Companies are quickly evolving into Bitcoin treasury entities, using funds to purchase BTC for their assets. Given the growing perception of bitcoin as a possible global reserve asset, gaining institutional interest and high price predictions, this trend could be logical. However, there’s an issue: many of these companies have acquisition strategies but lack a solid business plan.

Why buy at a premium when you can buy bitcoin directly?

Instead of buying Bitcoin directly, many investors have the option to invest in it either immediately (spot) or indirectly by purchasing shares of an ETF. However, one might wonder why someone would choose to invest in a publicly-traded company whose share price is noticeably higher than the actual value of its Bitcoin holdings (Net Asset Value, NAV).

In simpler terms, it’s generally not advisable for a company to hold Bitcoin unless they have a well-defined plan to utilize it in a manner that’s not readily achievable by investors. The Bitcoin should serve a practical purpose within the company’s operations. If not, the company should return the capital and let shareholders manage their own Bitcoin investments.

Bitcoin Yield ≠ Business Model

Some analysts are employing the term “Bitcoin return rate“, which refers to the proportionate growth of one Bitcoin unit over a period, as a means to rationalize premiums. Although this metric can be intriguing and useful for monitoring trends, it doesn’t necessarily warrant an increased price tag above Net Asset Value (NAV) by itself.

Absolutely! If a firm sells shares priced higher than their Net Asset Value (NAV) and uses those funds to acquire more Bitcoin, it can effectively increase the amount of Bitcoin represented by each share. However, if an investor aims to maximize their Bitcoin exposure for every dollar they invest, it would be more beneficial to simply purchase Bitcoin directly.

Leveraged long with limited upside

In order to expedite their purchases of assets, numerous treasury firms increase their funding by issuing several types of debt that can be converted. This strategy creates a highly leveraged investment in Bitcoin, offering maximum risk in the event of a drop but limited potential benefits when Bitcoin rises. This setup is what has sparked interest among creditors to facilitate these financial instruments.

When Bitcoin decreases in value, creditors receive their repayment in U.S. dollars, while the company might need to liquidate its Bitcoin holdings to meet the debt obligations. Conversely, if Bitcoin increases, creditors can exchange their debt for shares at a reduced price and then sell those shares to profit from the appreciation above the conversion price – an advantage that would typically go to shareholders in normal circumstances.

When deciding between investing in a Bitcoin company that uses leverage or opting for self-leveraging your own Bitcoins, one should ponder: Is the potential decrease in profit worth the convenience of not having to manage the process personally?

If the company’s stock value significantly exceeds its Bitcoin holdings and it doesn’t have a clear strategy for using these Bitcoins beyond just keeping them, then the probability is probably low that it would be a good investment.

In much the same vein, other straightforward investment tactics involving Bitcoin, like offering it as collateral for interest, carry risks, yet fail to adequately compensate for the extra risk taken on.

A business plan, not just a BTC plan

Just because not every bitcoin treasury company needs to trade at or beneath their Net Asset Value (NAV), it doesn’t necessarily imply a premium can be achieved solely through funding and acquisition strategies. Instead, a premium typically necessitates the implementation of a robust, well-thought-out business strategy.

A robust Bitcoin financial structure provides a solid base for running a successful business. In finance, a balance sheet is crucial for loans, transactions, organization, and various other activities, and it’s possible that Bitcoin-holding businesses today could develop into financial titans of tomorrow.

Various business strategies such as facilitating trades (brokerage), providing funds for smooth transactions (liquidity provision), offering loans backed by assets (collateralized lending), and creating complex financial instruments (structured products) are all types of operations that can grow, produce income, and warrant high market values.

Instead of just gathering funds for “bitcoin returns,” a strategy alone does not constitute a business plan. If a company solely focused on treasury functions doesn’t create an operational blueprint, its value will plummet, potentially leading it to be bought by a firm that knows how to effectively utilize bitcoin.

Bitcoin serves as a benchmark for success nowadays. For a company to surpass Bitcoin, it’s not enough to merely acquire and store it. Instead, they need to innovate and develop a business model centered around Bitcoin.

I have rephrased your sentence in natural and easy to read language: Please adhere to the guidelines provided, as they are the author’s personal views and do not necessarily represent those of CoinDesk Inc., its owners, or affiliates.

Please ensure that your opinions align with the given guidelines, as they are solely the author’s perspective and may differ from those held by CoinDesk Inc., its proprietors, or associated parties.

ICP Rebounds From Intraday Lows as Support at $4.80 Holds Firm

The Coming Crypto Tax Bomb

NEAR Protocol Surges Past $2.19 Resistance on 61% Volume Spike

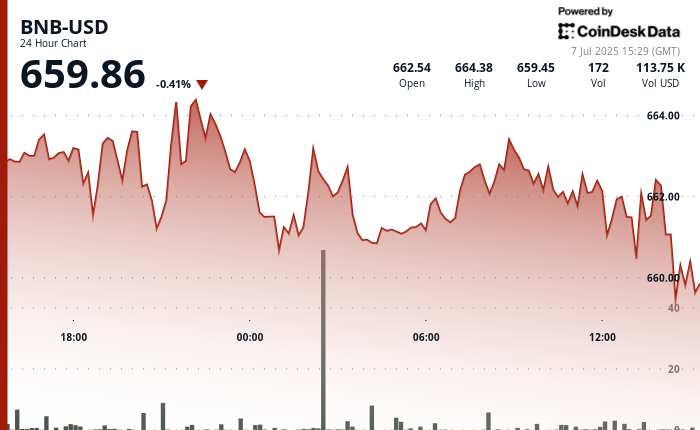

BNB Holds Near $660 as Traders Weigh Breakout Potential

Kevin O’Leary: U.S. Must Learn From Bitcoin Miners to Win ‘AI Wars’

BONK Reclaims Momentum as Solana ETF Buzz and Ecosystem Growth Drive Rally

Core Scientific, Bitcoin Miners Tumble on CoreWeave Buyout; Jefferies Says Price in Expected Range

Strategy Books $14B Q2 Bitcoin Profit, Sets $4.2B STRD Preferred ATM Offering

Bitcoin’s Potential Bull Market Resistance: $115K or $223K?

Vitalik Buterin’s New Proposal Seeks 16.7M Gas Cap on Ethereum to Rein In Transaction Bloat

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-07-07 20:47