Once, as I sat among asset managers—those keepers of money so sophisticated they speak in tongues of derivatives and private equity funds—I found myself amused, even a little sad, at their suffering. They parade through the financial districts, nobles in fine suits, wielding Excel spreadsheets like sabers. Yet under all the self-assurance lies a gnawing rot: these lords of capital are running empires on broken fax machines and hopes. 📠

//cdn.sanity.io/images/s3y3vcno/staging/ac6bf763b67c66aeb40bc1b8d64de9e4fea8527f-2000×1500.png”/>

The system creaks. The invisible hands clutch spreadsheets, trembling with the knowledge that one lost password might bring a trillion-dollar empire to its knees. “Transparency,” they say, yet you need a cipher and three interns to find out how the money’s actually moving.

Now, here comes blockchain—no, not another fever dream from the crypto prophets, but a ledger in the sky, promising that every blessed soul—GPs, LPs, auditors, even Fred from compliance—can see the same truth at the same time. The data! It flows in real time. The wine of the people, poured from the bottle of smart contracts. 🍷

Modernizing Fund Infrastructure—Or How I Learned to Stop Worrying and Love the Blockchain

Laugh if you will, but even the grandest bank is a tangled nest of administrators and clerks, reconciling the world’s fortunes with ancient shamanic rituals (read: emailing .csv files back and forth). Errors multiply. Costs rise. And somewhere, the ghost of Karl Marx is giggling into his beard.

The quiet revolution is this: blockchain, that notorious troublemaker, forces everyone to share the same ledger. The GP, the LP, the auditor—suddenly, they’re all reading from the same holy scripture, up-to-date and (almost) incorruptible. Manual reconciliation vanishes, transparency emerges from the basement like a mole blinking in the sun. Audits no longer require caffeine and tears. Smart contracts enforce payments instantly (as if the gods of finance finally joined the gig economy). No more PDFs. No more “just resend the wire when you have a moment?”

These innovations are no carnival tricks, no snake oil sold at the crossroads—they are real, like the callouses on a banker’s soul. Investors become the digital children of the revolution, holding fund shares that exist only in the ether, trading redemptions as easily as breathing, watching their yield accrue minute by minute—because sitting and waiting for hunched men to send out statements is so last century.

This is the exile of the spreadsheet—may it rest in peace. Asset management can finally emerge from its windowless back office. 🕯️

The Next Generation of Investment Vehicles, or: Blockchains and Other Marvels

But oh, humans are wild creatures! No sooner do they automate their toils than they seek new lands to conquer. Look at Apollo—moving one hundred million dollars on-chain, living (and perhaps loving) on multiple blockchains like a digital Don Juan. Or Franklin Templeton, bestowing tokenized money market funds that prance across blockchains, earning yield by the second—because minutes are for the bourgeois.

And BlackRock, of course, who has given birth to a $2.5 billion tokenized fund (one can only imagine the christening party). These brave pioneers have turned investment into a game for all: fractional ownership for the people, liquidity for the masses, wrappers so accessible even a Dostoevskian anti-hero could get exposure.

On the furthest shore stand the bravest: those who build on-chain yield vaults, smart contracts making trades, staking tokens, lending to protocols while you sleep or eat borscht. Companies like Veda Labs hand institutions a white-labeled goose that lays golden eggs, replacing intermediaries with code—because who wants middlemen when you can have algorithms that never ask for vacation?

It is the birth of a new asset class: as transparent as the vodka of my homeland, as relentless as a Moscow winter, as programmable as a Soviet five-year plan (but with fewer unexpected disappearances).

The Time to Build Is Now (Or “Get Busy Building, or Get Busy Sidelined”)

Let the asset managers keep their pride; let them boast of track records and cleverness. Yet, the world is changing. While some still fax in their wire instructions, the new world builds itself in code and consensus. The infrastructure is live, the tools are sharp. The revolution is polite but swift—and if you’re not on-chain, you are merely waiting for the next flood.

In conclusion: Blockchain is not the end of finance—it is merely the end of finance as we knew it, where mistakes and opacity ruled. There is no going back. The future is now… and it has no patience for quarterly PDFs.

Note: The author’s views are his own, and may not reflect the mighty opinions of CoinDesk, Inc. or its various capitalist overlords. 😎

Solana Treasury Firm Expands SOL Holdings and Staking Strategy With $2.7M Purchase

Tom Lee’s Bitmine Surges 3,000% Since ETH Treasury Strategy, but Sharplink’s Plunge Warrants Caution

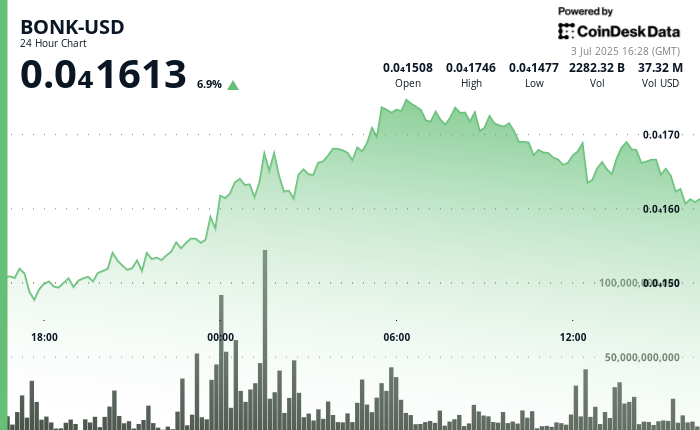

BONK Leads Memecoin Amid Crypto Rally While the Token Approaches 1M Holder Milestone

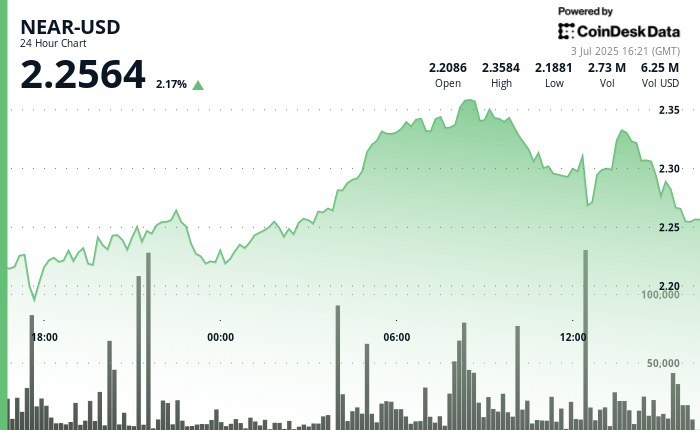

NEAR Protocol Surges 10% Before Profit-Taking Halts Rally

Traders Pile on Short Positions as Bitcoin Approaches All-Time High

U.S. June Jobs Data Blows Through Forecasts, With 147K Added, Unemployment Rate Falling to 4.1%

A Major Currency Outpaces Bitcoin With More Possible Momentum Ahead: Macro Markets

Crypto Tax Proposal That Didn’t Make it to Trump’s Budget Bill Pushed on Its Own

IMF Rejects Pakistan’s Proposal to Subsidize Power for Bitcoin Mining: Reports

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-03 21:12