sell or hedge positions via derivatives. And so, short-term downside volatility looms ominously, like a storm cloud hovering over your picnic plans. Bring an umbrella-or perhaps a parachute. 🌧️🪂

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

2025-08-15 20:34