Hold onto your wallets, folks! This week is shaping up to be a rollercoaster for Bitcoin, and if you’re not on the edge of your seat, well, you might want to check your pulse. With US inflation taking center stage and oil supply predictions on the way, it’s going to be one of those “data-heavy” weeks where macroeconomic forces decide whether Bitcoin breaks out of its comfy consolidation phase and hits fresh highs… or continues to linger in the land of uncertainty. 🚀

Brace Yourselves: Crypto Market Prepares for Impact

The July Consumer Price Index (CPI) is hitting the market Tuesday, August 12 at 14:30 CEST (08:30 ET). According to Bloomberg’s survey, the economists are betting on a 0.3% increase in the core CPI month-over-month (because apparently, inflation just can’t stop doing its thing). Meanwhile, headline CPI is expected to rise by 0.2% m/m, with the year-on-year figure hanging around 2.8%, just a smidge higher than June’s 2.7%. 🌍

The Cleveland Fed’s real-time nowcast is showing similar numbers-around 2.7% for headline and 3% for core. Translation: markets will be watching like hawks. If that 0.3% core CPI holds, it’ll tell the world that inflation is sticky, but not exactly on the warpath-unless of course, tariffs or energy prices make a surprise guest appearance. 😬

Then, on Thursday, August 14, we’ve got Producer Prices to chew on. The consensus is for a modest 0.2% increase, which would imply only slight pressure on prices-unless services margins decide to throw a curveball. Who knows? It’s 2025, anything can happen. 💥

Retail sales data is expected on Friday, August 15, with predictions of a 0.5% month-over-month increase. If sales are booming, the chatter around “higher-for-longer” rates will only intensify-unless the numbers come in cooler, in which case, well, the rate hikes might take a breather. 📉

Now, if you thought the economic data was all there is to worry about, think again. Energy prices could shake things up big time. OPEC’s oil market report on Tuesday, August 12, will give us some clues about supply growth. And on August 13, we’ll get the IEA’s oil market insights, which could send inflation expectations into overdrive. Let’s just say, it’s a volatile cocktail of data. 🍸

On the crypto front, FTX’s estate will set Friday, August 15 as the record date for its next cash distribution cycle. That’s right, the cash from FTX’s big ol’ bankruptcy payout is finally trickling in. But don’t get too excited-actual funds won’t land until September 30. Mark your calendars, but don’t hold your breath. 🤑

Ethereum, meanwhile, has some corporate-treasury drama to add to the mix. SharpLink Gaming, which has been quietly amassing Ethereum like it’s a hobby, is holding its Q2 2025 earnings call on August 15. They’re sitting on over half a million ETH-so, any changes in their strategy could set the ETH price on fire. 🔥

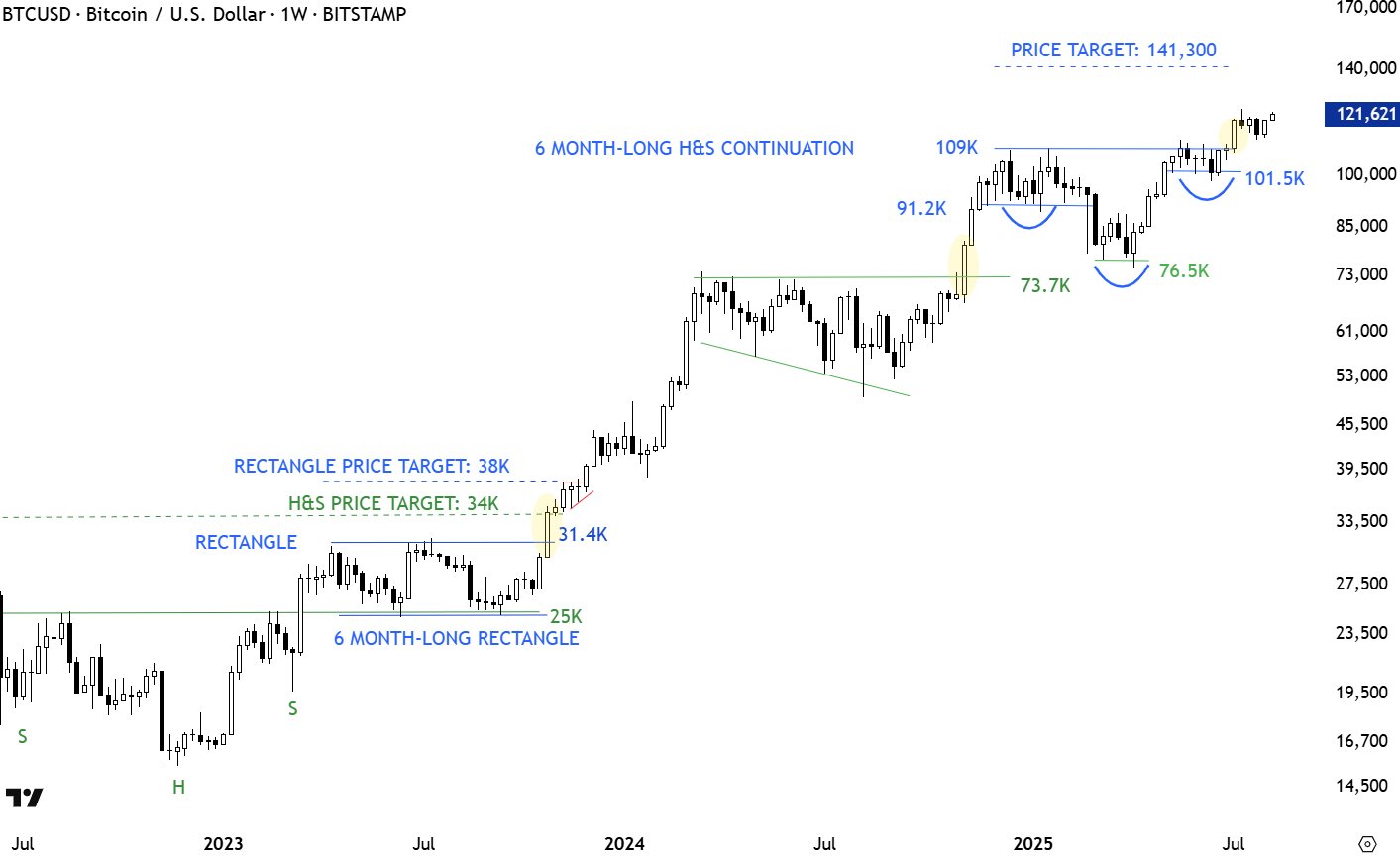

And here we are-Bitcoin. At the time of writing, it’s just a hair under $122K, with a record-high of $123,153 tantalizingly close. Aksel Kibar, CMT, describes the current price action as a “text-book pullback” and is watching for acceleration this week. If Bitcoin breaks past $123.2K, we could see another leg up. So yeah, it’s crunch time. 🧐

At press time, BTC traded at $121,699. Stay tuned, it’s about to get interesting! 🚨

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-08-11 14:53