If there’s a cryptocurrency that knows how to keep you guessing—and occasionally shout at your phone—it’s XRP, which, as of July 4, 2025, is hovering at a modest $2.24. Cue the analysts, traders, and that guy at your gym who claims to “just know” the charts: Will it pop above $2.50 before the much-anticipated ETF approval, or will we all just sit here chewing our nails down to nubs?

Ripple: Now Attempting to Become The World’s Most Boring Bank

Ripple has officially applied for a national banking license from the U.S. Office of the Comptroller of the Currency (OCC). Somewhere, bankers everywhere just got nervous—if not about Ripple, perhaps about the possibility of having to pronounce “OCC” without giggling. If Ripple succeeds, it’ll join the exclusive club of federally-chartered crypto firms, which currently has all the exclusivity of a middle school chess team (shoutout to Anchorage Digital, the OG).

The fun doesn’t stop there. Ripple’s apparently aiming for a Federal Reserve Master Account. Picture it: holding reserves with the Fed. Not exactly rock ’n’ roll, but for RLUSD (Ripple’s stablecoin, coming soon to a spreadsheet near you), it’s a trust boost. RLUSD now teeters just under a $500M market cap—a number impressive enough to mention at dinner parties, unless you actually want to be invited back.

“Ripple is playing the long game,” says one industry observer—probably while staring into an existential void or at least a Bloomberg terminal. As the endless telenovela with the SEC limps toward a conclusion, Ripple is doing its best impression of a teacher’s pet: regulatory alignment, shiny apples, and maybe even some overdue homework. Will it matter? Possibly. Will it be entertaining? Absolutely not.

Grayscale, ETFs, and the Institutional FOMO Epidemic

Big money—think yachts and people who unironically say “synergy”—is starting to notice XRP. Grayscale’s Digital Large Cap Fund (GDLC) now features XRP. It’s kind of like making the starting lineup, except Bitcoin is basically playing every position except for waterboy. Still, XRP’s inclusion signals a nod from people who have corporate swag and maybe even a Bloomberg mug.

Rumor has it (loudly, in analyst circles) that a standalone XRP ETF is just waiting in the wings, with a Bloomberg-estimated 95% chance of approval. That’s almost as good as my odds of finding an expired yogurt in the back of my fridge. Brad Garlinghouse sounds vaguely optimistic, as usual. If approval happens, expect the phrase “I told you so” to be uttered by exactly everyone.

Traders Desperately Cling to Chart Patterns for Meaning 🫨

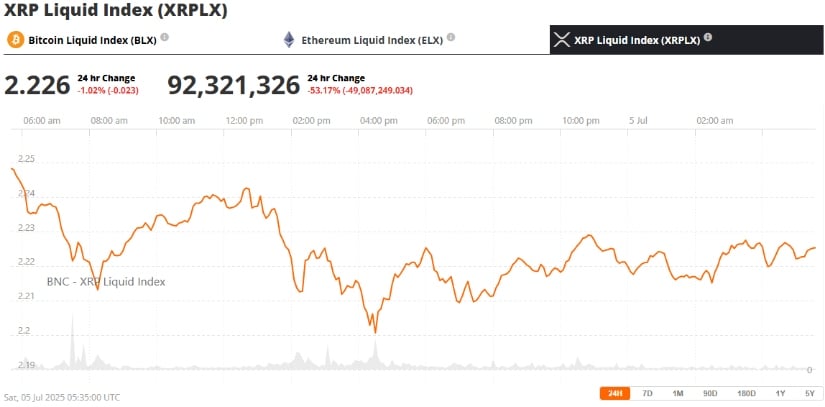

From the technical analysis front (also known as “places where lines get more action than most people’s dating apps”), XRP is holding the fort above its ascending trendline from late June. Recently, the price did a little bounce—bullish engulfing candle, spinning top, and all the other astrology-esque terms traders love.

If You Insist on Numbers (But Don’t Blame Me):

- Support: $2.21, aka “the comfort blanket”

- Immediate resistance: $2.32 and $2.38, a.k.a. “the hard ceilings”

- Breakdown risk: $2.17, maybe $2.12, or your sanity—whichever snaps first

The golden cross is in play—the 50-day EMA finally smooching the 200-day EMA. The RSI’s being, well, indecisive. Add a rising wedge, and you’ve cooked up a scenario where, if XRP keeps its chin above $2.21 and bulls actually rally, $2.50 starts looking less like a fantasy and more like a slightly smaller fantasy.

Bullish Patterns or Just Your Imagination?

Elsewhere in the world of squiggly lines, we’ve got a symmetrical triangle forming (“often a precursor to explosive price movement,” says every TA bro ever). The Bollinger Bands are getting tighter—wink wink, nudge nudge. The result? If this triangle goes Pennant Mode™️, you could see XRP flirting with $3.40. Or you could see nothing at all. That’s the magic of crypto.

Add in record highs on the Nasdaq and S&P 500 and a flailing U.S. Dollar Index, and—why not—a market that’s feeling downright risky. Because if there’s anything more exciting than stocks going up, it’s maybe crypto not crashing for a whole week.

Institutions: Buying XRP Like Avocado Toast In Brooklyn

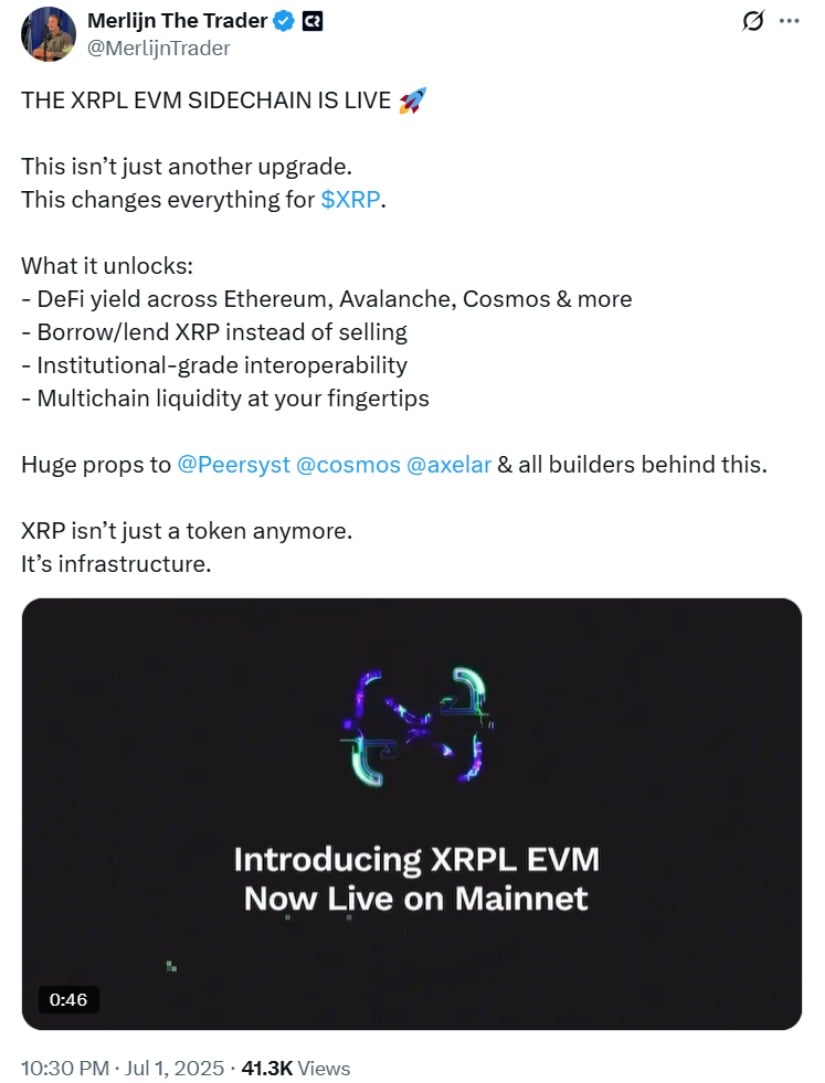

This week, per the folks at CoinShares who track these things so you don’t have to, XRP is now the third-most-purchased token behind Bitcoin and Ethereum. What’s with all the love? Thank Ripple’s shiny new EVM sidechain, which lets developers finally run their Ethereum-flavored code on the XRPL. Smart contracts on XRPL: what could go wrong?

The bold are already predicting XRP at $1,000 by 2030. Full regulatory clarity! Global adoption! Unicorns for every bagholder! If any of that actually happens, I’ll eat my Ledger hardware wallet—no salt, just for the flavor.

legal news, regulatory melodrama, and whatever tweet breaks the internet next.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- All Boss Weaknesses in Elden Ring Nightreign

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-07-05 14:45