Oh, joy! New data from the market intelligence firm Glassnode reveals that ancient Bitcoin (BTC) is *awakening*—a phenomenon so thrilling, it’s like watching a sloth sprint. 🧙♂️ This suggests that sell-side pressure may rock the crypto king, who’s probably napping in a digital cave.

In a new thread on the social media platform X, the crypto analytics platform notes that tens of thousands of tokens have sprung to life during the month of July. Early investors, it seems, are finally remembering they own Bitcoin. Or maybe they’re just trying to pay their taxes. 🐦💸

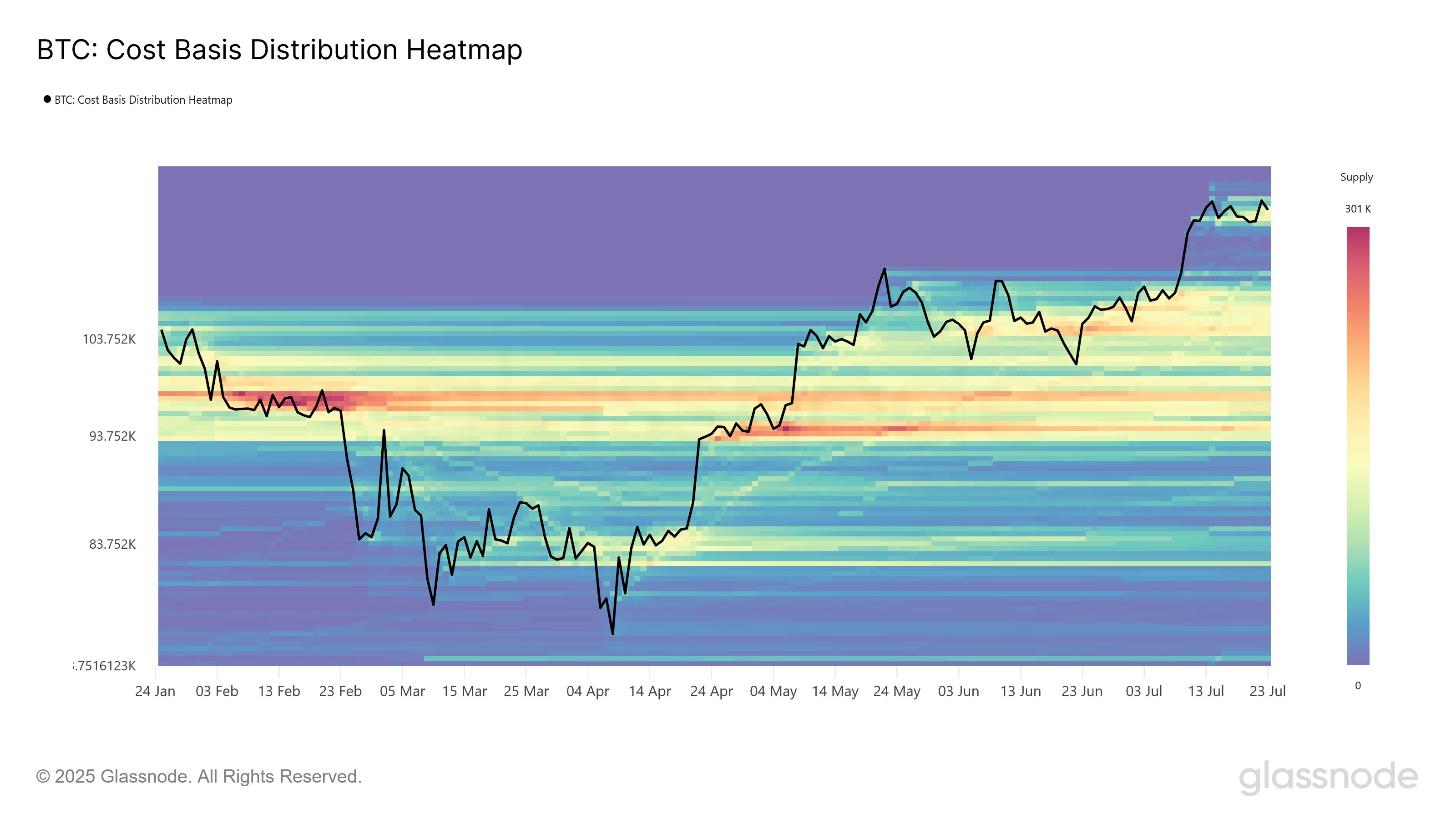

“[Thursday] saw another wave of ancient coins move on-chain, with 3,900 BTC aged over 10 years becoming active. This follows the 80,000 BTC that moved on July 4, 2025. Such activity from long-dormant supply often reflects internal reallocation, custodial shifts, or in some cases sell-side pressure.”

Ah, yes. Because nothing says “I’m a responsible investor” like suddenly moving 80,000 BTC on the 4th of July. 🎉💣

According to Glassnode, the top crypto asset by market cap could still form a “bottom formation zone” if it fails to hold support. A “bottom formation zone”! What a poetic way to say “the market might crash, but we’ll call it a ‘zone’ to sound less dramatic.” 📉

“The sharp rally from $110,000 to $117,000 created an on-chain air gap or a low-density accumulation zone. Since the $122,000 ATH (all-time high), price has held above it. If support fails, history shows such gaps can still evolve into bottom formation zones.”

History? Oh, right—the history of people crying into their crypto wallets. 🥺

In its weekly on-chain analytics report, Glassnode details how BTC reaching a $1 trillion realized market cap is a monumental step for the flagship cryptocurrency. Monuments! A $1 trillion realized market cap! It’s like the crypto world’s version of “I’m the king of the world!” 🏰

“Recent capital inflow has pushed Bitcoin’s realized cap above the $1 trillion mark for the first time. This is truly a monumental milestone for Bitcoin, highlighting its deep liquidity profile, and growing relevance on the macro stage. The larger Bitcoin becomes, the more capital can be stored within it, and the larger size can be settled via transactions.”

Yes, because nothing says “deep liquidity” like a number so big, even the developers of Bitcoin might not understand it. 💸

Bitcoin’s realized market cap calculates the value of each coin at the price it was last transacted (on-chain), rather than the current market price. The metric aims to represent the “true” capital inflow into the BTC network. *True*? Or just a very specific way of lying? 🤔

Bitcoin is trading for $116,671 at time of writing, a 2.1% decrease during the last 24 hours. The market is so volatile, it could make a rollercoaster jealous. 🎢

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-26 16:12