It is a truth universally acknowledged, that a single man in possession of a good fortune must be in want of a wife. However, in the bustling world of modern finance, a single stock in possession of a good fortune must be in want of a bullish investor. Today, we find ourselves in the company of three such gentlemen: Circle (CRCL), Coinbase (COIN), and Robinhood (HOOD), all of whom are making notable strides in the crypto market. CRCL, the most dashing of the trio, has seen a rise of over 18% today and a staggering 404% since its IPO, much to the delight of its many admirers, fueled by the growing popularity of USDC and its cross-chain adventures.

COIN, ever the gentleman with a penchant for innovation, is gaining ground with new product launches and a promising regulatory landscape in Europe. Meanwhile, HOOD, the belle of the ball, continues to charm investors with a 102% gain year-to-date, dancing near its all-time high. As each company approaches key technical levels, the market watches with bated breath to see if the bullish momentum will hold, or if these stocks will falter in the face of market whims. 🕊️

Circle Internet Group (CRCL)

Circle, a company of considerable means and even greater ambition, continues to expand its dominion over the stablecoin realm. With network integration and cross-chain growth as its twin pillars of strength, Circle has recently launched native USDC support on the XRP Ledger (XRPL), a move that has eliminated the need for cumbersome bridges and allowed developers and institutions to partake in the swift and cost-effective transactions of USDC on XRPL.

Furthermore, Circle’s Cross-Chain Transfer Protocol (CCTP) has achieved a record $7.7 billion in stablecoin bridging volume in May, a remarkable 83% increase from April. These developments have come at a time when Circle’s newly listed stock, CRCL, has opened today with a rise of more than 18%, pushing its post-IPO gains to a most impressive 404%.

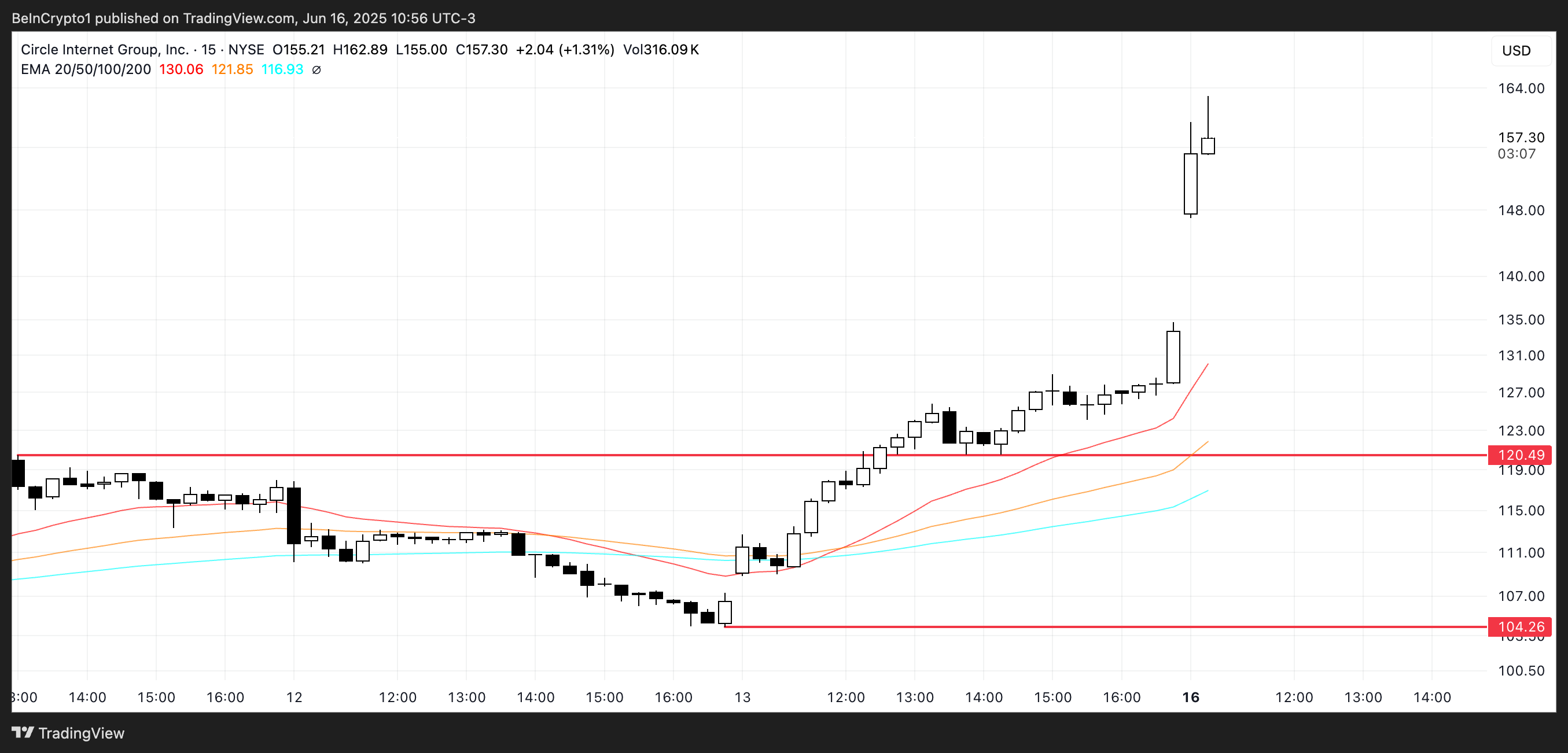

The company’s steadfast refusal of Ripple’s $5 billion acquisition offer, coupled with its expanding network of institutional partnerships, has only served to fuel the bullish sentiment. Currently trading around $158, some analysts have set a target price as high as $300, a testament to the firm’s strong position in the stablecoin market. However, should the momentum wane, CRCL’s nearest strong technical support lies near $120, a level that must be defended with the utmost vigor. 🛡️

Coinbase Global (COIN)

Coinbase, a gentleman of considerable repute, is once again the center of attention as it continues to fortify both its product offerings and its global regulatory presence. In a significant development, Coinbase has partnered with Shopify and Stripe to enable USDC stablecoin payments on Shopify’s Base-integrated checkout system. This feature allows merchants to accept crypto payments without the need for additional infrastructure, offering settlement in either USDC or local fiat currencies.

Moreover, Coinbase is reportedly on the cusp of securing a full EU crypto license through Luxembourg, a crucial milestone under the MiCA framework that would grant the exchange regulatory access across the European Union. 🏛️

COIN shares are up 2.7% at the time of writing, a reflection of growing investor optimism. Following a 76% year-over-year revenue surge and recent product announcements during its State of Crypto Summit, analysts like Rosenblatt Securities continue to rate the stock a “Buy,” with a target price of $300. If Coinbase can regain the bullish momentum seen earlier in May, it may soon challenge the $265 resistance level, with $277 as the next key upside target. However, momentum must hold, especially as trading volumes remain soft in the near term—analysts see this as a potential buying opportunity rather than a red flag. 📈

Robinhood Markets (HOOD)

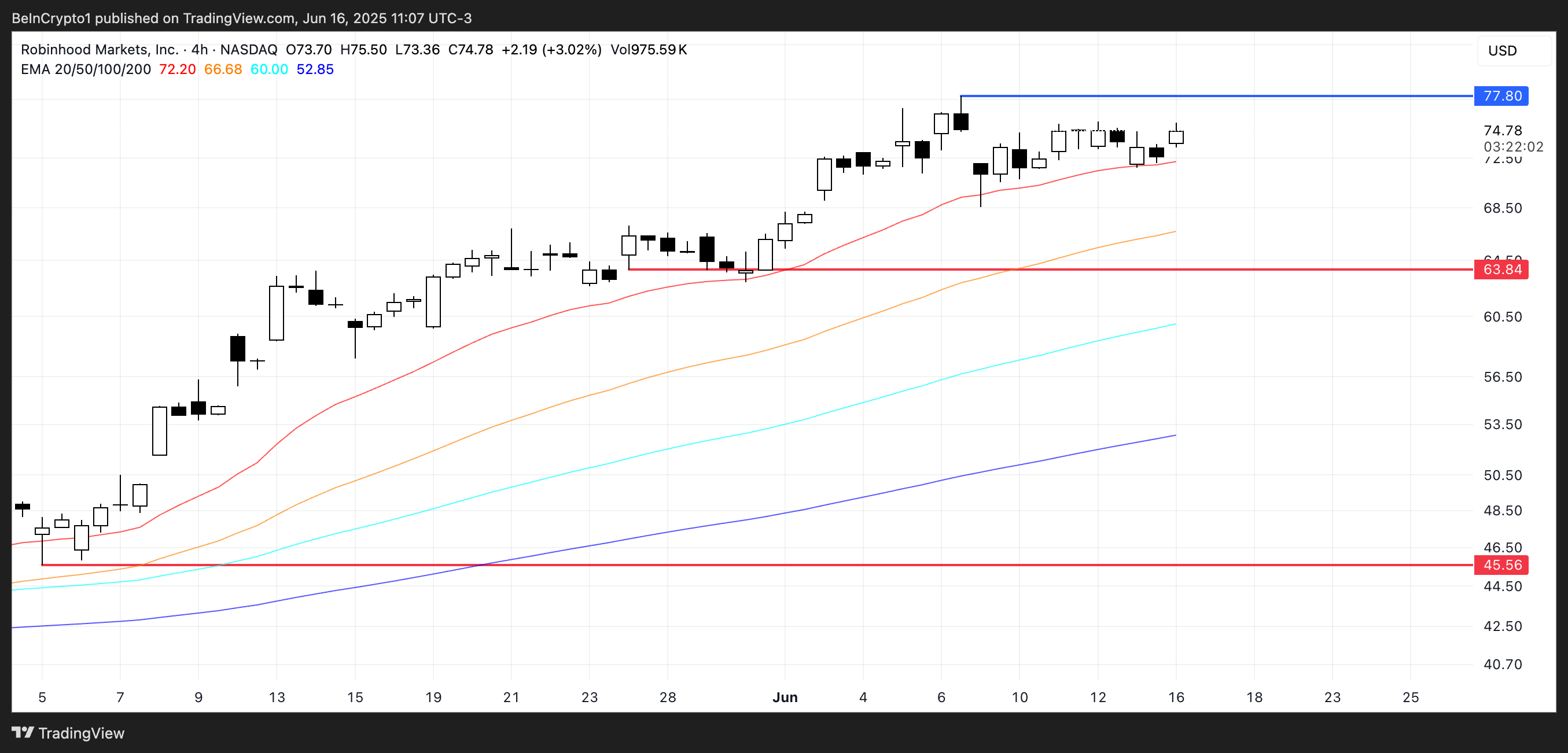

Robinhood, the darling of the fintech sector, continues to trade near its all-time high, with the stock up nearly 102% year-to-date. Its Exponential Moving Averages (EMAs) remain firmly bullish, with short-term averages well above the long-term ones, a clear sign of strong underlying momentum. If this trend continues, HOOD could soon test the resistance at $77.8, and a breakout above that level may open the path toward $80, marking a new all-time high and further validating the stock’s upward trajectory. 🌟

However, despite the bullish structure, investors should keep a watchful eye on key support levels. The $63.84 support zone is critical—if broken, it would likely signal a loss of momentum and a potential trend reversal. In such a case, HOOD could decline sharply, with $45.56 as the next significant downside target. 🚨

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-16 17:56