In the vast, unpredictable world of cryptocurrencies, Hedera (HBAR) has taken a tumble, falling 11% over the last three days. Like a stray dog wandering away from the pack, HBAR is moving out of Bitcoin’s (BTC) orbit, signaling a shift in market sentiment and a waning of investor confidence. 🌕✨

With the market conditions looking grim, HBAR finds itself more vulnerable to further decline, much like a farmer watching his crops wither under a relentless drought.

HBAR Investors Pull Back

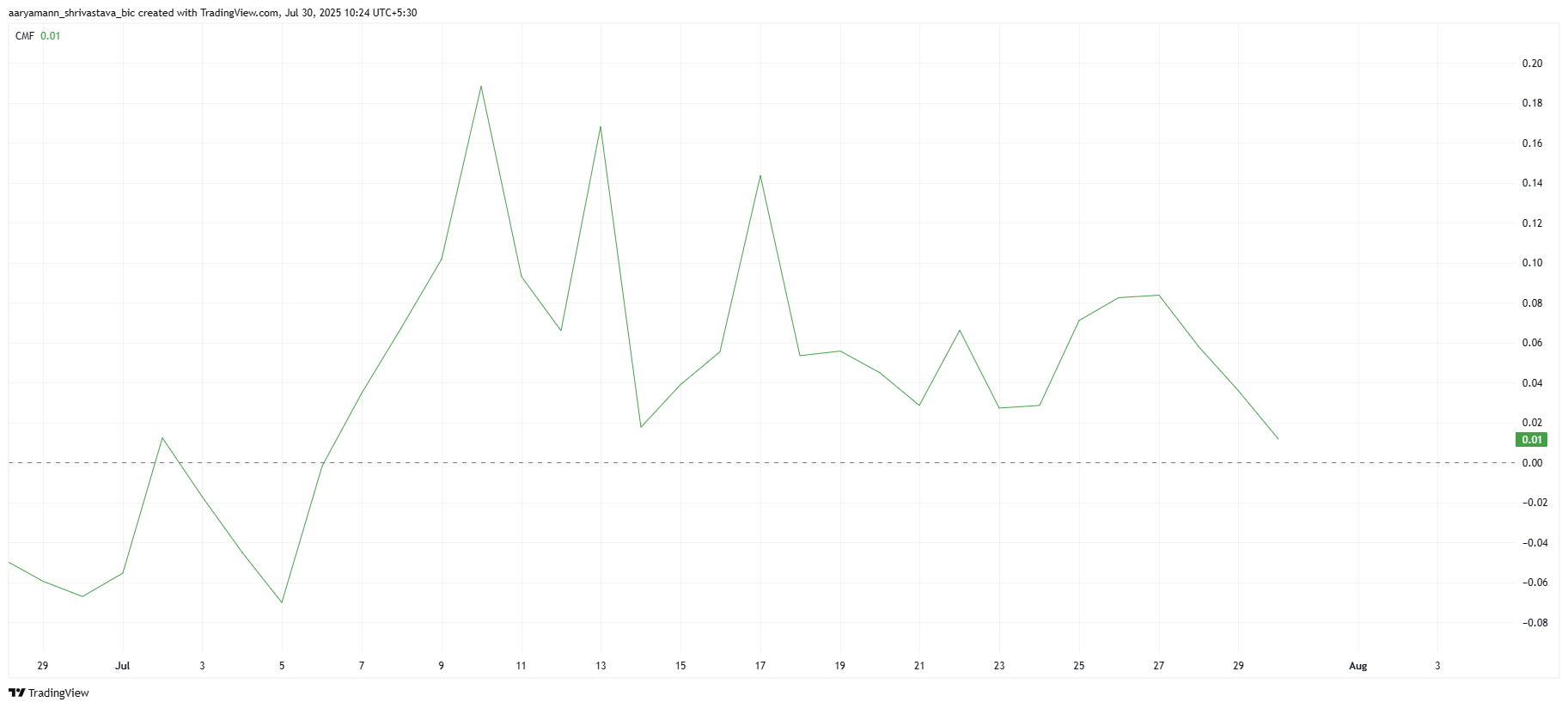

The Chaikin Money Flow (CMF) for HBAR is hovering at a near 4-week low, just above the zero line. This metric, like a weather vane in a storm, indicates that investors are pulling back, with a significant shift from accumulation to selling. Should the CMF dip below the zero line, it would confirm that the selling pressure is drowning out the buyers. 🌊📉

The current market sentiment is as uncertain as a foggy morning in Salinas Valley. The weakening CMF reading underscores the lack of faith in HBAR’s future, suggesting that the altcoin could face a steeper decline unless the sun breaks through the clouds. ☀️,

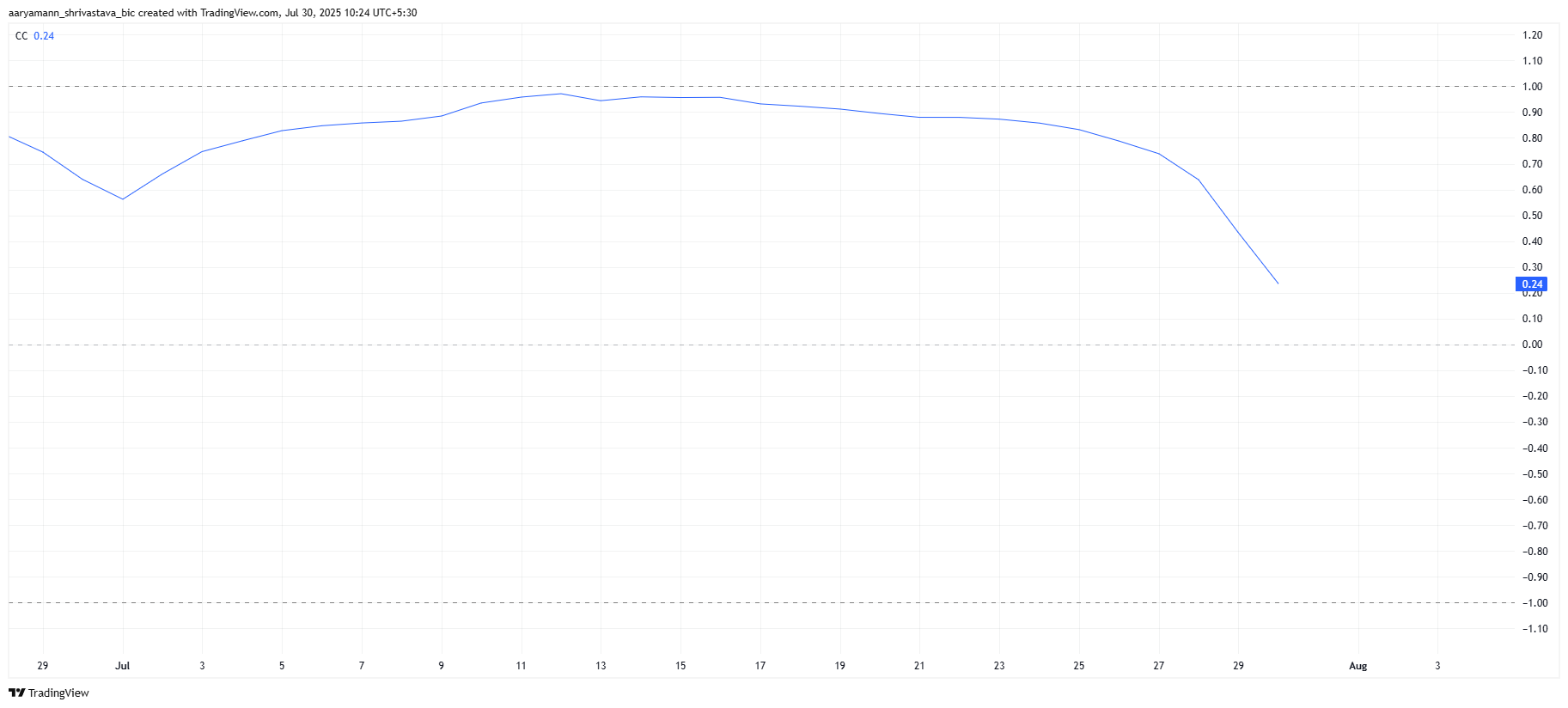

The broader market momentum for HBAR is heavily influenced by its relationship with Bitcoin. However, the correlation between HBAR and BTC is at a near 2-month low, a situation that is both a blessing and a curse. While HBAR might avoid the worst of Bitcoin’s downturn, any uptick in BTC could spell trouble for HBAR’s price. 🍀🚫

As HBAR drifts away from Bitcoin’s gravitational pull, it becomes more susceptible to independent price movements. With investor sentiment shifting and external market forces taking the helm, HBAR’s price is likely to see more volatility, swinging like a pendulum between hope and despair. ⚖️,

Can HBAR Rise To $0.30?

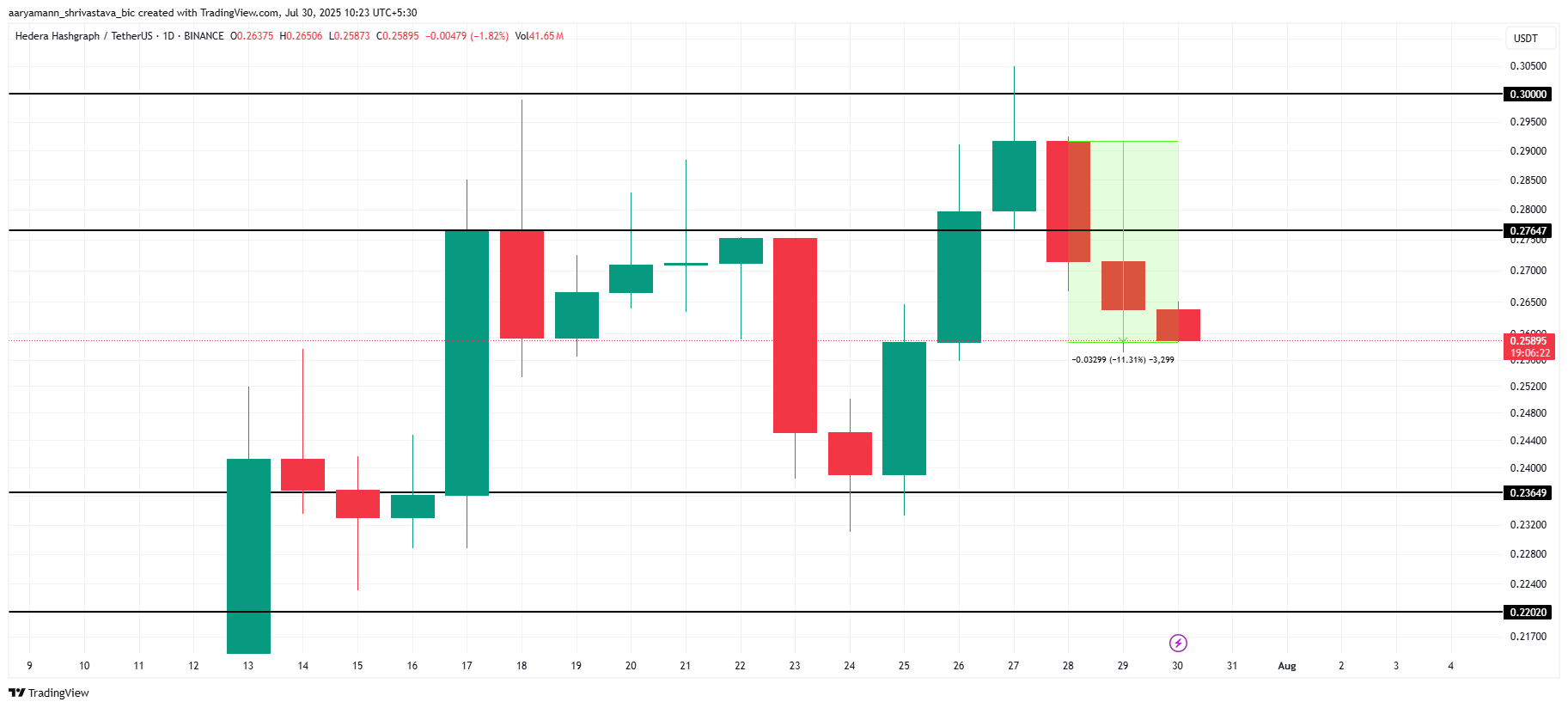

Trading at $0.258, HBAR is teetering on the edge of a cliff after its recent 11% plunge. The altcoin is perched just above crucial support levels, and a further decline seems all too possible. A drop to the $0.236 support level appears inevitable, given the current market climate and investor mood. 🏔️,

If the downward trend continues, HBAR might find itself stuck in a consolidation phase between $0.236 and $0.276. These price levels could offer some temporary stability, but they also represent formidable resistance. A prolonged period of consolidation could leave HBAR trapped, unable to break free and climb higher. 🤷♂️,

However, if the winds of fortune change, HBAR might reclaim the $0.276 level as support, opening the door for a potential surge toward $0.300. Whether it can breach this resistance and soar higher remains uncertain, but a shift in market sentiment could be the catalyst HBAR needs to rise again. 🚀,

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-30 13:17