As the illustrious Bitcoin (BTC) wobbles precariously just beneath the shimmering $120,000 mark, a curious phenomenon unfolds: the rise of the new investors! Yes, those fresh-faced enthusiasts, armed with dreams of digital gold, are steadily increasing their grip on this cryptographic beast. Yet, lo and behold, the on-chain data reveals that our beloved BTC is far from overheating, suggesting that this wild ride may have a few more exhilarating loops before we plunge into the abyss of correction.

Bitcoin: The Energizer Bunny of Cryptos

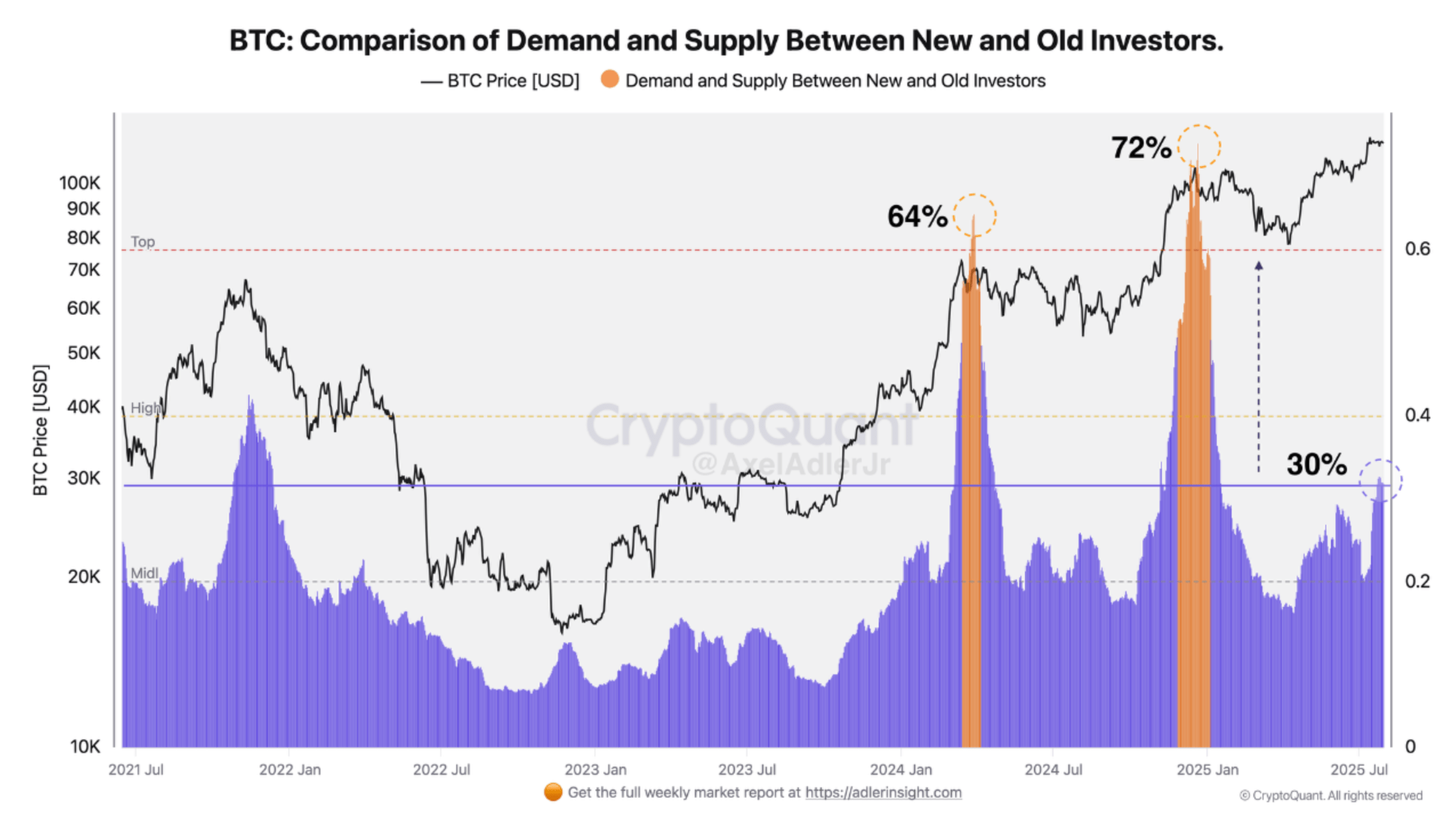

According to the sage musings of CryptoQuant’s very own AxelAdlerJr, the dominance of these new investors is creeping up like a cat on a hot tin roof—currently lounging around 30%, which is merely a hop, skip, and a jump away from the historical “overheated” threshold. Who knew numbers could be so thrilling?

Our analyst friend has graciously provided a chart, a veritable tapestry of past events—marked in a rather flamboyant orange—where new investor dominance reached dizzying heights, coinciding with BTC’s local price peaks. Ah, the sweet scent of nostalgia!

The first of these glorious instances occurred in March 2024, when the metric soared to a staggering 64%, and the second in December 2024, peaking at a jaw-dropping 72%. In both cases, BTC, in a dramatic twist, experienced a significant pullback, leading to the formation of local bottoms. Quite the plot twist, wouldn’t you say?

As the tide of new liquidity ebbed during these thrilling escapades, our long-term holders, those wise old owls, began to take their profits, adding a delightful pinch of pressure to BTC’s price. It’s like watching a game of chess, but with more drama and fewer pawns.

At present, while the new investor dominance is on the rise, it remains comfortably nestled below the euphoric zone—typically between 60% and 70%—indicating that BTC still has some room to frolic in the fields of bullish momentum before it tires out. How charming!

Meanwhile, our seasoned holders continue to sell with the grace of a ballet dancer. The chart reveals a coefficient of 0.3, indicating that the supply of three-year-old BTC is still absorbing fresh demand without any sharp disruptions. Bravo!

From a long-term perspective, the market remains as balanced as a tightrope walker, and the risk of a mass exodus from veteran wallets appears as low as a limbo stick at a party. AxelAdlerJr concludes with a flourish:

If the indicator’s growth accelerates and approaches the historical corridor of 0.6-0.7, one should expect intensified profit-taking and, consequently, a correction. For now, the supply/demand structure remains in a healthy late bull cycle phase, when new money is coming in but old players have not yet transitioned to mass selling. How delightful!

Is BTC Price About To Hit the Brakes? 🚦

While the data above suggests that Bitcoin still has room to grow, other indicators are waving red flags like a matador in a bullring. One such signal is the recent decline in the Bitcoin Coinbase Premium Gap, which has broken its long streak of positive values. Oh, the drama!

Fellow CryptoQuant analyst ArabChain has confirmed this development, noting that US investor enthusiasm for BTC appears to be cooling at current price levels. A collective sigh echoes through the crypto community.

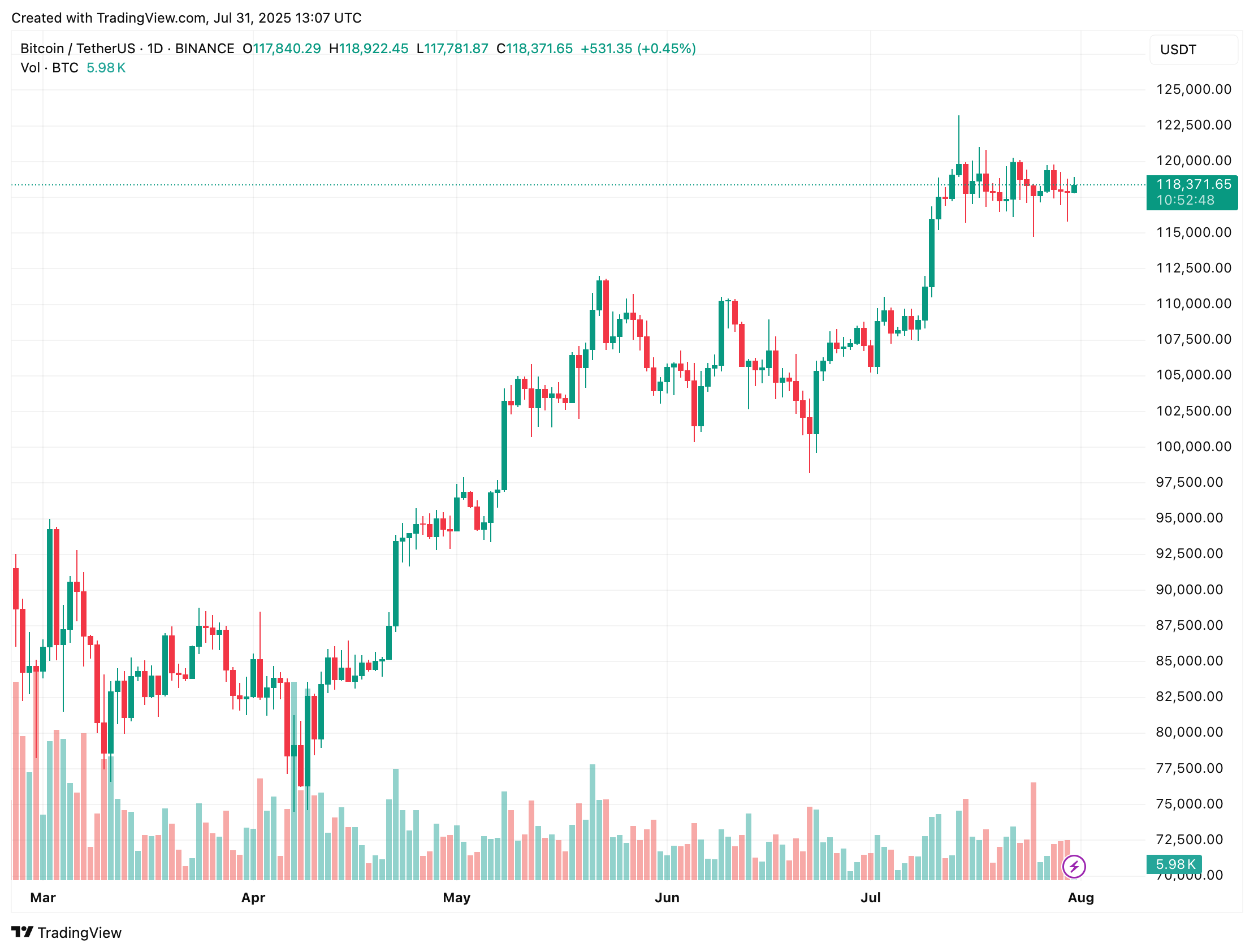

That said, positive macroeconomic factors—such as BTC’s historical correlation with global M2 money supply expansion—could still catapult this digital asset to new all-time highs in the near term. At press time, BTC trades at $118,371, up a modest 0.6% in the past 24 hours. A round of applause, please!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

2025-08-01 00:17