Welcome to the US Crypto News Morning Briefing-your essential rundown of the most important developments in crypto for the day ahead.

Now, grab your coffee and settle in-if you don’t, who knows what kind of financial chaos might ensue? The markets are buzzing more than a caffeinated squirrel, and today’s hot topics could be the crystal ball for tomorrow. Precious metals are hogging the spotlight, stocks are behaving like well-trained puppies, and Bitcoin…well, it appears to be lurking in the shadows, probably contemplating its existence.

Crypto News of the Day: Tom Lee Explains Why Gold and Silver Are Dominating Investors’ Attention

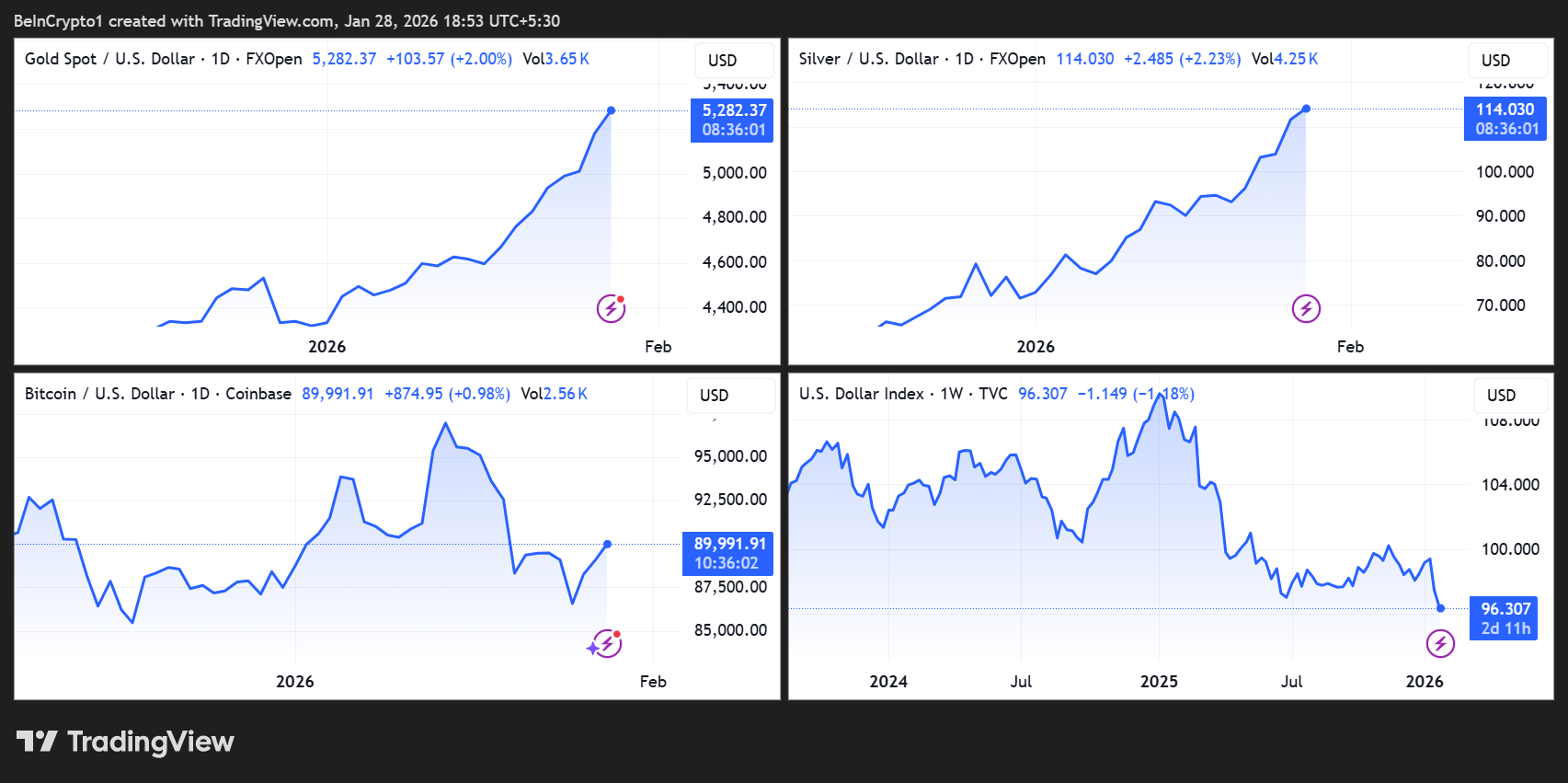

Investors are flocking to precious metals as if they were the last lifeboat on the Titanic, with gold and silver scaling multiyear heights. In an electrifying performance on CNBC’s Power Lunch, BitMine’s very own Tom Lee-who apparently moonlights as a market oracle-shared his wisdom on why these shiny assets have transcended their quirky “gold bug” reputation.

“Metals are proving to be a real, genuine asset class because I think for many years, maybe people thought only gold bugs should own gold. But now, especially the last three years, metals have, I think, proven to be a bit of a juggernaut,” Lee remarked, likely while sipping tea from a cup shaped like a dollar sign.

Lee attributed this metallic renaissance to geopolitical uncertainty, a floundering dollar, and central banks that seem to have taken a liking to easy policies-perhaps spending too much time at the buffet. He reassured us that the metal madness doesn’t spell doom for equities.

“I don’t think that those are bad for equities because if this is anticipating dollar weakness or more dovish moves by central banks, then it’s good for asset prices,” he explained, presumably with a twinkle in his eye.

According to Lee, the dollar’s wobbling and earnings growth doing a little happy dance should provide some stability for stocks, even as shiny metals steal the limelight.

Tom Lee’s Top Sector Picks and the Crypto Outlook for 2026

If you’re itching to get ahead of the curve for the rest of 2026, listen up! Lee has some sector recommendations that might just be the golden ticket you’ve been searching for.

From BitMine’s perspective, the crème de la crème includes energy, basic materials, financials, industrials, small-cap stocks, and the tech giants known as the Mag-7. Sounds like the ingredients for a Wall Street stew!

“Financials are being buffeted because the White House is choosing winners and losers…But the bank fundamentals are so good, and I think tokenization and blockchain are really big productivity drivers, and AI is a huge tailwind that I think banks are in the process of rerating more like tech stocks over time,” he said with the confidence of a man who just picked the winning lottery numbers.

While traditional markets remain anchored like a ship in a hurricane, Lee painted a rather bleak picture of the current state of crypto-it’s trailing behind metals like a forgotten puppy. The October 2025 deleveraging has left crypto markets limping along, but fear not!

“There was a massive deleveraging…some exchanges and market makers…so the industry is sort of limping along, but the fundamentals have improved a lot,” Lee noted, as if trying to console a sad puppy.

He added that historically, when metals perform a high jump, Bitcoin and Ethereum usually follow suit after a brief intermission. It’s like the markets are playing a game of musical chairs, and nobody wants to be left standing.

Lee also touched on short-term uncertainties like government shutdowns and earnings disappointments, insisting they often present buying opportunities instead of long-term threats-kind of like finding a dollar bill in your winter coat pocket.

“In the short term, of course, shutdowns create uncertainty…those have all proven to be buying opportunities,” he said, likely with a wink.

All in all, Tom Lee from BitMine paints a picture of a market in transition. Metals are the current darling of investors, but keep your eyes peeled-crypto could be gearing up for a comeback once the traditional safe havens decide to take a breather.

Investors seeking a balanced approach should maintain exposure to high-performing sectors, respect metals’ momentum, and keep a keen eye on crypto fundamentals for hints of the next big move.

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | Close As of January 27 | Pre-Market Overview |

| Strategy (MSTR) | $161.58 | $162.70 (+0.69%) |

| Coinbase (COIN) | $210.83 | $212.88 (+0.97%) |

| Galaxy Digital Holdings (GLXY) | $33.18 | $33.45 (+0.81%) |

| MARA Holdings (MARA) | $10.52 | $10.59 (+0.67%) |

| Riot Platforms (RIOT) | $17.55 | $17.72 (+0.97%) |

| Core Scientific (CORZ) | $19.94 | $20.22 (+1.405) |

Read More

- VCT Pacific 2026 talks finals venues, roadshows, and local talent

- EUR ILS PREDICTION

- Lily Allen and David Harbour ‘sell their New York townhouse for $7million – a $1million loss’ amid divorce battle

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- Gold Rate Forecast

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- The Beauty’s Second Episode Dropped A ‘Gnarly’ Comic-Changing Twist, And I Got Rebecca Hall’s Thoughts

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- eFootball 2026 Manchester United 25-26 Jan pack review

2026-01-28 18:16