Ah, Bitcoin! The digital currency that’s like a cat on a hot tin roof, navigating a high-stakes environment where tensions in the Middle East are escalating faster than a wizard’s temper at a failed spell. With macroeconomic risks piling up like laundry in a bachelor’s apartment, our beloved cryptocurrency is clinging to critical support like a toddler to their favorite teddy bear. For now, the bulls are in control, but beware! The hawks are circling, driven by rising US Treasury yields, inflation concerns, and geopolitical instability. A drop below the psychological $100,000 mark could send sentiment plummeting faster than a lead balloon. 🎈

Analysts, bless their hearts, are as divided as a group of wizards arguing over the best way to brew a potion. Some see the macro environment as a harbinger of deeper corrections, while others are calling for an imminent breakout and new all-time highs, fueled by long-term structural demand. It’s like watching a game of chess where both players are convinced they’re winning. 🐢

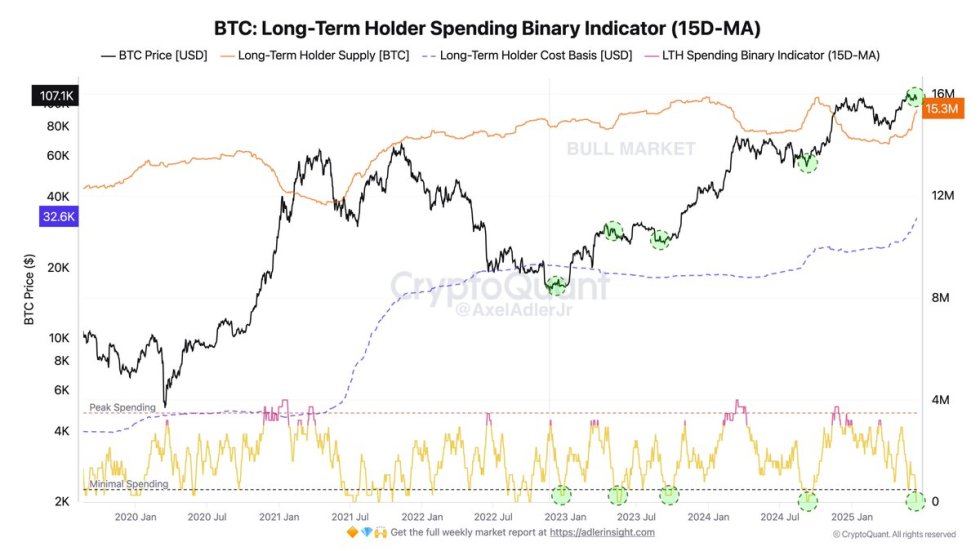

Supporting the optimistic view, new data from CryptoQuant reveals a powerful accumulation trend among long-term holders (LTHs). Apparently, their spending activity is now near historic lows—levels typically associated with early accumulation phases. In fact, in three of the last four similar instances, Bitcoin rallied 18–25% in the following 6 to 8 weeks. So, it seems the LTHs are playing the long game, like a tortoise in a race against a hare. 🐢💨

While short-term uncertainty clouds the outlook like a foggy day in Ankh-Morpork, the combination of low LTH spending and resilient support levels suggests that a significant move could be brewing. Whether it’s a breakout or a breakdown will depend on how global conditions evolve in the coming days. Stay tuned, folks! 📺

Bitcoin Consolidates Above $105K As Long-Term Holders Signal Strength

Bitcoin has entered a consolidation phase following its powerful rally from $74,000 to a new all-time high near $112,000. While the market has cooled off from its peak, BTC remains as resilient as a dwarf in a bar fight, holding above the $105,000 mark—a key level that now acts as support. This tight trading range reflects a broader sense of uncertainty, as investors await clarity on rising geopolitical tensions in the Middle East and macroeconomic shifts before committing to the next major move. 🏦

The coming weeks will be decisive. A resolution to the Israel-Iran conflict or a shift in monetary expectations could ignite a breakout. Conversely, prolonged volatility or new macro shocks may delay the next phase of the cycle. Still, many analysts maintain a bullish long-term view, projecting that BTC could soon enter price discovery and break above its $112K ATH. It’s like waiting for a kettle to boil—eventually, it’s bound to whistle! 🔔

Adding to this optimism, CryptoQuant’s analyst Axel Adler points to a compelling on-chain signal. The entire Long-Term Holder (LTH) cohort is showing spending activity near historic lows, levels typically associated with accumulation phases. In three out of the last four similar cases, Bitcoin rallied 18–25% over the following 6–8 weeks. This suggests strong conviction among experienced holders. 🧙♂️

Adler also notes that the current weakness in the LTH binary indicator is reinforced by other bullish signals: a positive shift in CDD Momentum (Coin Days Destroyed) and a still-elevated MVRV Z-score. Both metrics historically align with trend continuation and undervaluation periods. It’s like finding a hidden stash of gold in a dragon’s lair—unexpected but oh-so-sweet! 🐉

Together, these on-chain indicators suggest that Bitcoin is quietly building a base, with long-term holders accumulating rather than distributing. While short-term volatility may persist, the broader structure points toward a potential breakout once uncertainty clears. It’s like waiting for the clouds to part and reveal the sun—eventually, it’s bound to happen! ☀️

BTC Price Range Holds as Market Awaits Breakout

Bitcoin is currently trading around $105,569 on the daily chart, consolidating within a clearly defined range between the $103,600 support and the $109,300 resistance. This range has now been respected for several weeks, with BTC repeatedly testing both boundaries without a confirmed breakout or breakdown. The $103,600 level—Bitcoin’s previous all-time high from December 2024—has now become a critical demand zone. Buyers have consistently stepped in near this level, preventing further downside despite recent macro volatility and Middle East conflict concerns. 🏰

From a moving average perspective, BTC is still holding above the 50-day (blue) and 100-day (green) simple moving averages, signaling that mid-term momentum remains bullish. The 200-day SMA (red) sits far below the current price, reinforcing BTC’s broader uptrend. A daily close above $109,300 could signal a return to price discovery, likely triggering renewed bullish momentum and a potential push beyond $112K. It’s like a racehorse ready to burst out of the gate! 🏇

However, if $103,600 fails to hold in the event of renewed macroeconomic fear or negative news, BTC could drop toward the $97,000–$98,000 range. Until then, the market appears to be in a wait-and-see mode. The setup remains constructive as long as support levels continue to attract buyers and the higher time frame structure holds. So, keep your eyes peeled, folks! 👀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-06-18 03:16