It appears that Bit Digital has gone utterly besotted with Ethereum, rather like a debutante falling head over heels for a dashing young suitor. They’ve transitioned their entire corporate treasury into ETH, a move that’s left tongues wagging in the cryptocurrency world 🤯.

This saucy tidbit comes courtesy of Theminermag, a publication that’s all about the latest news and research on institutional bitcoin mining companies. Do pardon the yawn, darling.

It seems Bit Digital raised a whopping $172 million in gross proceeds through a public equity offering and used the funds, along with the sale of 280 BTC, to amass a total of 100,603 ETH on its balance sheet. One does hope they know what they’re doing, dear.

CEO Sam Tabar gushed, “We believe Ethereum has the ability to rewrite the entire financial system,” citing its programmability, staking yield, and broader adoption as the foundation for Bit Digital’s long-term strategy. “We are starting with exposure to over 100K ETH for now but we intend to aggressively add more so we become the preeminent ETH holding company in the world.” Oh, how thrilling! 🎉

In the first quarter of 2025, the company reported $560,641 in staking revenue from its ETH holdings, which stood at 24,434 ETH at the end of March. One supposes that’s a decent start, darling.

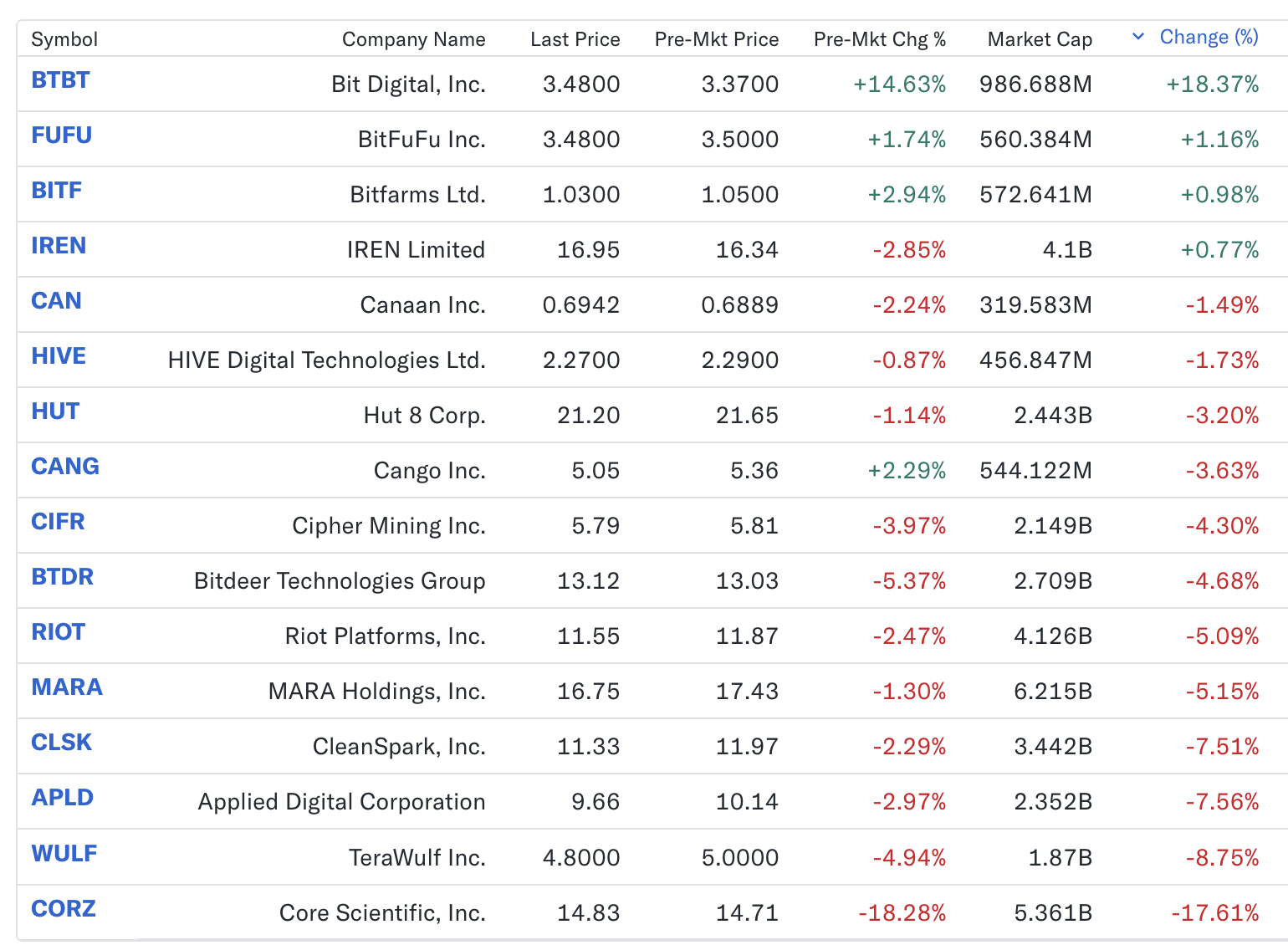

Bit Digital shares (Nasdaq: BTBT) jumped 18.4% on Monday, making it the top performer among its crypto mining peers, many of whom traded sharply lower. Most major mining stocks, including Cleanspark, Marathon, Riot, and Core Scientific, saw declines ranging from 5% to 17% on the day, underscoring a sharp divergence in sentiment. Oh dear, it seems some folks are having a bit of a rough day 😬.

The latest acquisition reflects a continuation of a strategy first tested in June 2024, when Bit Digital exchanged BTC for ETH at a rate of 0.048 BTC per ETH. Since then, the exchange rate has deteriorated to around 0.023 BTC per ETH—less than half—highlighting that ETH has significantly underperformed BTC over the past year. Oh dear, it seems Ethereum is having a bit of a rough patch 😳.

Despite that underperformance, Bit Digital has doubled down on its belief in Ethereum. The shift also comes as Bit Digital moves away from its legacy business in Bitcoin mining. The company previously disclosed that it planned to wind down its mining segment, aligning with a broader reorientation toward Ethereum-focused infrastructure and capital deployment. One supposes that’s a bold move, darling.

Bit Digital is not alone in reevaluating treasury strategy around Ethereum. Last month, Sharplink Gaming became one of the first U.S.-listed non-crypto firms to announce a formal ETH treasury allocation, guided by Consensys, the Ethereum software firm behind Metamask. Sharplink cited Ethereum’s growth as a financial infrastructure platform and its potential to offer a yield-generating asset class as reasons for the move. How fascinating, darling! 🤔

The original article can be viewed here, for those who simply must know more, darling.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-08 13:57