In a turn of events that would make even the most stoic of butlers raise an eyebrow, Uniswap has decided to break free from the shackles of local downtrend resistance, adding a delightful dash of momentum to its recent escapades. One can almost hear the cheers of the bulls echoing through the digital halls of cryptocurrency! 🐂💰

With trading volume strutting about like a peacock and a series of successful technical breaks over the past weeks, our dear asset is now eyeing those higher resistance points that it last flirted with months ago. It’s like watching a romantic comedy where the lead finally gets the girl-only this time, the girl is a price point, and the lead is a rather sprightly cryptocurrency.

Uniswap Breaks Free from Local Downtrend Resistance

In a recent post on the ever-charming platform X, analyst Crypto Rand has pointed out that UNI has gallantly surpassed several resistance barriers, with the latest move clearing a local downtrend line. The 3-day chart reveals a reversal from the extended decline earlier this year, with price action reclaiming the $9.00 and $10.00 zones. Now, it’s consolidating above $11.00, right in the midst of a historically contested price area-like a game of musical chairs, but with more money and fewer chairs.

Key support levels are still lurking about, including zones near $8.00 and $6.20, which could offer stability in case of any dramatic retracements. The breakout from the descending channel indicates that buyers are back in the driver’s seat, and they’ve got the pedal to the metal!

If the buying pressure continues to be as relentless as a dog with a bone, $13.00 could emerge as the next upside target. This transition from corrective movement to structural recovery is akin to a phoenix rising from the ashes-if the phoenix were a cryptocurrency, that is.

Market Data and Trading Activity

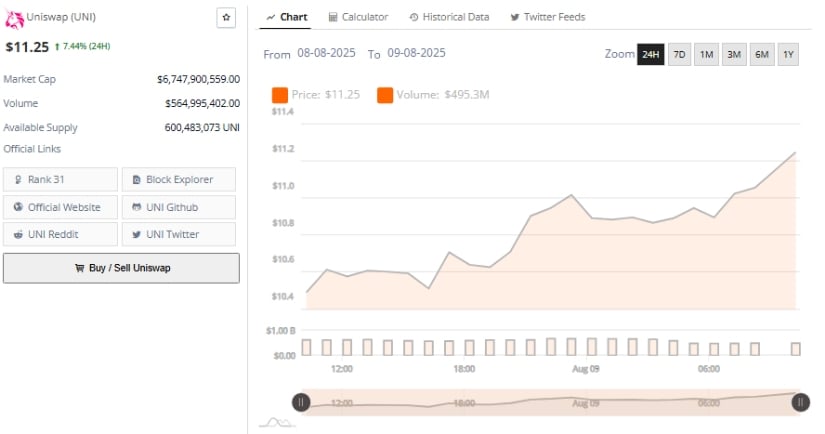

According to the ever-reliable BraveNewCoin, UNI is currently valued at $11.25, reflecting a rather impressive 7.44% rise over the past 24 hours. Its market capitalization stands at approximately $6.74 billion, ranking it 31st among cryptocurrencies-right up there with the big boys! 🎩

Trading volume over the same period reached a staggering $564.99 million, with a circulating supply of about 600.48 million tokens. These figures indicate robust liquidity and active market participation, much like a bustling bazaar where everyone is trying to outdo each other.

The 24-hour chart shows a climb from below $10.80 to above $11.40 before stabilizing, much like a tightrope walker finding their balance. Volume peaked during early trading and stayed elevated throughout the session, demonstrating continued interest from market participants. The gains were achieved without sharp pullbacks, indicating a gradual build-up of positions rather than a wild speculative frenzy-thank goodness for that!

The absence of strong selling pressure suggests that the current momentum could be sustained in the near term. Gradual upward movements tend to provide a stable base for extended rallies, especially when accompanied by consistent volume. Should liquidity levels remain steady, the price could continue to trend higher within a controlled structure-like a well-rehearsed dance number.

Technical Indicators Support Upward Momentum

At the time of writing, according to TradingView, Uniswap is trading at $11.255, marking a 3.63% daily increase. Price is positioned near the upper Bollinger Band at $11.487, showing firm buying activity-like a stampede of enthusiastic buyers at a sale! 🛍️

The middle band, at $10.136, serves as immediate dynamic support, while the lower band at $8.785 remains the distant downside level. The Relative Strength Index (RSI) is at 65.28, moving close to overbought territory but not yet signaling market strain-so no need to panic just yet!

Candlestick patterns point to steady gains since early August, with consistent closes above the 20-day moving average. The break beyond $11.00 has shifted attention to the next resistance at $11.686, a previous swing high-like a high jumper aiming for the next bar!

Volume trend and RSI levels indicate healthy momentum, though the RSI’s proximity to 70 warrants observation. Sustaining a price above the mid-Bollinger Band could preserve the bullish structure, while a drop below it may lead to short-term consolidation-like a well-timed intermission in a theatrical performance.

If the present trend holds, UNI’s breach of key resistance and consistent buyer presence could keep it well-positioned for further tests of upper resistance levels in the coming sessions. And who knows? Perhaps we’ll soon be toasting to even higher prices with a glass of bubbly! 🥂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-09 21:43