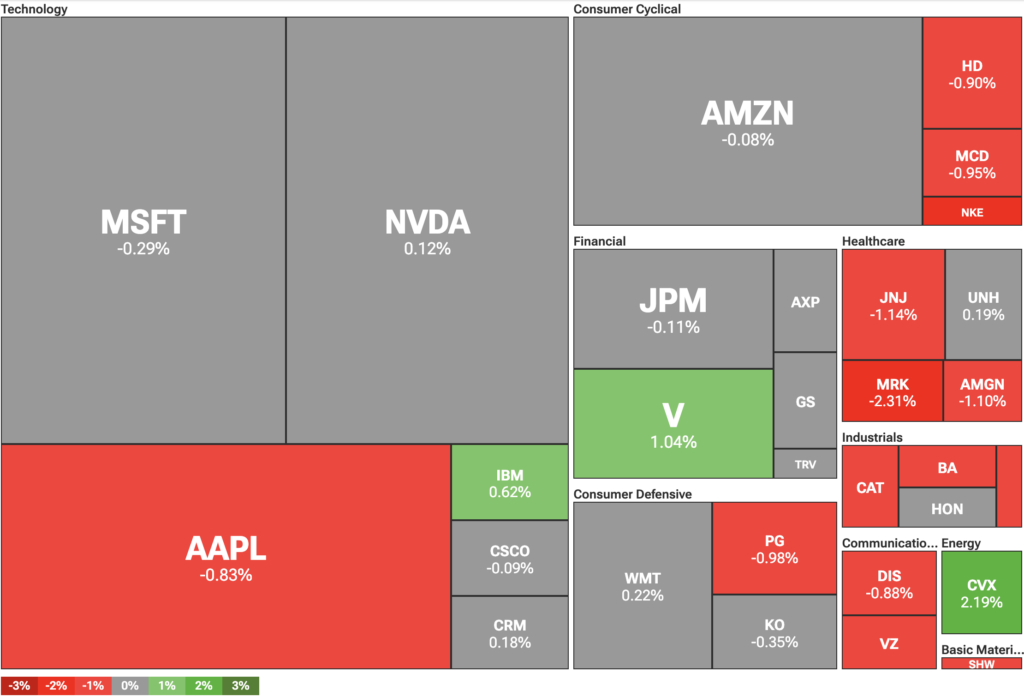

The iron sky presses down upon the city as another dismal note sounds from the markets—a song of loss and anxiety hummed by the weary men in suits, their faces drawn tight by another fall. Today, comrades, American stocks took a dive—no ballet or pirouette here, just a heavy stumble—while Trump, with the conviction of a czar at a chessboard, declares, “Iran must never possess nuclear fire.” And so, the shadows lengthen, hope recedes, and the Dow—that ancient beast dragging its feet along Wall Street—drops 130 points. It’s no surprise the healthcare barons lead the charge downward; after all, even the healthiest are sick of this market. The S&P 500 groans, the Nasdaq sighs—numbers tumbling like old men down icy Moscow stairs.

Then, straight out of an international farce, we hear President Donald Trump’s plea to “evacuate Tehran.” Wall Street shudders, investors stare into their little glowing screens and try not to spill their coffee. No peace, no handshake—just the possibility of protracted, cigar-smoke-lengthened negotiations while Trump stands arms folded, waiting for a disarmament that, realistically, may arrive later than the Moscow circus to Kansas City.

Meanwhile, oil prices shoot up 3%—faster than vodka at a village wedding—because real fear sets in when you imagine the Strait of Hormuz choked tighter than an oligarch’s wallet. Israel’s already tossed a few unpleasant surprises at Iranian oil plants. Speculators begin to sweat (perhaps for once with reason), and the world’s arteries clog with dread.

Some rather optimistic economists mutter over their spreadsheets: “Perhaps the Federal Reserve will cut rates.” Historically, the Fed has treated oil spikes like bad horseradish—unpleasant, but temporary. Yet, in this feverish new world, sustained surges may break more than piggy banks—they might crack the stone tables of employment itself. The Fed may soon have to lower rates just to revive the economy from its fainting spell.

Yes, my friends, when oil climbs and hope falters, perhaps only lower rates can soothe the tired brow of our beloved economy. One wonders if printing money will ever be as satisfying as printing vodka labels.

RFK Jr. takes aim at Big Pharma ads

In the midst of the ruckus, we turn to a different circus ring: Big Pharma. The Trump administration, it’s whispered, is plotting restrictions on pharmaceutical advertising—a $10 billion festival of grins and disclaimers—under the keen eye of People’s Champion, Health Secretary Robert F. Kennedy Jr. Prepare for law-mandated confessions in every sunny pill commercial, making each ad so long you’ll need a lunch break to watch. The pharmaceutical kingdoms are considering: Maybe they’ll have to make ads interesting or—dare we say—truthful? That’ll be the day! 🤡

Meanwhile, inspired by actual concern for human health (shocking, yes!), Kraft Heinz, that titan of processed foodstuffs, announces that artificial colors are out. By 2027, Kool-Aid and Jell-O may look more like rainwater than rainbows. So, the revolution comes not with a bang but a whimper—and a slightly less radioactive children’s snack. The march toward national health is slow, but hey, at least your gelatin dessert may soon be only half as suspicious as your bank statement.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

2025-06-17 20:40