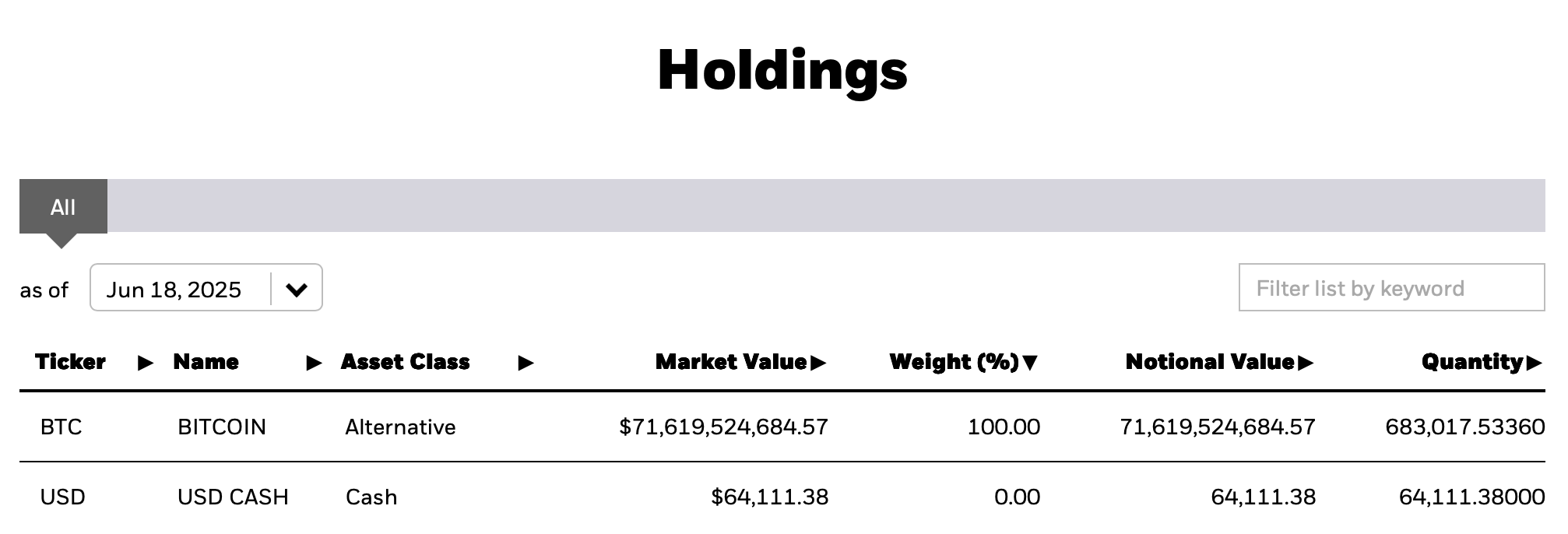

Ah, the insatiable hunger of the financial behemoths! In a span of mere fortnight, Blackrock’s Ishares Bitcoin Trust ETF (IBIT) has devoured a staggering 20,310.12 BTC, a sum worth a cool $2.11 billion. This brings its total holdings to a whopping 683,017.53 BTC, a treasure trove valued at approximately $72.19 billion. The great squid of finance has now wrapped its tentacles around 3.25% of the total bitcoin supply, and a formidable 3.44% of the circulating supply. 🐙

As we gaze upon the ascendancy of IBIT, we find its trajectory eerily mirroring that of bitcoin itself. On January 15, 2024, a mere four days after its launch, the ETF traded at a humble $23.80 per share; it now commands a price of $59.74, a return of 151% for those who dared to enter the fray at its inception. A parallel investment in bitcoin would have yielded a slightly more impressive return, a 153.7% gain, leaving the S&P 500’s 24.85% appreciation in the dust. Meanwhile, gold, that ancient store of value, rose from $2,029 per ounce to $3,365, a 65.85% increase, a respectable showing, yet still a far cry from the majestic rise of bitcoin. 💫

Thus, we behold IBIT, not merely as a rapidly expanding ETF, but as a significant conduit for the institutional embrace of bitcoin. Its pace of acquisition and close tracking of bitcoin’s price point to a strengthening bond between traditional finance (TradFi) and digital scarcity. The performance gap between bitcoin and legacy assets continues to reinforce its allure as a singular financial instrument, a beacon of hope in a world beset by the vicissitudes of fortune. 🌟

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-06-20 19:43