Ah, dear reader, gather ’round as we delve into the curious case of our friend, the Worldcoin token, which has recently decided to play a game of hopscotch around the $1.00 mark. After a rather dramatic plummet that would make even the most stoic of investors clutch their pearls, it appears our token is now stabilizing, much like a wobbly table in a posh café. With technical indicators aligning like a well-rehearsed chorus line and market interest picking up like a sprightly young lad at a dance, traders are peering through their monocles, eagerly anticipating a breakout.

Now, while the resistance at $1.20 stands as firm as Aunt Agatha at a family gathering, recent price antics and momentum metrics suggest that a bit of accumulation might be brewing. These developments come at a rather pivotal moment, as WLD approaches what one might call an inflection zone—think of it as a crossroads, but with fewer horses and more digital currency.

Price Activity Suggests Stabilization with Possible Reversal Indicators

Our dear Worldcoin (WLD) has been on quite the rollercoaster ride, with price movements that could rival the most dramatic of soap operas. Between June 4 and June 6, WLD experienced a significant price drop, marked by heavy selling activity and bearish candles that would make even the most seasoned trader weep into their tea.

However, fear not! This downturn was merely a prelude to a more stable price range between June 7 and June 10, where WLD traded within a narrow band, suggesting a delicate balance between buying and selling pressure—much like a tightrope walker at a circus.

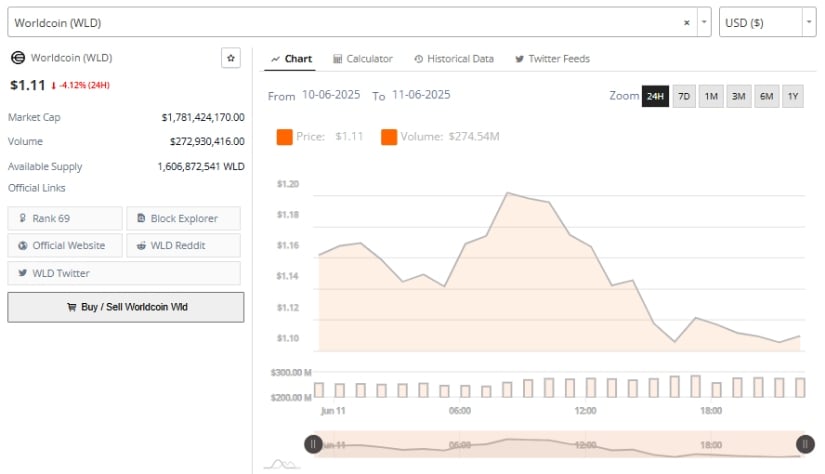

In the subsequent sessions, our token attempted to establish some bullish momentum, briefly flirting with the $1.23 mark on June 10 and early June 11. Alas, this upward move was met with resistance, leading to a swift rejection that sent the price tumbling back to around $1.11. The repeated failure to maintain levels above $1.20 indicates a rather robust resistance zone, akin to a bouncer at an exclusive nightclub.

As of June 12, WLD is trading near $1.11, aligning with its earlier consolidation lows and suggesting that unless a clear directional breakout occurs, we might be in for a bit of a sideways shuffle.

Open Interest and Volume Trends Reflect Market Sentiment Shift

//bravenewcoin.com/wp-content/uploads/2025/06/Bnc-Jun-12-2.jpg”/>

Open interest peaked around the time Worldcoin’s price prediction approached its local high on June 11. Following this, both price and open interest declined in tandem, a sign that traders may have been unwinding positions or locking in gains. This reduction reflects a temporary pause in speculative engagement, aligning with the broader consolidation phase—think of it as a brief intermission in a riveting play.

Additionally, the 24-hour volume of $274.54 million recorded during the price surge on June 10 further confirms active trading interest during periods of upward momentum. However, as prices fell, elevated selling volume suggested a potential distribution phase where short-term holders exited positions, much like guests leaving a party when the music turns sour.

Worldcoin Price Prediction: Technical Indicators Highlight Emerging Bullish Signals

On the weekly chart, WLD’s broader trend remains within a downtrend channel, with consistent lower highs and lower lows since its previous high of approximately $4.19. However, the asset has been trading near the $1.00 support zone for several weeks, indicating a potential base-building phase—like a sturdy foundation for a rather grand mansion.

The price is currently showing mild gains on the weekly timeframe, with the latest candle reflecting a 1.08% increase. The narrow-bodied candlesticks observed over the past month point to market indecision but also signal reduced volatility, which often precedes larger directional moves—much like the calm before a storm.

The Chaikin Money Flow (CMF) stands at -0.11, still in negative territory, which implies persistent capital outflows. However, the gradual upward slope of the CMF in recent weeks may indicate a shift in accumulation behavior, with investors beginning to cautiously re-enter the market. This development aligns with the declining selling pressure observed during the consolidation period—like a timid mouse peeking out of its hole.

Meanwhile, the Moving Average Convergence Divergence (MACD) offers a potentially constructive signal. The MACD line has crossed above the signal line, and the histogram has turned positive for the first time in several months. Though the MACD remains below the neutral level, the crossover typically signals early bullish sentiment and may precede a shift in trend. For this signal to hold weight, further confirmation through increased volume and sustained price movement above $1.16 would be essential—like a good cup of tea, it needs to steep just right.

In summary, while Worldcoin continues to face resistance in the short term, several indicators suggest that accumulation is taking place near support levels. A sustained move above immediate resistance and positive momentum in volume and open interest could position WLD for a potential breakout from its prolonged downtrend. So, dear reader, keep your eyes peeled and your wallets ready—this rollercoaster ride is far from over! 🎢💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- All Boss Weaknesses in Elden Ring Nightreign

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-06-12 23:40