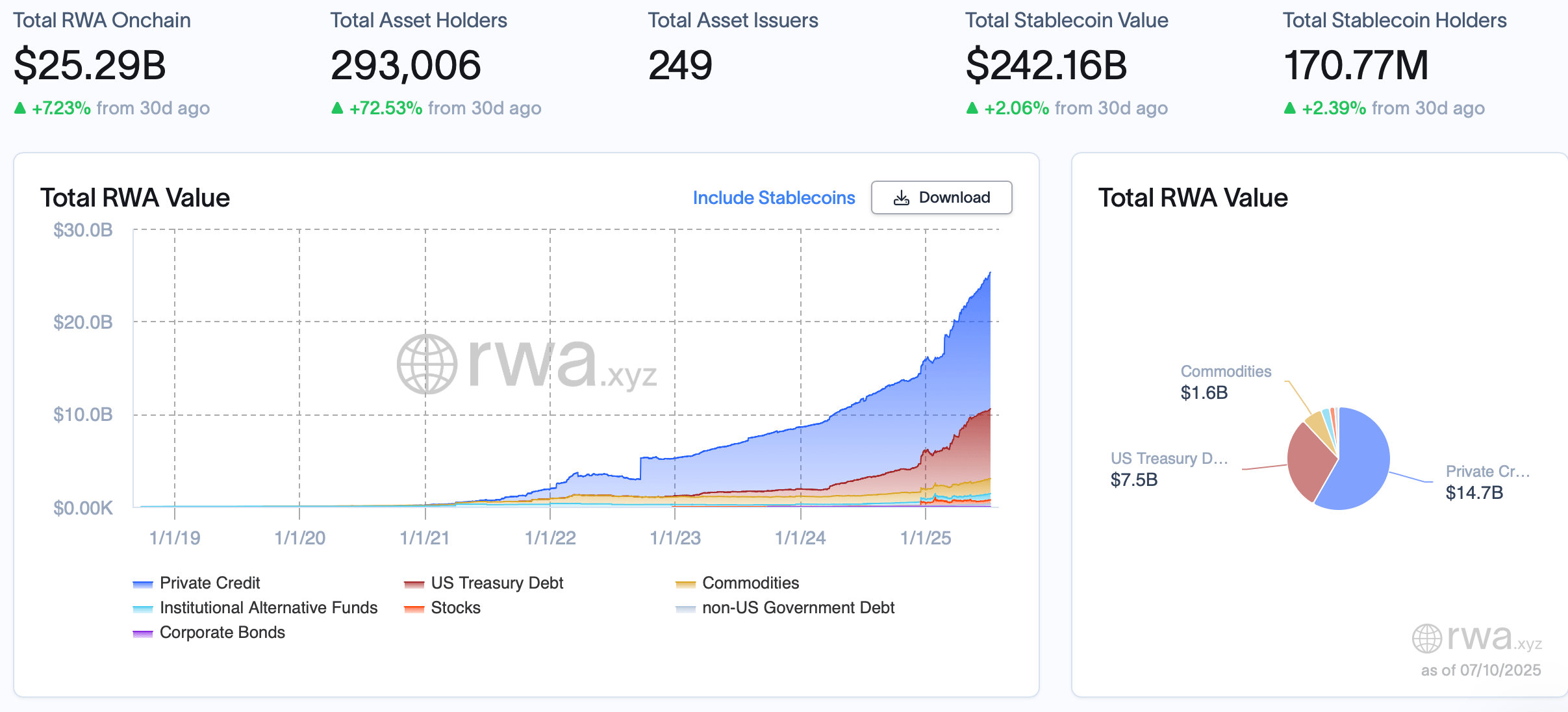

Well, folks, it seems the real-world asset (RWA) sector has finally decided to join the party, crossing the $25 billion threshold and making a grand entrance into the annals of finance. And just in case you thought that was impressive, the total number of asset holders has skyrocketed to 293,006, marking a jaw-dropping 72% increase in a mere 30 days. 🚀

Tokenized Assets: The New Gold Rush?

As of Thursday, July 10, 2025, the value of tokenized real-world assets (RWAs) has climbed past $25 billion. That’s a 7.23% increase since June 10. If you’re keeping score at home, private credit is currently the star of the show, leading the onchain value parade.

A whopping $14.73 billion is parked in blockchain-verified private credit offerings from firms like Figure, Tradable, and Maple. Leading the pack, Figure boasts $13.6 billion in cumulative onchain loans, according to data compiled by rwa.xyz. That’s more money than I’ve ever seen in my life, and I’ve watched a lot of infomercials. 💰

U.S. Treasury debt, or tokenized Treasury funds, hold the second spot, totaling $7.53 billion—up 1.96% over the past week. Blackrock’s BUIDL leads the pack with $2.82 billion onchain. Franklin Templeton’s BENJI follows with $790.44 million as of July 10, while Superstate’s USTB clocks in at $711 million. Just behind Treasurys, tokenized commodities land in third with a current market cap of $1.61 billion.

this market’s heading for the trillions. It’s like the financial equivalent of a black hole, sucking in everything in its path. 🌀

McKinsey puts the estimate at $2 trillion, while Boston Consulting Group (BCG) envisions a leap to $16 trillion by 2030. So, buckle up, folks, because the ride’s just getting started. 🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-07-10 23:27