So, on Tuesday, the almighty Bitcoin was chilling at a cool $119,072 on July 22, 2025. It’s got a market cap that could buy you a small country ($2.36 trillion) and a 24-hour trading volume that makes most other currencies feel like pocket change ($56.25 billion). The day’s price range was a rollercoaster from $116,787 to $119,296, making it a thrilling ride for traders who enjoy living on the edge. 🎢💰

Bitcoin

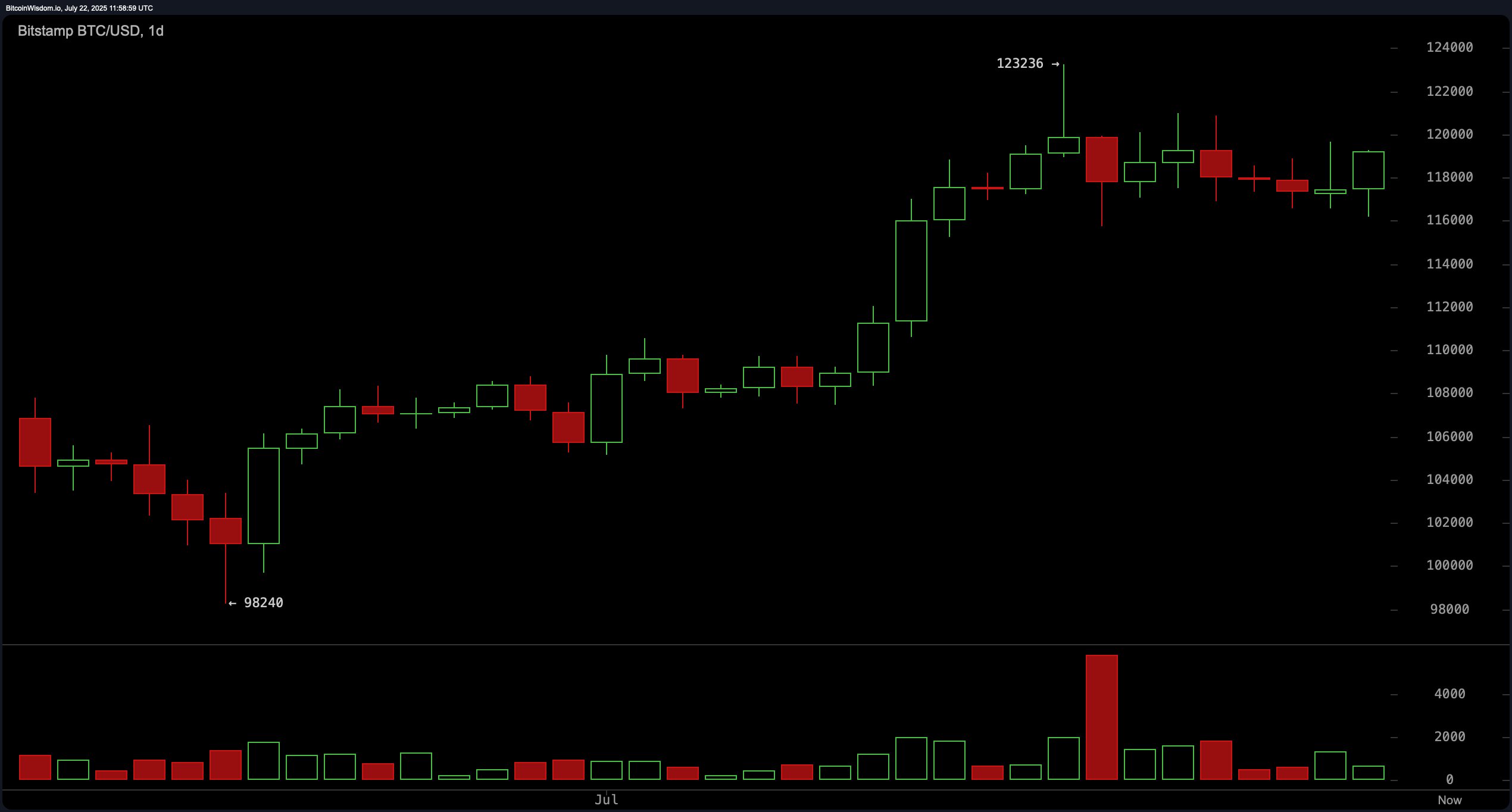

On the daily chart, bitcoin is basically flexing its muscles, showing off a confirmed short-term uptrend after bouncing back from a low of about $98,240. It’s tested the $116,000–$117,000 support range twice, which is like trying to break through a glass ceiling and failing, only to come back stronger. The $123,000 resistance level is like the final boss in a video game—once you beat it, you’re golden. But until then, there’s a lot of selling pressure post-July 10, which is like when everyone in the room decides to leave at once. However, if it can stay above $117,000, it might just have what it takes to keep climbing. 💪✨

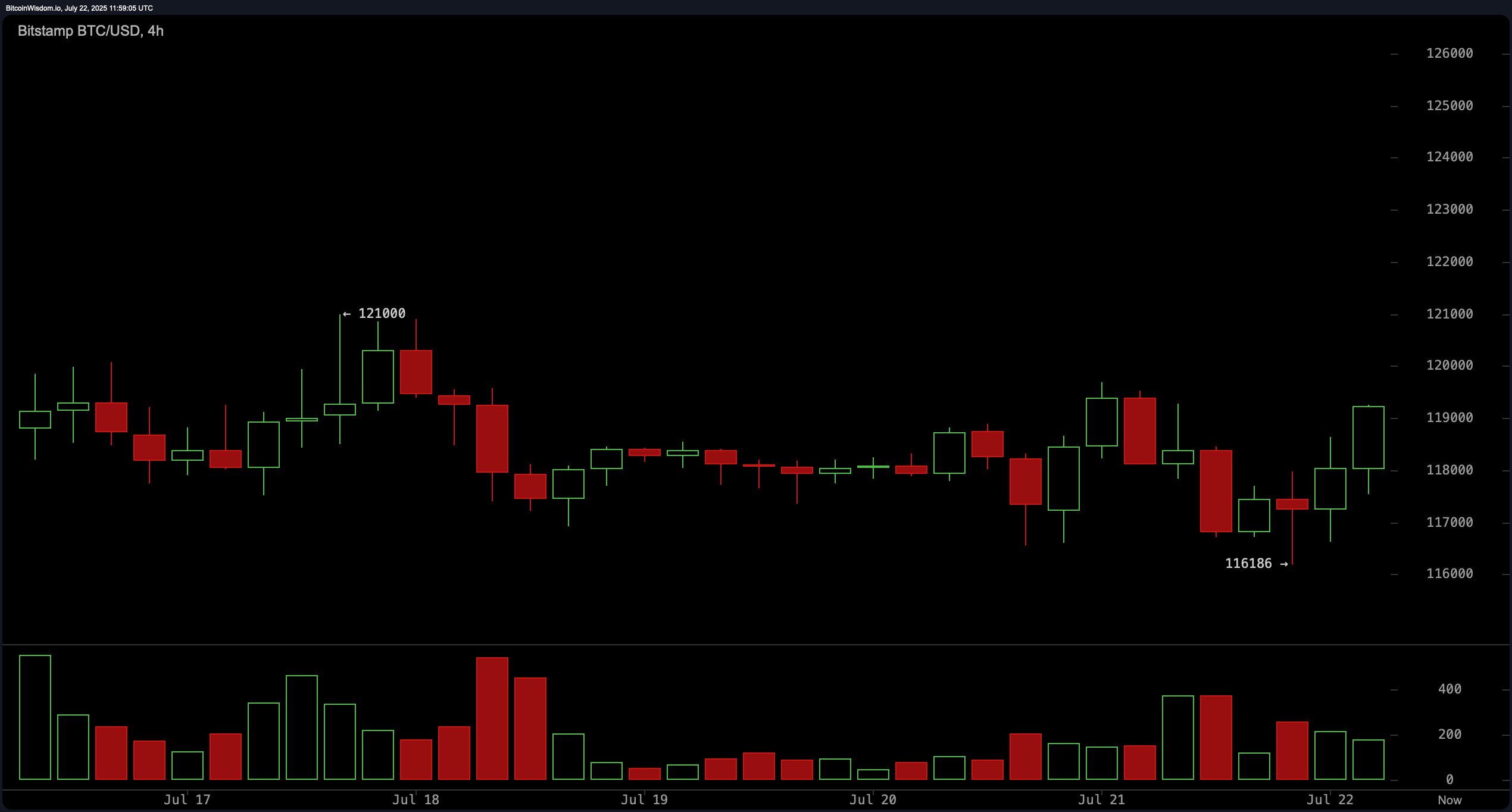

On the 4-hour BTC/USD chart, things are looking pretty cozy in the post-$121,000 high consolidation phase. It’s showing higher lows and modest pullbacks, which is like when you’re in a relationship and you know things are going well because you’ve had a few fights and still managed to come out stronger. Support is holding steady around $116,186, and the $117,000–$117,500 accumulation zone is where the real action is happening. If it breaks above $119,500, it’s like breaking up with your ex and finding someone even better. 🌟🎉

The 1-hour BTC/USD chart is all about the intraday drama. Bitcoin recovered strongly from the $116,186 mark, forming a structure of higher highs and higher lows. It’s like watching a soap opera where every episode ends with a cliffhanger. Volume increased on the bullish candles, which means people are actually buying into this, not just sitting on the sidelines. If it stays above $119,000, especially if it consolidates or breaks out around $119,500, it’s a sign that the bulls are in control. 🐂🔥

Oscillator readings are giving us a mixed bag. The RSI is at 67, which is like being a little tipsy but not quite drunk. The Stochastic and CCI are neutral at 66 and 54, respectively, which is like being in the friend zone. The ADX at 28 suggests a non-trending but strengthening environment, and the Momentum (10) at 1,748 is a bullish outlier, while the MACD at 2,902 is signaling a negative trend. So, it’s like having a best friend who’s always there for you but sometimes gives you bad advice. 🤔👀

From a trend-following standpoint, all the major moving averages (MAs) are giving the green light. The EMAs and SMAs across various periods are all bullish, with the EMA (10) at $117,530 and the SMA (10) at $118,470, both above current price levels. The long-term EMA (200) at $98,540 is like the wise old sage who’s been around the block a few times. While the momentum is strong, traders should keep an eye on volume divergence and manage their risks, because even the best relationships have their ups and downs. ❤️💔

Bull Verdict:

Bitcoin is looking structurally bullish across all major timeframes, with consistently higher lows, strong buying volume, and unanimous support from short- to long-term moving averages. If it can sustain a break above $119,500 with volume, it might just hit the $123,000 resistance zone, making it a great time for short-term and swing traders to get in on the action. 🚀💼

Bear Verdict:

Even with all the bullish signals, caution is advised. Key oscillators are showing neutral to overbought conditions, and the MACD is issuing a sell signal. If it fails to hold support above $117,000 or gets rejected below $119,500, it could face some serious downward pressure, potentially pulling back to $115,500 if the momentum fizzles out. 🌡️📉

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-22 16:04