Amidst the cacophony of financial news and the endless sea of charts, Ethereum has, once again, managed to touch the $3,000 price level. After weeks of languishing beneath $2,800, this brief but significant breakout marks the first time Ethereum has reclaimed this level since early February. According to the ever-optimistic technical analyst Merlijn The Trader, Ethereum’s next destination is already in sight, and it’s not just a mirage in the crypto desert.

Bull Flag Breakout Points To Measured Move For Ethereum

Ethereum’s recent rally, which coincided with Bitcoin’s push to new all-time highs, was not merely a case of the latter’s momentum spilling over. No, this time, Ethereum had its own reasons to shine, thanks to a surge in institutional interest from Spot Ethereum ETFs. According to data from SoSoValue, US-based Spot Ethereum ETFs saw a combined $907.99 million in inflows last week, their best week since the products launched in July 2024. Thursday, July 10, alone witnessed inflows of $383.10 million, making it the largest single-day inflow for any Ethereum ETF in 2025 so far. It’s as if the institutional investors finally decided to throw a party, and they invited Ethereum to be the guest of honor.

In a post shared on the social media platform X, crypto analyst Merlijn pointed to a confirmed bull flag breakout on Ethereum’s daily candlestick timeframe chart. The technical setup, he claims, follows a falling wedge reversal that preceded the current uptrend. The falling wedge, formed from the December 2024 highs to the April 2025 lows, broke out in mid-May, leading to a tight flag-like consolidation between May and June. The most recent breakout above $2,700 has now resolved to the upside, with the next technical level of interest at $3,834. It’s like Ethereum is playing a game of leapfrog, but with billions of dollars at stake.

That pattern has now resolved to the upside, and the next technical level of interest is a measured move based on the price action that formed the pole of the bull flag. This measured move places the next technical level of price interest at $3,834.

Image From X: Merlijn The Trader

80% Of ETH Now In Profit

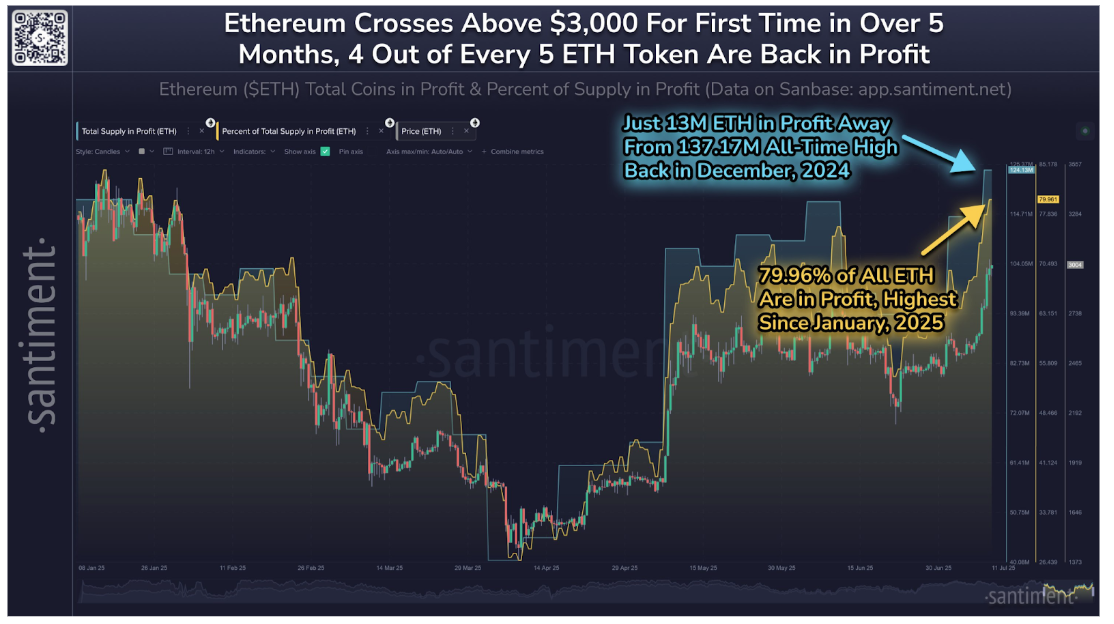

On-chain indicators further validate Ethereum’s current strength. According to data from on-chain analytics platform Santiment, Ethereum’s price action has been dancing around the $3,000 mark since Friday, crossing it multiple times intraday. During this back and forth, 124.13 million ETH out of the 155.04 million total supply crossed into profitability, representing 79.96% of all tokens. This is the highest percentage recorded since January 2025. It’s as if the Ethereum network is a giant casino, and the majority of players are now cashing out with a smile.

Image From X: Santiment

The same data shows Ethereum is just 13 million coins away from matching the total supply in profit at its previous all-time high of profitability recorded in December 2024. This shift toward a profit-heavy network state tends to encourage holding behavior and long-term conviction, which could translate into reduced sell pressure in the coming week. This, in turn, could see Ethereum close a daily candle above $3,000 and move toward the $3,834 price target during the new week. It’s a tale of patience and perseverance, with a dash of crypto magic.

At the time of writing, Ethereum is trading at $2,960, up by 17.5% in the past 24 hours. It’s a bumpy ride, but for those holding on, the view from the top might just be worth it. 🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-13 19:41