Well, well, well! In just 19 days, the mystical world of tokenized U.S. Treasuries has gobbled up an astonishing $340 million. That’s right—who knew that digital dollar magic could grow so fast? In the blink of an eye, this sector has swelled by 4.86%, as if capitalism itself had a sugar rush! 🍭

$340 Million Gets Swapped for Digital Dough – Institutions Are Loving It!

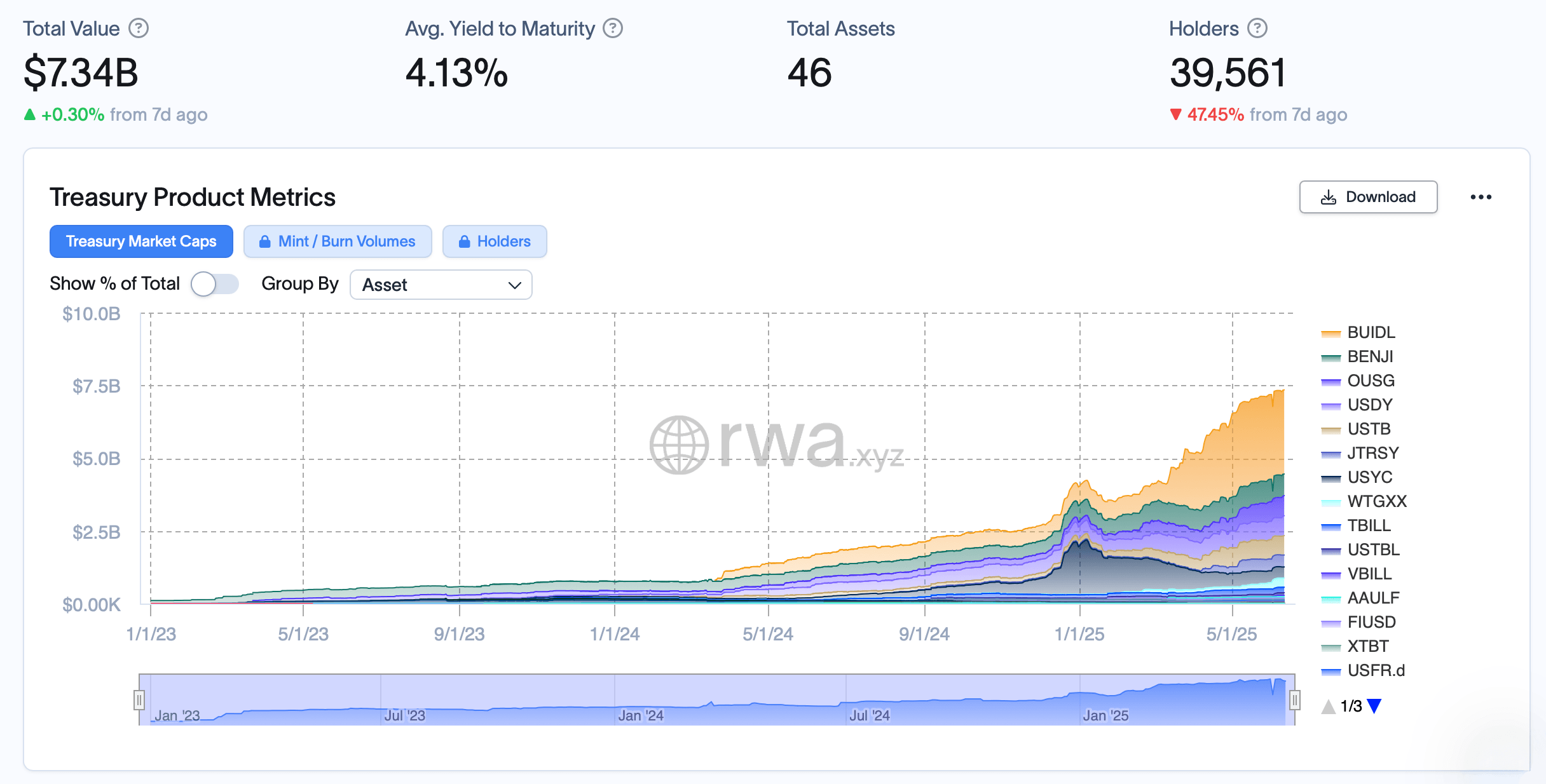

As of June 12, 2025 (yes, 2025—time flies faster than your grandma’s gossip), the blockchain-blessed U.S. Treasury fund market is sitting pretty at a whopping $7.34 billion. According to rwa.xyz stats (because who doesn’t love a good stat?), since May 24, investors have flung in about $340 million—no big deal, just a tiny flood of cash! 🎉 Blackrock’s fancy-pants USD Institutional Digital Liquidity Fund, aka BUIDL, is now worth $2.890 billion—just a teensy little dip of $23 million (as if anyone’s counting). 🧐

BUIDL, king of the tokenized treasury castle, is backed by 79 sturdy holders who clearly love digital dollars. Coming in second is the Franklin Onchain U.S. Government Money Fund, aka BENJI. It’s sitting pretty at $742.04 million, down a measly $16 million from its glory days of $758 million. About 607 investors now hold BENJI—sounds like a club, doesn’t it? 🕺💃

The Ondo Short-Term US Government Bond Fund—fancy name, huh?—or OUSG, is now worth $691 million, up $54 million from 19 days ago. It boasts 73 proud holders. Not far behind, Ondo’s other darling, USDY, has climbed to $683 million after gaining $52 million, with 15,492 participants — that’s right, nearly fifteen thousand folks just like you and me playing the digital penny game! 🤑

And let’s not forget the Superstate Short Duration U.S. Government Securities Fund, proudly holding $668 million. That’s a nice $12 million bump from its previous $656 million. Several other funds outside the top five also got a taste of the capital pie, contributing to the grand total of $340 million added to the sector. Yum! 🥧

All this bubbling enthusiasm for tokenized treasuries isn’t just child’s play—it’s a clear sign that big-money institutions are happily dipping their toes into the blockchain pond. As more cash flows in, it’s like watching the old financial world get a shiny digital facelift, and everyone’s invited to the party! 🎉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- PUBG Mobile or BGMI A16 Royale Pass Leaks: Upcoming skins and rewards

- The John Wick spinoff ‘Ballerina’ slays with style, but its dialogue has two left feet

- Kingdom Rush Battles Tower Tier List

- Clash Royale Season 77 “When Hogs Fly” November 2025 Update and Balance Changes

- Delta Force Best Settings and Sensitivity Guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Stocks stay snoozy as Moody’s drops U.S. credit—guess we’re all just waiting for the crash

- ‘Australia’s Most Sexually Active Woman’ Annie Knight reveals her shock plans for the future – after being hospitalised for sleeping with 583 men in a single day

2025-06-12 20:58