In the grand tradition of Soviet-era five-year plans, the Germans have decided to outdo themselves in the realm of blockchain. NRW.BANK, a state-owned development bank, has issued a €100 million blockchain-based bond on the Polygon network. Because, why not? 🤷♂️

This two-year bond was registered under Germany’s eWpG law, which allows bonds to exist entirely on blockchain networks without a physical certificate. Ah, the joys of digital paperwork! 📝

- NRW.BANK issued its first €100 million blockchain-based bond on the Polygon network.

- The bond was registered under Germany’s eWpG using Cashlink’s BaFin-regulated crypto securities registry.

- The move signals growing institutional acceptance of tokenized securities across European finance.

Michael Duttlinger, CEO of Cashlink, waxed poetic about the development: “This is more than a technical milestone. It’s a signal that public financial institutions are ready to move beyond blockchain pilots and start integrating these systems at scale.” 🚀

Germany’s eWpG law, introduced in 2021, has paved the way for securities to be registered on distributed ledger technology systems. Because who needs traditional capital markets when you can have blockchain? 🤔

The issuance attracted participation from institutional investors, with Deutsche Bank, DZ BANK, and DekaBank acting as joint lead managers. Because who doesn’t love a good blockchain party? 🎉

As more public issuers follow, it’s a step toward reshaping how traditional capital markets operate in the digital era. Or, you know, it could all just be a bunch of hype. 🤷♂️

NEAR Protocol Gains 5% Amid Surge in Trading Volume

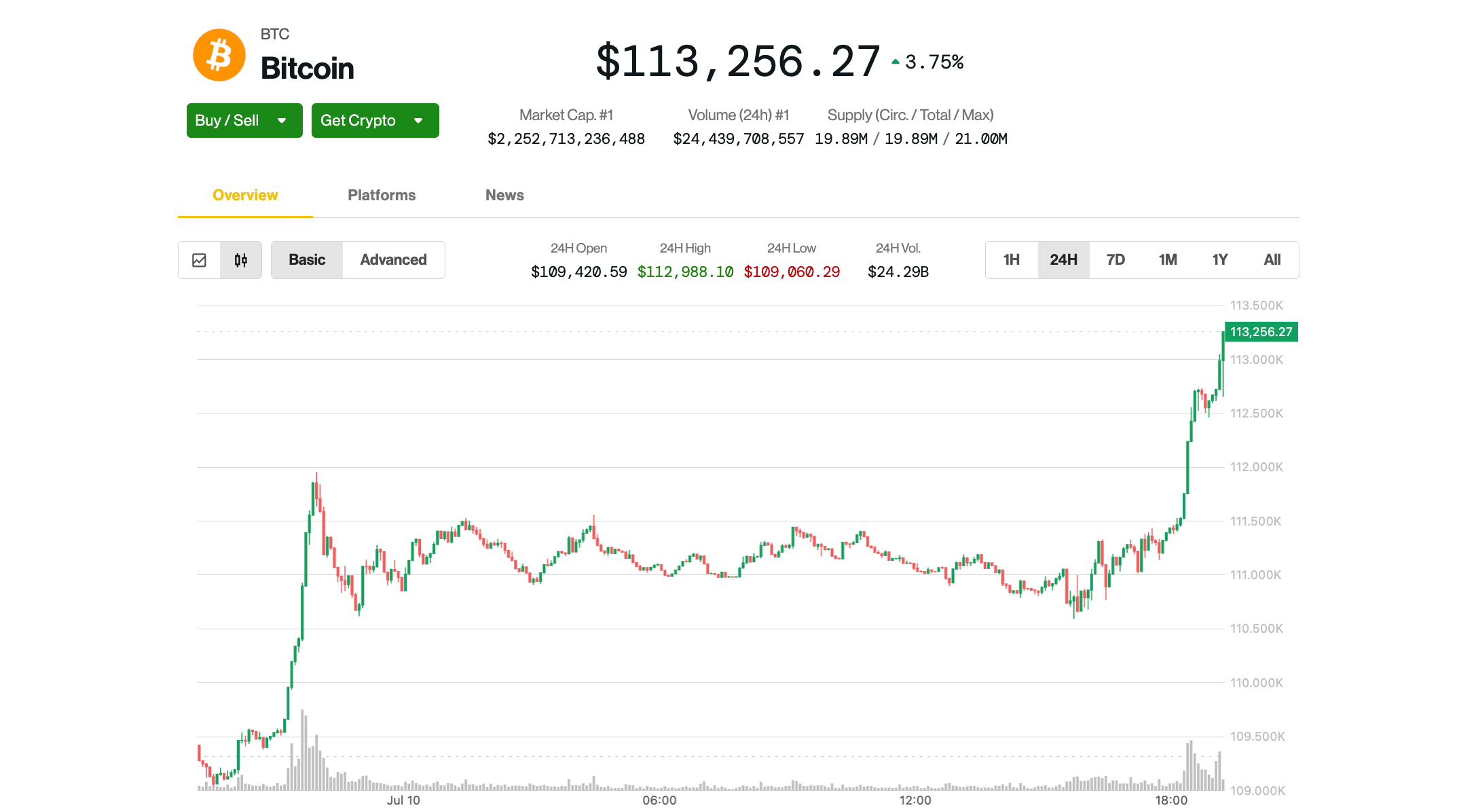

Bitcoin Breaks Fresh Record Topping $113,000

Sui Rallies Nearly 10% in Bullish Breakout

Why 24/7 Digital Markets Will Power Development in Frontier Economies

Japanese Real Estate Firm GATES to Tokenize $75M in Tokyo Property on Oasys Blockchain

DAOs 2.0: What’s Next For Decentralized Governance?

Bitmine Immersion Stock Sheds Another 20% After $2B ATM Offering

BIT Mining Surges 250% on Solana Pivot

Europe’s Financial Watchdog Probes Malta Over Fast-Track MiCA Authorizations

Circle Has USDC Revenue Sharing Deal With Second-Largest Crypto Exchange ByBit: Sources

Rumble Taps MoonPay for Crypto Wallet Ahead of Q3 Launch

Alibaba Founder-Backed Ant Group to Integrate Circle’s USDC on Its Blockchain

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-10 20:44