Bitcoin (BTC), the crypto equivalent of that one guy at the party who never quite knows when to leave, is down 3.6% over the past week. It fell from a rather impressive $119,800 to a somewhat less impressive $114,500—because why not make things a bit more exciting, right? 💸

The Tale of the Disappearing Bitcoin ETF Funds

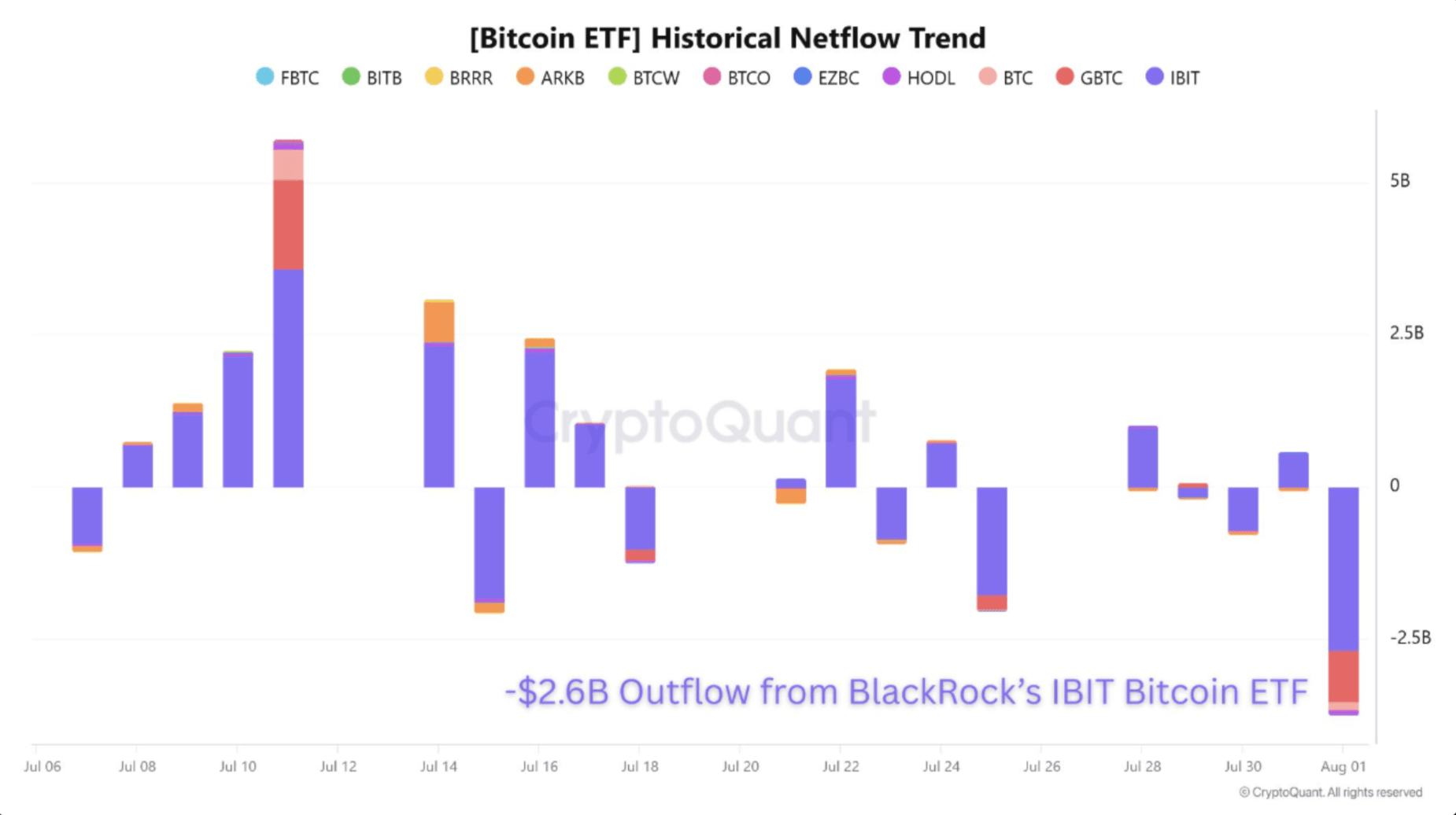

On August 1, something not-so-shocking happened: BlackRock’s IBIT Bitcoin ETF took a massive hit, with a dramatic $2.6 billion outflow. Yes, billion. That’s with a “B.” It’s the highest outflow in the past two months, and no, it’s not the plot of a high-budget drama series, though it could be. 🍿

Our ever-watchful contributor, Amr Taha, pointed out that institutional investors were apparently tired of the Bitcoin ETF party and decided to leave early. Just a few weeks ago, things were looking up with positive inflows, but now? Caution seems to be the word on everyone’s lips, as confirmed by the data gods at SoSoValue.

For the week ending August 1, US-based spot Bitcoin ETFs saw a net outflow of $643 million, ending a seven-week streak of glorious, near-mythical positive inflows. In total, that seven-week party had seen more than $10 billion come in. And now… it’s all gone, like a soufflé that collapsed under the weight of reality. 🎭

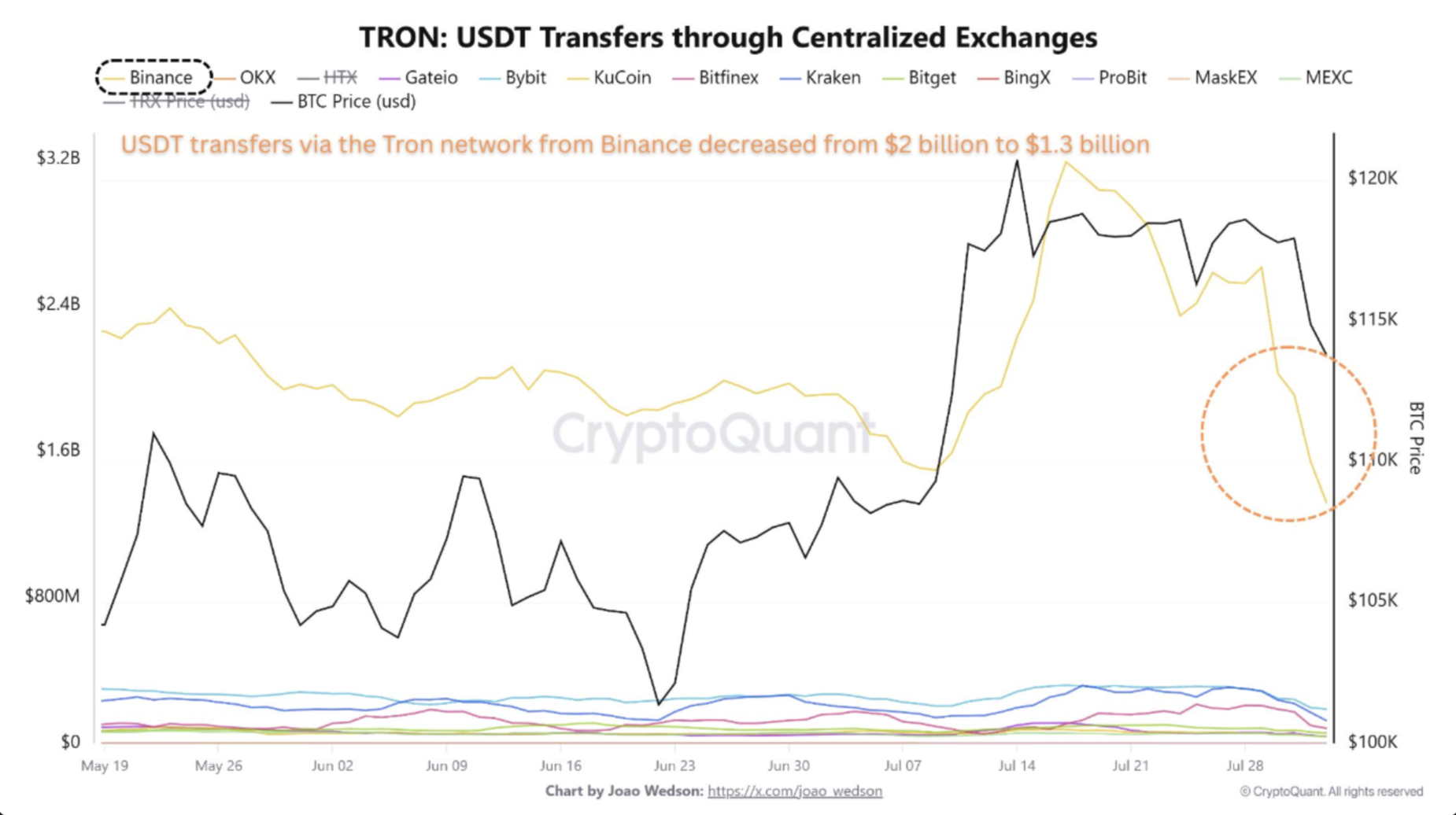

Now, for a twist worthy of a crime thriller: BlackRock’s $2.6 billion outflow wasn’t mirrored by other ETFs. But here’s the real kicker: the outflows and the sudden drop in USDT transfers on the Tron network are related. Are we entering the realm of conspiracy theories? Well, it sure looks like it.

As Taha keenly observed, alongside the outflows from IBIT, Binance-origin USDT transfers on Tron dropped by 35%, from $2 billion to $1.3 billion. That’s like watching someone order the most expensive bottle of wine at a fancy restaurant, and then suddenly say, “Actually, I’ll just have water, thanks.” ⛔

“The timing strongly suggests a link between the ETF-driven selling pressure and the accelerated pace of stablecoin withdrawal via Tron, a blockchain known for lightning-fast transactions,” says Taha, who obviously has a PhD in Crypto Sherlock Holmes-ing.

Tron, with its ultra-low fees and high-speed capabilities, has been the blockchain darling for retail and institutional transfers alike. A drop in USDT transfers from Binance, coupled with IBIT outflows, could mean one thing: the institutional crowd might just be cooling off. 🧊

Binance continues to lead the pack in Tron-based USDT transfers, so when it sneezes, the entire market catches a cold. Or maybe just a small sniffle. Either way, their volume trends tend to reflect shifts in investor sentiment like a poorly kept secret. 🤐

Fresh Data: Forecasts and Fables

Now, if you were hoping for a happy ending, well, buckle up. New exchange data suggests that Bitcoin could be heading into some choppy waters. For instance, Binance’s net taker volume dropped to a not-so-cheerful -$160 million last week, signaling that there’s a bit more selling than buying going on. 🚨

On the technical front, crypto analyst Josh Olszewicz predicts that BTC might be range-bound until October 2025. In other words, if you’re holding your breath for Bitcoin to soar to the stars, you might want to grab a snack. 🍿

But, before you despair, there’s a glimmer of hope. A report from CoinShares claims that Bitcoin could skyrocket to $189,000 if it just captures a tiny sliver—just 2%—of the global M2 money supply or 5% of gold’s market cap. At the moment, BTC is hanging around $114,494, which is a 0.3% increase in the last 24 hours. So, who knows? Maybe tomorrow will bring better news. Or not. 🤷♂️

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-05 00:29