There is a silence on the crypto steppe, as Hedera (HBAR) claws its way 4% higher across 24 hours, only to be reminded—like a snowbound prisoner—that the week is still down 7%. Escape remains impossible below the $0.19 barrier. The chart, a pitiless warden, shows technical signals muttering contradictory rumors: BBTrend dreams bearish dreams, and EMA lines sigh—more snow, perhaps, but colder. ❄️

But lo! Is that a thaw? The RSI, battered but indignant, recovers—defiant, like a shivering zek who finds a crust of bread under the cot. Buying pressure, says the RSI, returns, even if only for a cigarette’s worth of hope. Crackling resistance and weary support wait to ambush; Hedera, like a fugitive, edges into a no man’s land with eyes wide open.

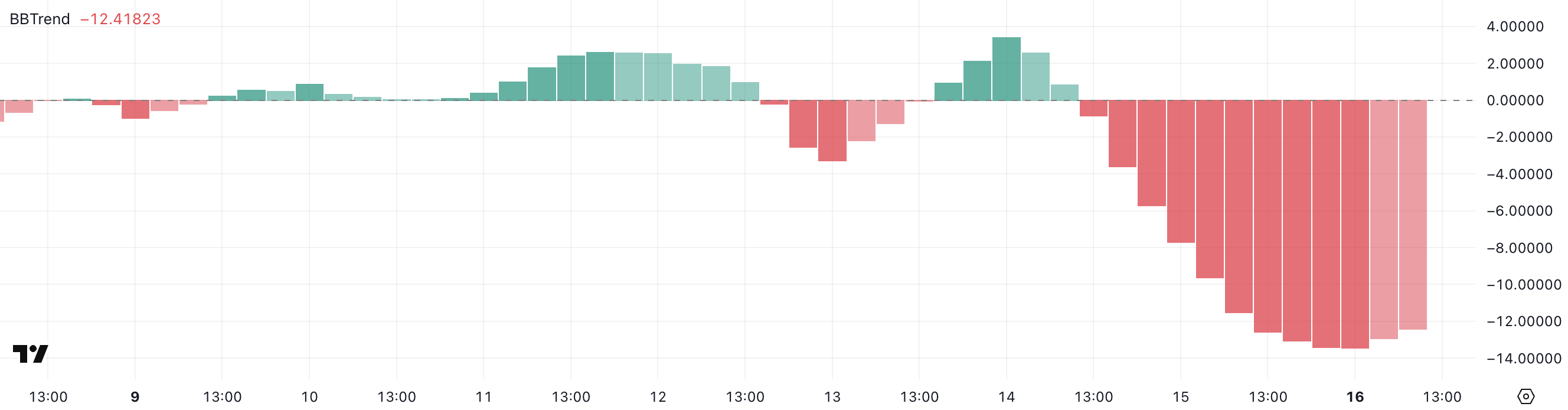

The Bears’ BBTrend Gulag: No Amnesty for HBAR

HBAR limps as BBTrend nosedives to -12.41, down from -0.83—two days’ time but a lifetime for those who count only reds in their ledger.

This very morning, BBTrend hit -13.43 before crawling up a little, a small mercy before the next interrogation session.

Such a plunge points to intensifying bearish control; the sellers are the new camp guards, rationing dreams and squeezing any glimmer of rebellion out of the price action. Buy the dip? Maybe after ten more years of hard labor. 😏

The BBTrend, for those who haven’t yet chewed the dried crust of charting despair, is the Bollinger Band Trend—the all-seeing Commissar watching shifts in price width and slope.

When BBTrend turns dark as a Siberian December, it shouts ‘downward with increasing volatility!’—as if anyone had forgotten. HBAR’s mood, now at -12.41, seems suited for the camp newsletter: “Bearish forces maintain labor discipline.”

If the present trend persists, don’t expect parole; more price declines loom, or (for the hopeful) endless shivering in the lower bunks—‘consolidation’, as the optimists say before lights-out.

RSI Rises From Its Ice-Covered Cot: Moment of Defiance?

Yet, a shift. Some scrawled notice appears: RSI ascends to 50.39, up from 26.6—either a clever escape or the guards are simply distracted by vodka.

This leap registers as renewed buying zeal, a potential end to the oversold hunger. Has the kitchen run out of bad news, just for today?

The RSI, now at Switzerland-level neutrality, signals not bread, but a pause. The tipping point awaits: breakout feast? Or another round of cold soup?

Your RSI, in case they confiscated your chart textbooks, oscillates from 0 to 100—below 30, oversold Siberia; above 70, overbought dacha.

HBAR now huddles at 50, neither jubilant nor broken, poised between buyers’ chorus and sellers’ dirge. Balance, or the calm before another guard dog charge?

This level could be a spring thaw—if buyers rush the gate. Or maybe… the blizzard resumes. ⛄️

HBAR at the Barricades: $0.160 Resistance or Just Another Snowdrift?

HBAR’s bearish architecture stands as enduring as a labor camp fence: short-term EMAs are shackled below long-term ones, shackling every price dream.

Yet, the exhausted price action is squinting at a resistance checkpoint at $0.160. Does the guard look sleepy?

A break above this checkpoint could usher HBAR to daylight: $0.175, or—dare we hope—$0.193, if bullish crowds finally overthrow the warden.

But if the guards do not falter, expect a brutal return to $0.155. Slip below $0.155, and it’s back to $0.150—where all the rumors started and the soup is coldest. Same as yesterday, same as tomorrow, unless the winds of fortune change. 🙃

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-17 03:06