Ah, Ethereum, the perpetual bridesmaid of the cryptocurrency world 🤵. Despite its lackluster price performance, it seems that institutional investors are still enamored with this digital darling 💘.

On-chain data, that most thrilling of topics 😴, reveals that selling pressure from US-based whales and institutions has steadily declined over the past month. One can almost hear the collective sigh of relief from the Ethereum faithful 🙏.

Americans Still Smitten with Ethereum

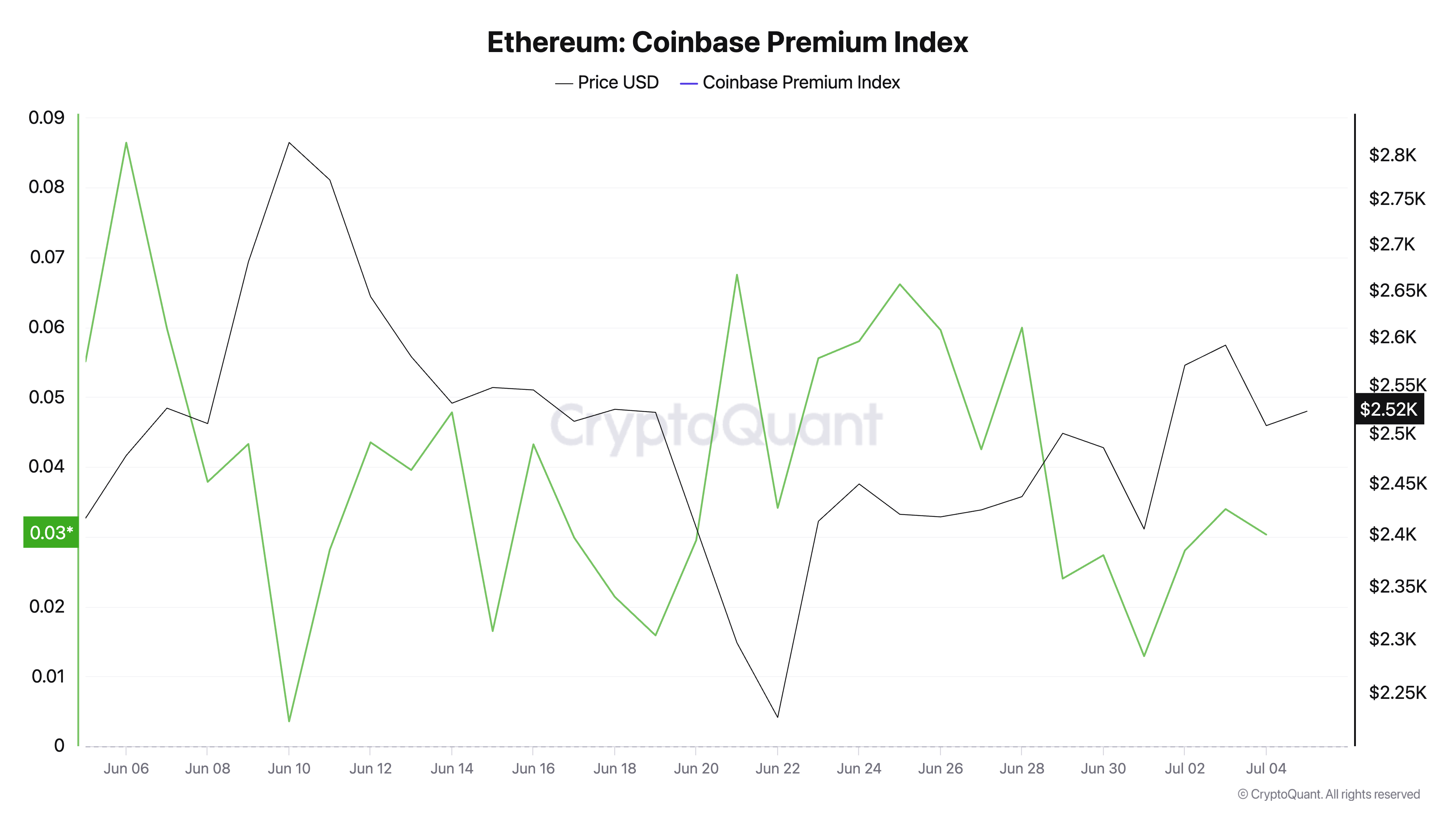

According to the omniscient CryptoQuant, Ethereum’s Coinbase Premium Index (CPI) has remained consistently above the zero mark over the past month. This, dear reader, is a signal of sustained buying interest from U.S.-based investors 📈.

At the time of writing, the CPI stands at a whopping 0.03 🤯. One can only imagine the champagne corks popping in the Ethereum camp 🥂.

This metric, for those who may be unfamiliar, measures the difference between the ETH‘s prices on Coinbase and Binance. It’s a bit like a digital game of “spot the difference” 🤔, but with more graphs and fewer puppies.

When the CPI rises, ETH trades at a premium on Coinbase compared to international exchanges. This, in turn, reflects stronger buying pressure from US-based investors 💪.

Conversely, when the CPI falls—or worse, turns negative—it signals that demand on Coinbase is lagging behind global markets due to profit-taking or waning interest among US buyers 😔.

Therefore, despite its lackluster price performance in recent weeks, ETH’s steady CPI above the zero line suggests that US investors are continuing to buy rather than exit the market 📊. This points to a measured accumulation trend rather than a sell-off 📈.

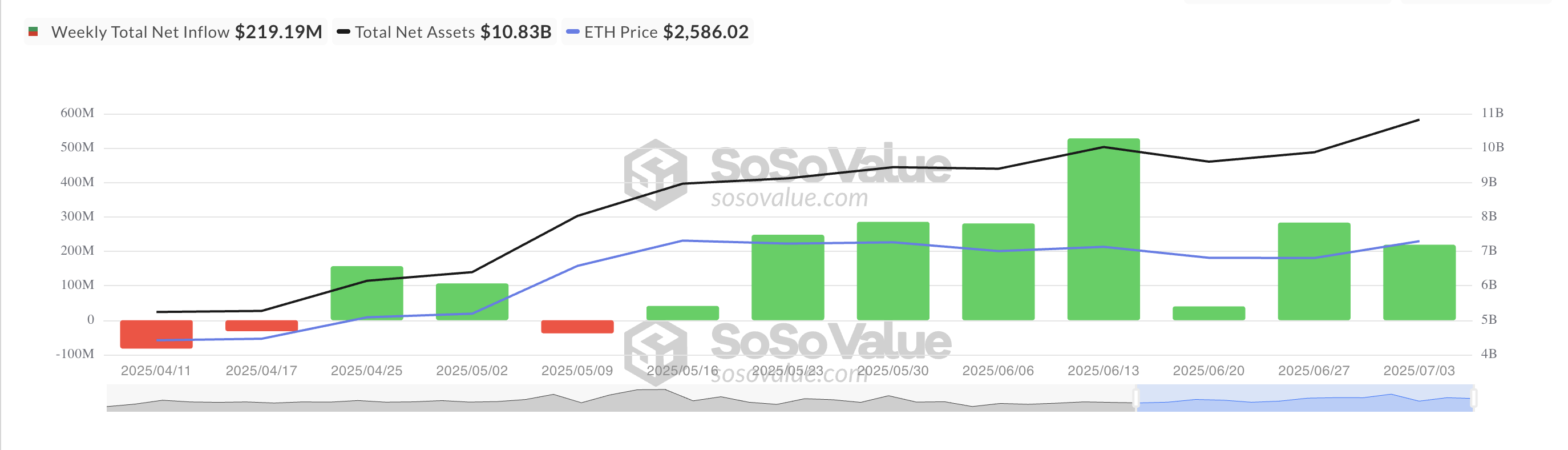

Moreover, the consistent weekly inflows into ETH-backed exchange-traded funds (ETFs) confirm the sustained interest from key investors 📈. Per SosoValue, these funds have recorded consistent weekly net inflows since May 9 📆.

This reflects a sustained appetite among institutional investors for exposure to ETH, even as its price action remains relatively muted 🤐.

ETH: The Great Wall of $2,750

Readings from the ETH/USD one-day chart confirm that ETH has been consolidating within the $2,750 to $2,424 price range since early May 📊. If institutional investors increase their buying pressure and broader market sentiment improves, the coin could rally toward the $2,750 resistance level and potentially attempt a breakout above it 🚀.

If successful, ETH’s price could climb further to around $3,067 🤩. But, alas, if investors’ participation weakens and bearish pressure builds, ETH may fall back toward $2,424 😔. It could decline toward $2,185 if that support fails to hold 😨.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-07-05 19:11