Oh, darling, gather ’round, because the world of Chainlink (LINK) is serving up more drama than a West End matinee. Top analysts—yes, those glamorous creatures who live for charts and patterns—are whispering about a breakout structure so tantalizing it could make even Noël Coward blush. Over the past week, LINK has strutted its stuff with a cheeky 16% rebound, clinging to support levels like a debutante clutching her pearls at a soirée. How divine!

On the 4-hour and 15-day charts, our dear analysts CW and Captain Faibik are practically giddy, pointing out potential breakout zones between $25 and $27. Apparently, Chainlink’s multi-year consolidation pattern is nearing its grand finale. With trading volume still high and sentiment turning as bullish as a bull in a china shop, LINK might just be preparing for its star turn in the next altcoin rally. Curtain up, please! 🎭

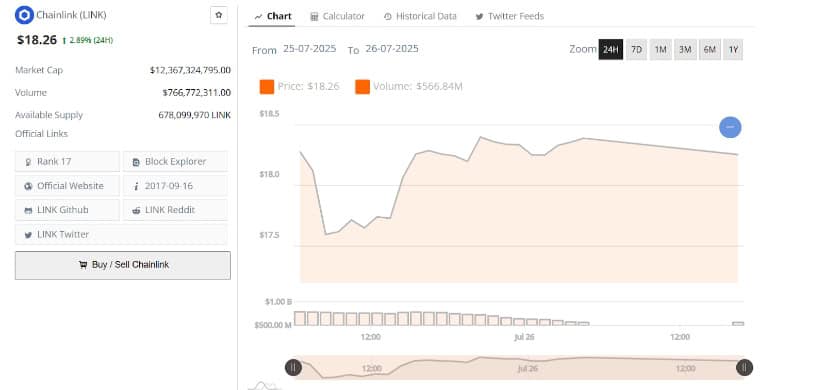

Chainlink (LINK) has been playing hard to get, maintaining its support zone near $18.26—a modest 2.89% rise in 24 hours. After dipping below $17.50 earlier, buyers swooped in faster than you can say “martinis all around,” pushing the token back above $18.00. Throughout the session, LINK formed higher lows like a well-rehearsed chorus line, keeping its upward structure intact. Bravo! 👏

Total trading volume reached a respectable $766.77 million over 24 hours, proving that LINK remains the life of the party. Although volume tapered off toward the close (how rude!), market capitalization stayed strong at approximately $12.36 billion. Clearly, $18.00 is the new black—or rather, the new support base. Let’s hope it doesn’t trip over its own stilettos during this recovery. 😅

Resistance Zones Near $20 While $26 Steals the Spotlight

Ah, but LINK isn’t resting on its laurels just yet. Resistance looms between $19.00 and $20.00, where analyst CW has marked the next hurdle for eager buyers. LINK flirted with $20 before retreating slightly, now consolidating just below this resistance band. At $18.34, it teeters on the edge of a potential breakout toward $26.00. One can almost hear the violins swelling in anticipation. 🎶

Source: X

Volume indicators show increased activity on upward candles, signaling that buyers are still sipping champagne and cheering from the sidelines. Support zones linger around $16.40 and $15.20, acting as trusty safety nets during pullbacks. If LINK clears $20 with gusto—and follow-through volume—we may see it waltzing toward $26.00 as part of this ongoing bullish cycle. Encore, anyone? 🎉

Multi-Year Triangle Formation Approaches Its Climax

Captain Faibik, bless his analytical soul, informs us that Chainlink is forming a symmetrical triangle pattern on the 15-day chart. This little gem has been simmering since 2020, and now LINK finds itself approaching the apex. As of late, LINK trades near $18.36 after posting a dazzling 16.57% gain. The suspense is killing me—or should I say, thrilling me? 😍

This pattern represents an extended period of consolidation, darling. And oh, how price movements near the lower trendline suggest renewed interest! Testing the upper boundaries is like watching a diva rehearse her big number—it’s only a matter of time before she takes center stage. The breakout potential grows stronger as the range narrows. Keep your eyes peeled for the $25.00–$27.00 zone; if broken, it could spark fireworks worthy of New Year’s Eve. 🎆

Trend Structure Holds Despite Consolidation

Despite some sideways shuffling, LINK’s macro trend remains as sturdy as a British stiff upper lip. The lower boundaries of the symmetrical triangle continue to offer structural support, while daily candlestick formations hint at buyer activity around $17.50–$18.00. Higher lows in this region contribute to the broader bullish narrative, even amidst short-term pullbacks. Indicators like RSI and MACD remain neutral to positive, showing no signs of a dramatic collapse—thank heavens! 🙌

Traders seem determined to maintain accumulation within the current range. Should support zones hold firm and volume resume on upward moves, LINK may attempt to reclaim previous highs above $20 before testing long-term breakout levels near $26. Until then, we wait with bated breath, cocktails in hand, ready to toast whatever comes next. Cheers to that! 🥂

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-26 21:48