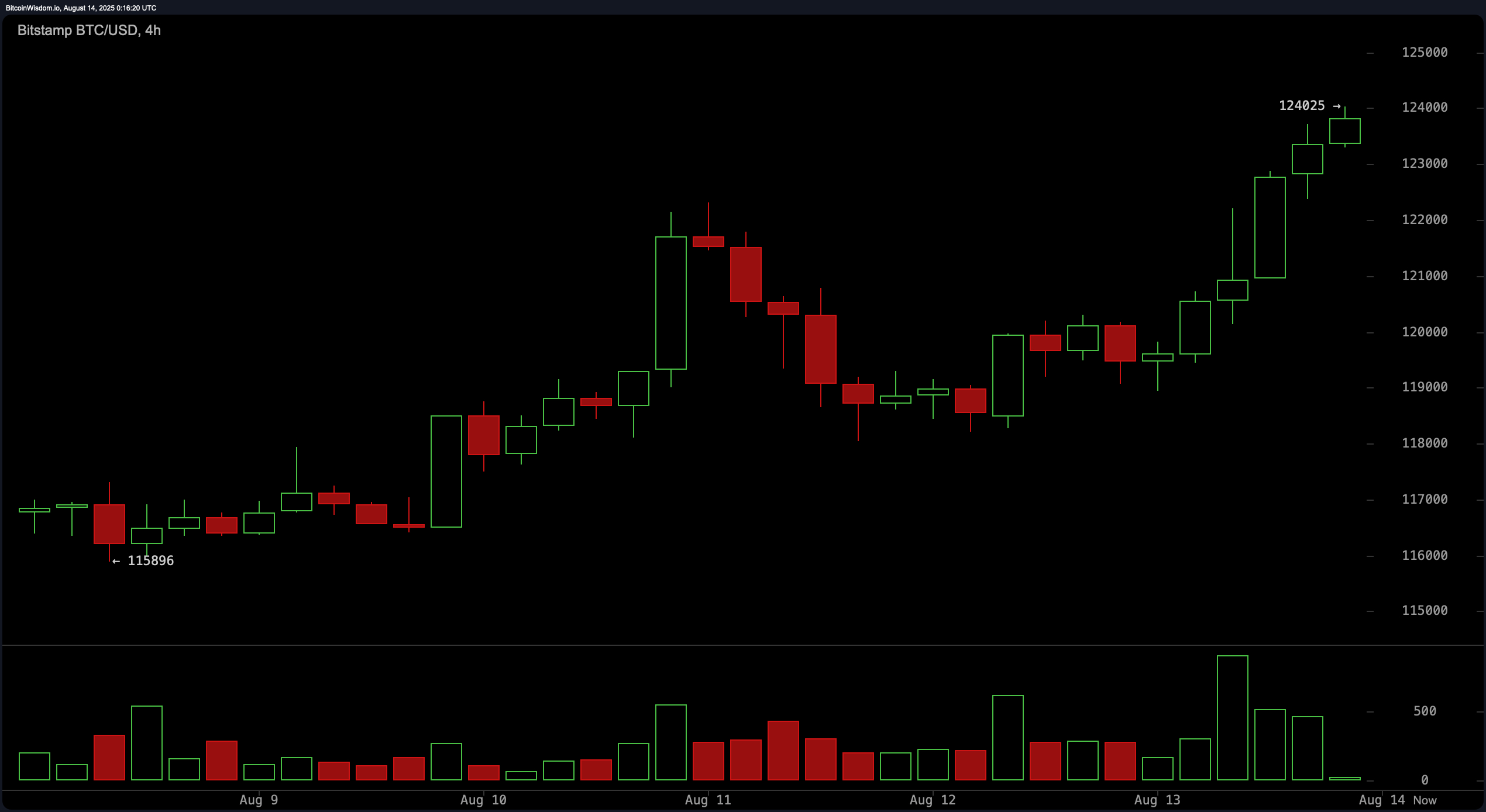

Ah, Bitcoin. That digital phantom, that fever dream of the modern age. It has, so they say, breached the lofty edifice of $124,025. A number, a mere string of digits, yet it seems to hold such sway over the souls of men! 💸 Between the hours of seven and eight in the evening, Eastern time, this… thing… dared to surpass its previous, equally arbitrary peak. Now, its “market capitalization” – a phrase I find increasingly absurd – eclipses even the venerable Google. Fifth largest asset globally, they proclaim! As if mere quantity could measure the weight of human longing.

Bitcoin’s New High – Traders Gamble on the Void

On Bitstamp, a place of digital reckoning, this Bitcoin (BTC) dared to climb, past the $123,236 mark of July 14th, 2025. A trivial increment, wouldn’t you say? Yet, it now boasts a capitalization of $2.458 trillion – a sum that would, no doubt, alleviate much suffering if redirected towards, say, feeding the poor. 🤔 The heaviest trading, predictably, occurs on platforms named with unsettling enthusiasm: Binance, Bybit, Coinbase, Upbit, and OKX. These are the new cathedrals, are they not? Where faith is placed not in God, but in algorithms.

The “active pairs” – USDT, FDUSD, USD, KRW, EUR, and JPY – are but a bewildering alphabet soup of currencies, all chasing the same phantom wealth. The “market indicators,” as they are so coldly named, lean “bullish.” RSI, momentum, MACD… such clinical terms to describe the irrational exuberance of the crowd. The moving averages, too, track positively. It seems the world is determined to believe, even in the face of… well, everything. 🙄

And yet, even as BTC clings to its newfound height, it controls a mere 58.8% of the total crypto market – a market dominated by phantasms and fueled by speculation. Ethereum and its brethren have also risen, driven by the same relentless tide. Bitcoin options trading is “heating up”, with calls – that is, bets on further increases – leading the way. On Deribit, 61.93% are calls, leaving a paltry 38.07% for puts. They’re anticipating $140,000! $200,000! The audacity! 🤩 But, is it not the nature of man to reach for the impossible? Or is it simply the nature of man to be fooled?

The options market whispers of “acceleration”, of “aggressive upside potential”. Such language… it suggests not optimism, but a frantic clinging to hope, a desperate attempt to justify a system built on nothing but air. 💨 The currents of capital intensify. Trading concentrates. Bitcoin deepens its insidious grip on the crypto… economy. Institutional shifts, strategic recalibrations… it all sounds so grand, so important, while the true tragedy unfolds beneath the surface.

As the flow of capital increases, Bitcoin’s influence grows. It threatens to prompt changes in the established order, in the way things have always been. It is a test, you see. A test of our sanity. A test of our understanding. Will we succumb to the digital delusion, or will we remember what truly matters? A question for the ages, wouldn’t you say? And one which, I fear, will be answered not by logic, but by greed.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Witch Evolution best decks guide

2025-08-14 03:34