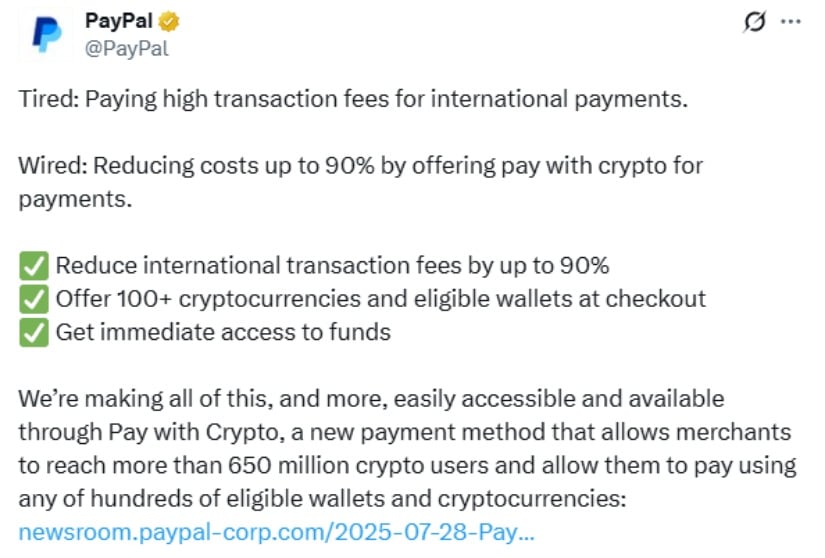

In the restless spirit of our age, where fortunes rise and fall like leaves in a autumn wind, PayPal has cast its lot with the enigmatic world of cryptocurrencies. Its “Pay with Crypto” feature whispers promises of slashing transaction costs by up to 90% for those weary merchants tangled in the web of international sales—ah, but can such savings truly tame the chaos of commerce? 😏

Picture this: customers wielding digital talismans like Bitcoin, Ethereum, and those ever-reliable stablecoins, paying through wallets such as MetaMask, Coinbase, or Binance. In a flash, PayPal transmutes this crypto into cold, hard US dollars for the merchant, sidestepping the dreaded price fluctuations that make business owners pace their studies at night. It’s almost poetic, isn’t it? The digital age delivering stability, or so they say. 💸

How the System Works

Oh, the machinery of it all unfolds with the swiftness of a summer storm. A customer tenders payment in cryptocurrency, and PayPal, in its cunning design, sells the digital coin on an exchange, alchemizes it into their own stablecoin PYUSD, and voilà—dollars appear in the merchant’s account. No need for the merchant to decipher the cryptic runes of blockchain; they receive their familiar currency, as dependable as a old family heirloom. Yet, one must chuckle at the irony: simplifying the complex, only to hide the gears beneath. 🔄

This scheme embraces a vast array of cryptocurrencies, commanding some 90% of the market’s value—from the titans Bitcoin and Ethereum to stablecoins like USDT and USDC, and even those whimsical novelty tokens that pop up like mushrooms after rain. Customers revel in choice, while merchants bask in ignorance, or perhaps blissful unawareness. After all, who needs to understand the beast to reap its fruits? 😜

Significant Cost Savings

Ah, the siren song of savings! PayPal lures businesses with fees starting at a mere 0.99% for the first year, climbing to 1.5% thereafter until July 31, 2026—pennies compared to the typical 1.57% for domestic credit card woes, and downright laughable against the exorbitant international rates that can exceed 3%. “Incredible pressure,” sighs CEO Alex Chriss, as if global expansion were a tragic novel rather than a balance sheet. “We’re removing barriers,” he declares—barriers that, one suspects, PayPal itself helped erect in the first place. 😂 Yet, for cross-border escapades, this crypto route dodges the tolls of traditional banking, leaving merchants to count their coins in peace.

Growing Competition in Crypto Payments

PayPal is not alone in this digital fray; it’s a crowded field, much like a provincial fair with too many peddlers. Shopify cozies up with Coinbase, and Stripe gobbles up a stablecoin firm for a cool $1.1 billion—each vying to make crypto as commonplace as morning coffee. This rivalry, one might say, is a boon for merchants, spurring innovation and price wars, though it smacks of desperation. PayPal, ever the opportunist, leans on its vast network and PYUSD, offering a 4% annual reward for those who linger in the stablecoin realm. Why convert to cash when you can earn a pittance on digital dust? 😒

Regulatory Clarity Helps Growth

Fortune smiled upon PayPal earlier this year when the SEC waved away its investigation into PYUSD without a fuss— a victory that lifts the fog of uncertainty, much like clearing the air after a heated argument. Issued by Paxos and overseen by New York’s financial watchdogs, PYUSD stands firm, backed by dollars and Treasury bonds, its value as steady as a rock in a stream. Unlike its volatile cousins, it’s meant for the drudgery of payments, not speculative gambles. But alas, New Yorkers are still barred from the feast, and there’s no FDIC shield for these digital dreams— a reminder that not all that glitters is gold. ⚠️

Part of Broader Strategy

This crypto foray is but a chapter in PayPal’s grand “PayPal World” saga, a vision to weave together payment threads across the globe, from India’s UPI to Latin America’s Mercado Pago. Imagine a Guatemalan buyer and an Oklahoman seller united by crypto’s invisible hand, banishing the delays and costs of old-world transfers. With over 20 million merchants in its fold, PayPal peddles ease, letting small businesses dip toes into digital waters without drowning in technical tides. Yet, one wonders if this is progress or merely a fashionable distraction. 🌐

What This Means for Digital Payments

In the evolving landscape of finance, PayPal’s leap into crypto payments marks a pivotal moment, stripping away the complexities for the common trader. No longer must one be a crypto sage to partake; PayPal handles the riddles and regulations. But herein lies the rub: will merchants and customers abandon their trusty credit cards for this new frontier? The allure of savings is strong, yet the comfort of the familiar often wins. Success hangs in the balance, a delicate dance between innovation and inertia, with a dash of corporate showmanship. Perhaps, in time, we’ll see if this digital dream endures or fades like morning mist. 🤔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-07-29 01:24