The sun beat down on the dusty streets of the financial world, casting a golden glow over the anxious faces of investors. Bitcoin, that most mercurial of creatures, danced precariously above the $104K mark, its fate hanging in the balance like a condemned man on the gallows. The recent skirmishes between Israel and Iran had injected a shot of adrenaline into the markets, and the cryptocurrency was feeling the effects.

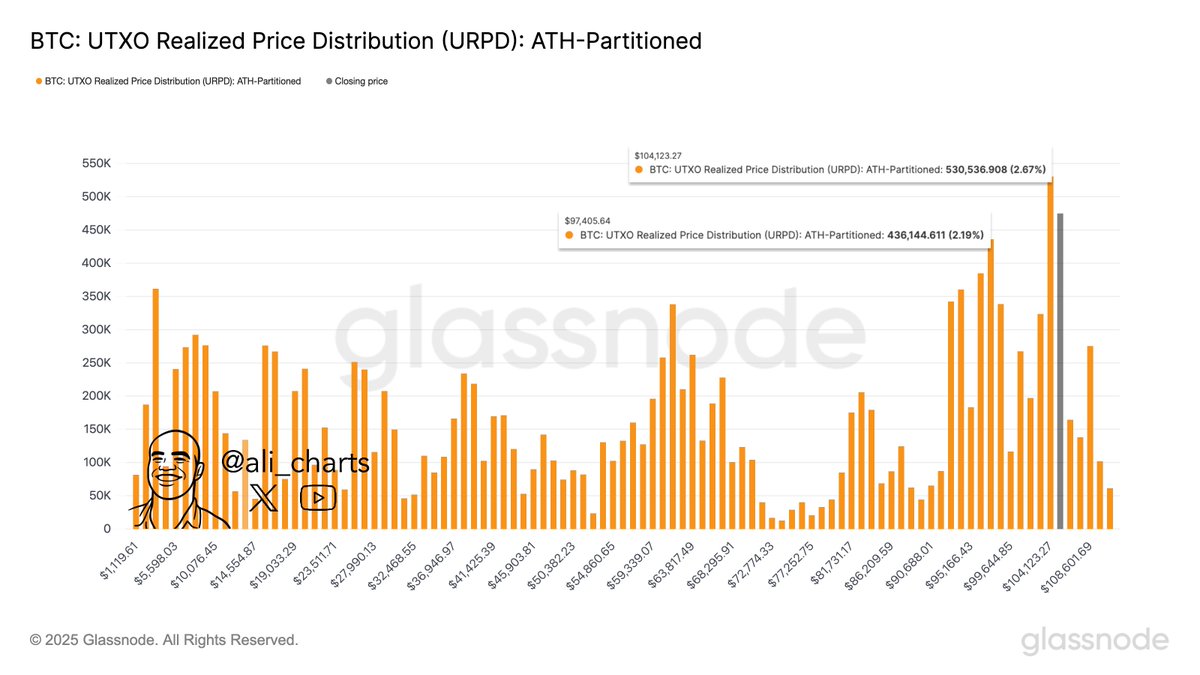

Despite the chaos, Bitcoin showed a resilience that would put a cockroach to shame. Down a mere 5% from its all-time high of $112K, it continued to trade within a broader consolidation range, like a cowboy waiting for the perfect moment to strike. Top analyst Ali Martinez eyed the $104,124 level with a hawk’s intensity, noting that it aligned with a cluster of Unspent Transaction Outputs (UTXOs) that shone like a beacon in the darkness.

“This level is the real deal,” Martinez declared, his voice dripping with conviction. “If Bitcoin holds above it, we might just see another push toward price discovery. But if it breaks down… well, let’s just say things could get ugly.” The image of a lemming hurtling off a cliff came to mind, and investors shuddered at the thought.

As the world teetered on the brink of chaos, Bitcoin stood firm, a digital Atlas holding aloft the weight of the crypto market. The $100K mark beckoned like a siren’s song, and investors prayed that the cryptocurrency would continue to resist its allure. A sharp rise in oil prices loomed on the horizon, threatening to upset the delicate balance of the markets.

“It’s a transitional phase, folks,” the analysts chimed in unison. “Either Bitcoin is gearing up for a breakout or preparing for a deeper retracement. The next few days will be crucial.” The air was thick with tension as investors waited with bated breath for the cryptocurrency’s next move.

The coming days would be a true test of Bitcoin’s mettle. Would it emerge victorious, or would it succumb to the pressures of the market? Only time would tell. For now, the bulls remained in control, but the path forward was fraught with peril. As the great philosopher, Ferris Bueller, once said, “Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” 🤯

The charts told a story of consolidation and indecision. Bitcoin hovered between $103,600 and $109,300, like a hummingbird sipping nectar from a flower. The 50, 100, and 200-period SMAs converged above the current price, a sign that a decision point was near. A clear break above $106,800 could trigger momentum to test $109,300 again, while a failure to hold above $104,500 would expose BTC to downside risk.

Volume remained muted, a sign that the panic selling had cooled for now. But the price remained below the 200 SMA, a reminder that the bulls still had work to do. As the sun dipped below the horizon, investors could only wait and watch, their hearts pounding in anticipation of what the future held. 🤔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- ATHENA: Blood Twins Hero Tier List

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-06-15 11:47