What to know:

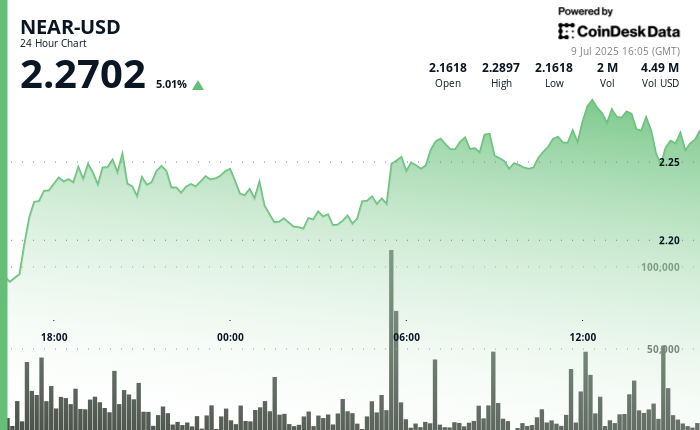

- NEAR Protocol has leaped 5% in a 24-hour session ending 9 July at 15:00, closing at $2.27 and leaving volatility spinning in a corner muttering “I just can’t anymore.”

- Grayscale—yes, the institution with more funds than common sense—has now crammed NEAR into its Decentralized AI Fund, assigning it a weight of 28.41%, narrowly avoiding an existential crisis beside Bittensor’s 29.10%.

In a move that can only be explained by quantum physics or galactic mismanagement, NEAR Protocol racked up 5% gains in a day so volatile, analysts were last seen hiding under their desks. At $2.27, it’s still a number you can find in the dictionary under “statistically unlikely events.”

The rally conveniently coincides with Grayscale’s quarterly ritual of rebalancing—a process involving spreadsheets, caffeine, and sacrificial office chairs. NEAR now constitutes 28.41% of the Decentralized AI Fund, a ratio experts assure us was produced by a highly sophisticated game of blindfolded darts.

The broader altcoin market is suddenly drowning in optimism—or is it just the usual flood of memes—amid the perennial prediction of an “altcoin season.” This long-awaited period, according to market sages and bored pets everywhere, is expected to follow bitcoin smashing another record and then lounging about, forcing everyone’s coins to behave as if gravity is just a rumor. 🌪️🚀

Technical Analysis (or, How to Read Runic Symbols for Fun and Crypto):

- NEAR opens at $2.16, closes $2.27—a 5.09% session gain. That’s enough to make calculators blush.

- The token yodels between $2.15 and $2.29, a $0.14 swing (6.20%). The volatility was so dizzying, even the candlestick chart needed a nap.

- At 17:00, 4.16 million tokens switched hands—presumably searching for meaning. Price sprints from $2.18 to $2.23. Why? Who knows. The market doesn’t.

- This surge flattened the day’s average volume of 1.87 million tokens, setting a new high bar for over-caffeinated trading.

- Volume drew imaginary resistance at $2.24 and support at $2.21—purely to amuse technical analysts who needed something to obsess over.

- $2.25 was tested so many times the number now requests hazard pay.

- Late trading propelled the price toward its high, signaling that momentum, like a caffeinated squirrel, refused to sit still.

- At 14:36, existential dread set in: NEAR plummeted to $2.25, losing 1.64% in nine minutes, mostly to create suspense.

- At 14:56, a 515,008-unit spike reversed course from $2.25 to $2.26, confusing robots and humans alike.

- The last 30 minutes brought a dramatic 1.20% bounce from session lows, for the sake of anyone still watching.

NEAR did a thing, Grayscale did another thing, and both seem delighted to confuse everyone in between. If you’re feeling lost, don’t worry: so is the market. 🎢

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

2025-07-09 19:47