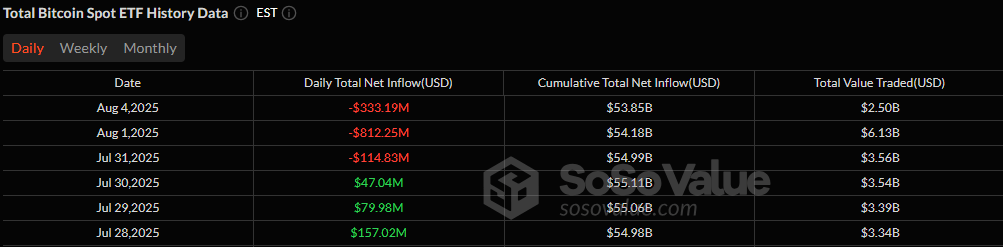

Early Monday morning, the crypto world looked like a ghost town. Bitcoin ETFs, the supposed heroes of the digital gold rush, took a beating of $333 million, while Ether ETFs decided to throw a record-breaking exit party, leaving the scene with $465 million lighter. It’s as if the investors packed their bags and vanished into thin air, leaving behind a trail of red ink and broken hopes. The total loss? Nearly $800 million in a single trading shot-no punchline, just a punch to the wallet.

Crypto ETF Sell-Off: Bitcoin and Ether Funds Post $798 Million Combined Outflow

It was the kind of day that makes you wonder if the crypto bubble finally popped or if someone just finally noticed the emperor was walking around naked. The sell-off was swift and brutal. Bitcoin ETFs hemorrhaged $333.19 million, but the crown went to Ether ETFs with an eye-watering $465.06 million-perhaps trying to escape the unrest, or maybe just chasing after that elusive “correction” everyone’s whispering about. Either way, it’s the summer’s biggest carnival of red flags. The combined exit was enough to make anyone question whether the magic is over or if this is just a brief summer storm.

Notable casualties include Blackrock’s IBIT, which gave up $292.21 million with the grace of someone throwing in the towel, Fidelity’s FBTC lost a modest $40.06 million-because even giants get tired-and Grayscale’s GBTC and Valkyrie’s BRRR added their name to the casualty list, hemorrhaging nearly $20 million combined.

Meanwhile, a tiny $18.74 million trickled into Bitwise’s BITB-think of it as the last ember flickering in the wind, far too faint to stop the flood. Total BTC ETF volume danced around $2.50 billion, with net assets sticking stubbornly at $147.96 billion-because why not keep the illusion alive?

Ether ETFs had it even worse. Blackrock’s ETHA led the mass exodus with a jaw-dropping $374.97 million out, leaving behind the faint hope that maybe next time will be better. Fidelity’s FETH trailed with $55.11 million, while Grayscale’s ETHE and Ether Mini Trust combined bled another $34.98 million, like a leaky faucet in a sinking ship. Trading volume was hefty at $1.92 billion, but net assets still slipped down to $20.47 billion-because nobody wants to stay when the party’s over.

So, the big question looms-was this just a summer tantrum, or are investors finally waking up from an overhyped dream? Either way, the sell-off makes one thing clear: the crypto rollercoaster ain’t over, and nobody knows whether it’s a loop-de-loop or the final drop.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-08-05 17:57