Ah, what a marvelous day for the market! Stocks are climbing faster than a squirrel on a caffeine binge, all thanks to the delightful news of inflation behaving itself a tad more than expected. Hopes are high that the Federal Reserve, in its infinite wisdom, might decide to cut interest rates, and who wouldn’t want that? 🏦💰

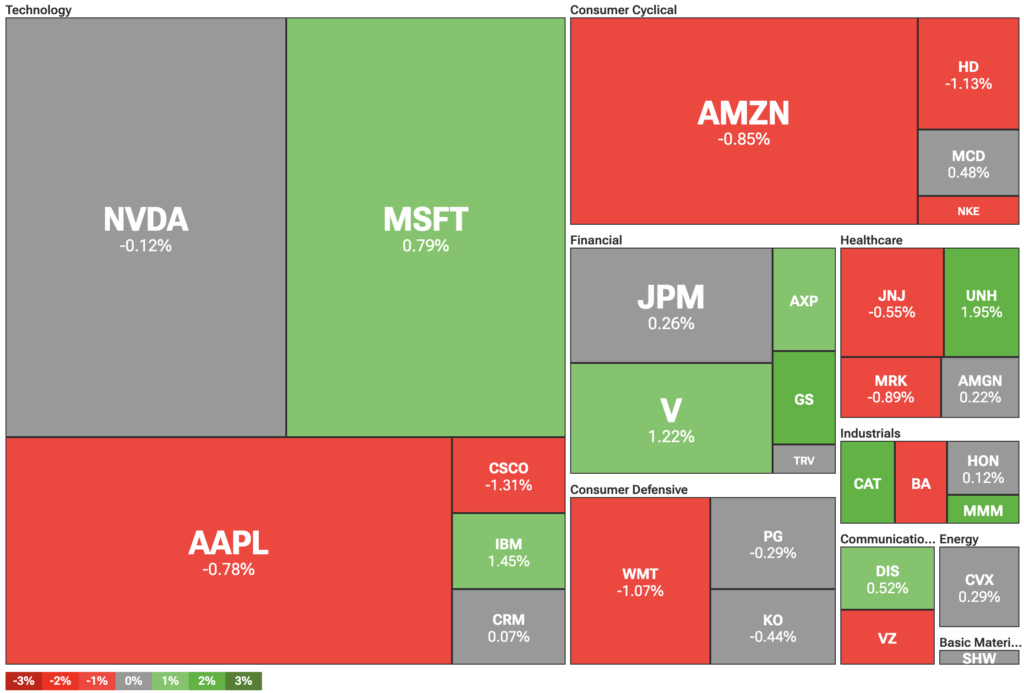

Once again, dear traders are peering into the mystical depths of Federal Reserve policy for their precious direction. On this fine Wednesday, June 11, behold the Dow Jones as it soared nearly 200 points, or a modest 0.45%. Meanwhile, the S&P 500 danced up by 0.16%, and the ever-ambitious Nasdaq crawled upwards by a mere 0.11%. Small but mighty, eh?

The market, dear readers, is in a jolly mood, encouraged by whispers of a trade deal, even as the uncertainty of monetary policy continues to swirl around like a perplexing riddle. Earlier that same day, President Donald Trump triumphantly announced that the U.S. had struck a deal with China over rare earth minerals. Victory! Or so we are told. 🥂

This rare earth business had been a major stumbling block—China, ever the wise and crafty negotiator, wanted to keep control of these precious resources. But, of course, the U.S. had a counterpunch—access to their shiny advanced microchips, the ones essential for artificial intelligence. Yes, the future of humanity rests on these little silicon wonders!

Ah, but even as the trade winds blow sweetly, the ever-looming shadow of the Federal Reserve casts its concern. June 11 brought a lovely surprise: inflation only rose by 2.4% year over year, quite lower than expected! Is there hope for a rate cut? Oh, we certainly hope so! 📉

Trump Cries, Fed Hides: Cut Those Rates, Already!

The plot thickens, my friends. Lower inflation numbers have President Trump and the White House shaking their fists at the Fed, urging Chairman Jerome Powell to slash those rates! “At least one point!” they demand. You see, Trump’s administration believes that lower rates will send stocks soaring and might even improve his approval ratings—such is the magic of economic growth! ✨

But fear not! Vice President JD Vance, ever the valiant knight, has joined the fray, accusing the Fed of committing “monetary malpractice” by failing to cut rates. It’s all about stock prices and growth, you see, and in their view, a little inflation be damned! Yet the Fed, in its infinite caution, remains ever wary of inflation’s sneaky comeback, especially with Trump’s tariffs in the mix. 📊

Meanwhile, in a twist of fate worthy of the theatre, Tesla shares rose 1.44% after CEO Elon Musk made the rather unexpected confession that he regretted some comments about Trump. And, oh dear, the plot thickens further! Musk claimed that Trump was implicated in the Epstein files, hinting at a possible connection to… well, let’s say, unsavory matters. 🤯

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-06-11 20:34