Picture this, my good sirs and madams: On the fateful day of Tuesday, our esteemed Bitcoin exchange-traded funds (ETFs) did gather a modest purse of over $200 million. “Splendid!” you declare—yet, alas, this pittance but pales before the previous day’s grand feast of $421 million. Truly, the banquet is thinning!

The chill wind of caution now rattles the crypto salon, as BTC itself tripped and tumbled to a lamentable low of $103,371—surely enough to make even the boldest investor fetch their fainting salts. Should this tragic descent persist, one might expect our ETF inflows to dwindle further, as the mighty lords of capital clutch their fortunes with the zeal of misers come tax season.

BTC ETFs: Once a Raging Inferno, Now a Smoldering Ember 😬

On the very same Tuesday, spot Bitcoin ETFs from the land of Uncle Sam saw net inflows of $216.48 million. A reason to prance with joy? Perhaps, but let us not break out the champagne just yet. For behold—a harrowing 47% drop from the previous day’s revelry of $412 million! One could say the “momentum” has taken a holiday, armed with a parasol and a deep sense of foreboding.

The timing could scarcely be worse; the inflow dip tangoed gracefully with BTC’s price stumble. Such theatrical coincidence! The price fell to a pitiful $103,371 as demand dried faster than a wine bottle at a playwright’s supper. Spirits dipped, wallets closed, and the trickling of new capital became but a drizzle, not even enough to water one’s houseplant.

BlackRock’s IBIT strutted ahead like a vain Marquis, raking in $639.19 million in a single day—raising its historical net inflow to the truly baroque sum of $50.67 billion. Meanwhile, Fidelity’s FBTC was left clutching its pearls as $208.46 million performed an elegant exit, stage left.

BTC: Pressure as Familiar as a Mother-in-Law’s Gaze 🙄

The comedy of errors endures! Today, BTC persists in its downward pirouette, shedding another 2% as if divesting itself of winter weight. The entire crypto ballroom whirls in a spree of selling, while the coin’s futures open interest (OI) sulks in the corner at $70.24 billion—a 3% dip in just one night! Traders duck for cover, closing positions faster than servants hiding from yet another tedious monologue.

Let us not forget! Open interest denotes all unsettled futures contracts, and when it shrinks—with prices tumbling—’tis but a sign that speculators flee faster than actors upon spotting the critic in the front row. Such weak conviction! Such timid appetites!

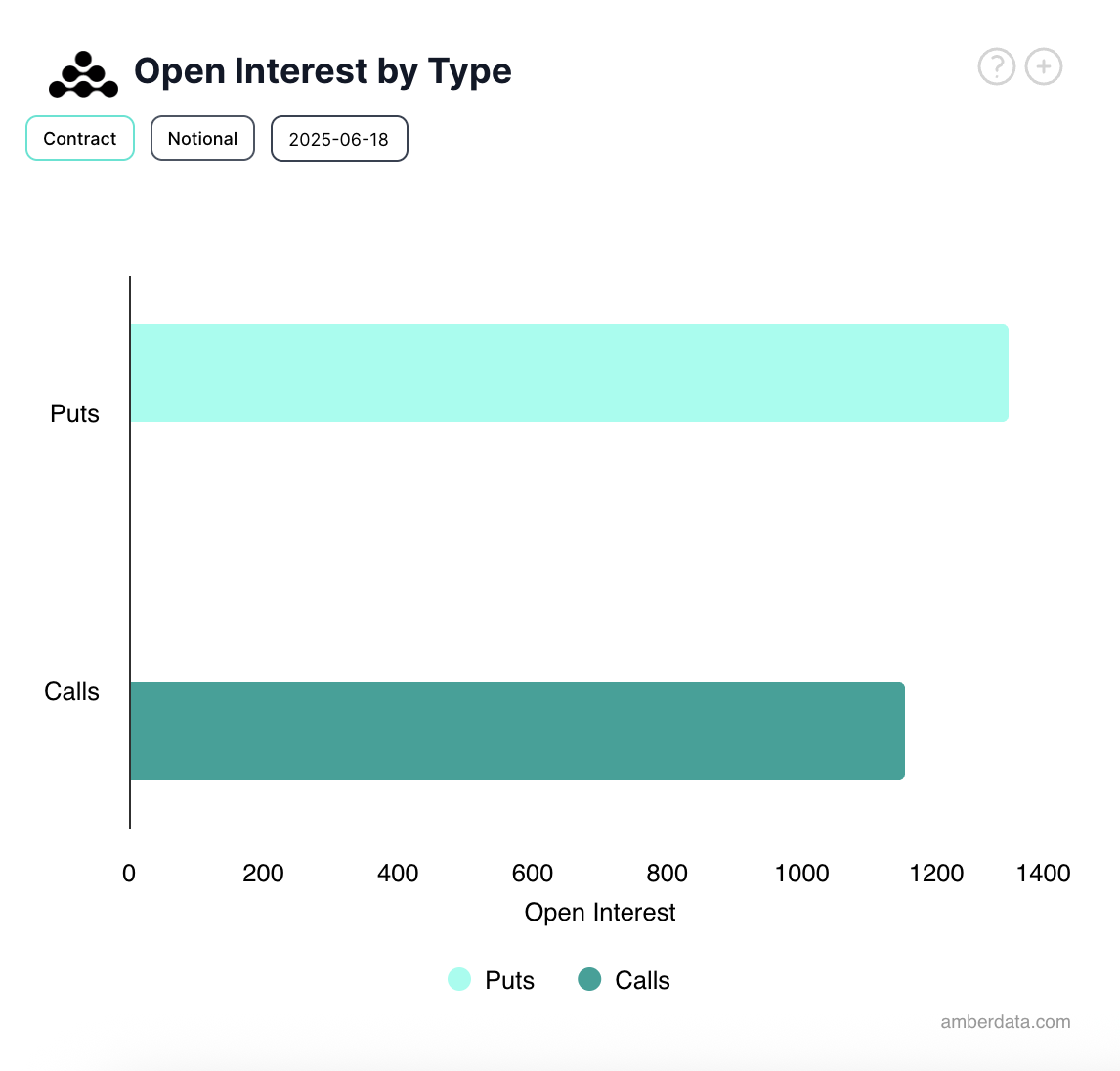

More grim tidings: bearish fever plagues the options market, with the populace hoarding put contracts like apothecaries before a plague. This imbalance screams “expect ruin!”—or at the very least, complaints at the next investor soirée.

So here we stand: ETF inflows like tepid tea, open interest receding, options traders dressing for a funeral. Institutional interest lingers, but—like a courtesan considering her options—appears rather noncommittal, waiting for fortune’s wheel to spin in a more agreeable direction.

Oh, Bitcoin! Thy drama outshines even the most florid of comedies! 🎭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- How to find the Roaming Oak Tree in Heartopia

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- What If Spider-Man Was a Pirate?

2025-06-18 10:42