Bitcoin‘s Rollercoaster: Is It a Thrill or Just a Fizzle? 🎢💰

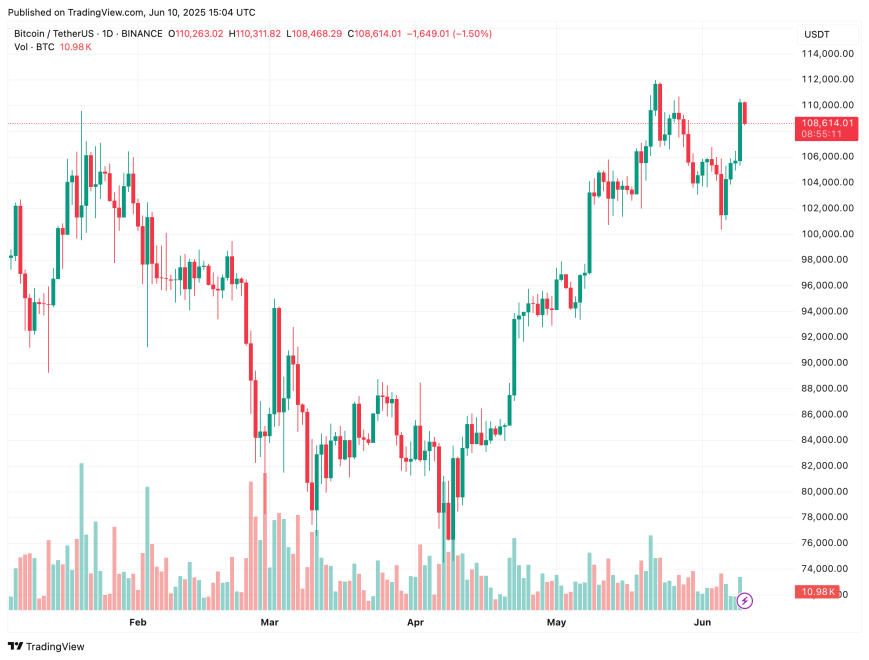

After a week of what can only be described as a rather dismal price performance, Bitcoin (BTC) decided to don its superhero cape over the weekend, swooping in to reclaim much of its recent losses. It now finds itself trading tantalizingly close to its all-time high (ATH) of $111,814, a figure that was last seen in the halcyon days of May 2025.

Bitcoin May Have More Room To Run (Or Not!)

According to a recent missive from the ever-astute CryptoQuant contributor, Avocado_onchain (yes, you read that right, Avocado), Bitcoin’s current upward trajectory – hovering just below its ATH – might still have a bit of gas left in the tank, potentially leading to a new record “at any moment.” Talk about a cliffhanger! 🍿

Our analyst friend noted that this rally is rather unique, emerging in a “much quieter market environment.” In layman’s terms, it’s like throwing a party and realizing no one showed up. The ongoing absence of retail investor participation is as noticeable as a butler in a tuxedo at a beach party.

For instance, Google Trends data reveals that search interest in Bitcoin is languishing at a paltry score of 21, compared to a dizzying peak of 66 in November 2024. For context, it was a whopping 100 during the bull market of May 2021. One might say the excitement has all but evaporated! 🥱

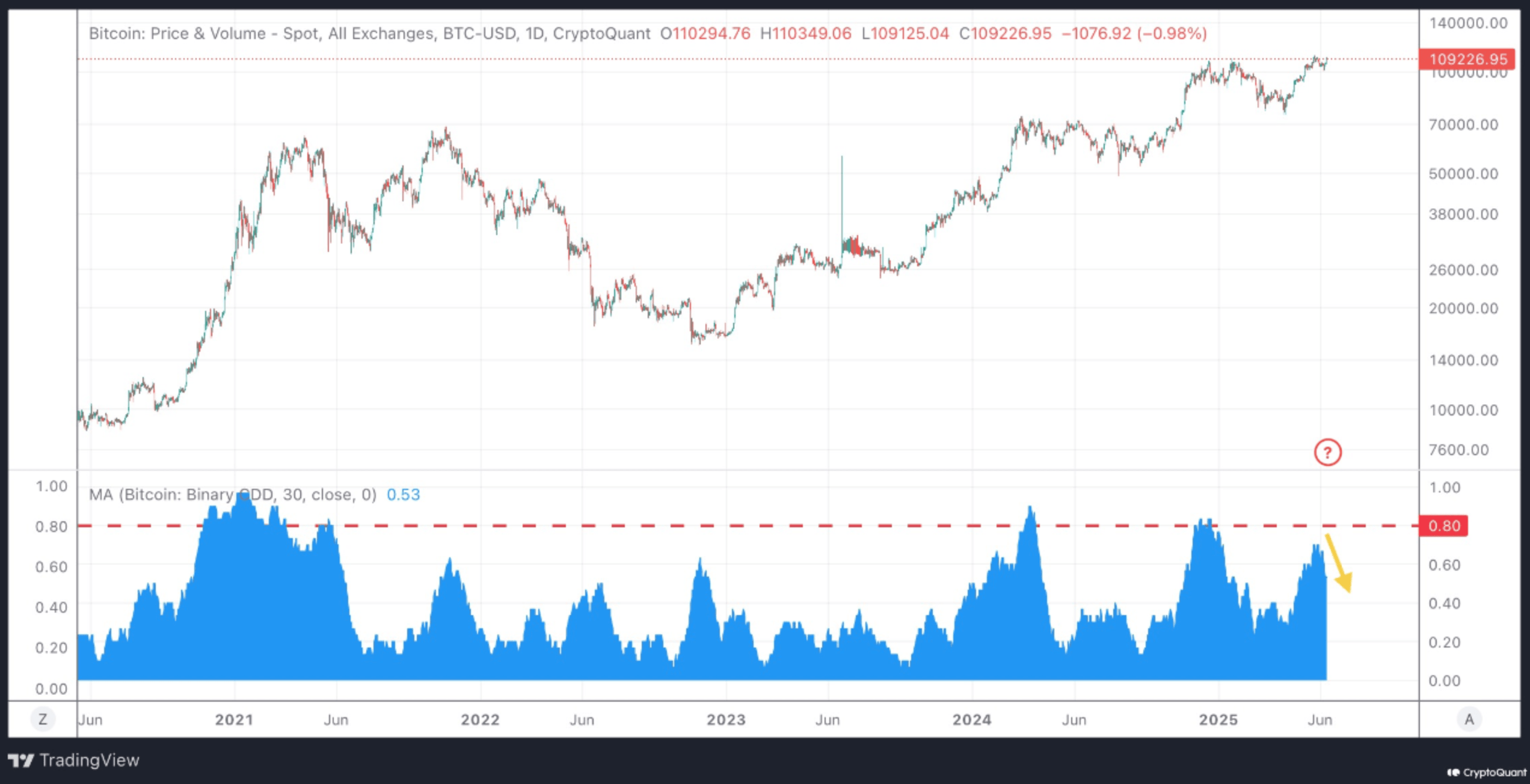

Similarly, a key on-chain metric known as the 30-day Binary Coin Days Destroyed (CDD) has been on a downward trajectory, even as BTC’s price rises. This suggests that long-term holders (LTHs) are opting to clutch their Bitcoin like a child with a favorite toy rather than sell.

For those not in the know, Bitcoin Binary CDD measures the sum of coin days – coins held multiplied by days held – spent in a transaction. High CDD indicates that older coins are being moved, often signaling potential market shifts as long-term investors decide to part with their precious digital gold.

Conversely, a declining Binary CDD suggests that fewer old coins are being spent, implying reduced selling pressure from LTH. This behavior often reflects rising confidence or accumulation, potentially indicating bullish sentiment as circulating supply tightens. Or perhaps they’re just waiting for the right moment to strike! 🦁

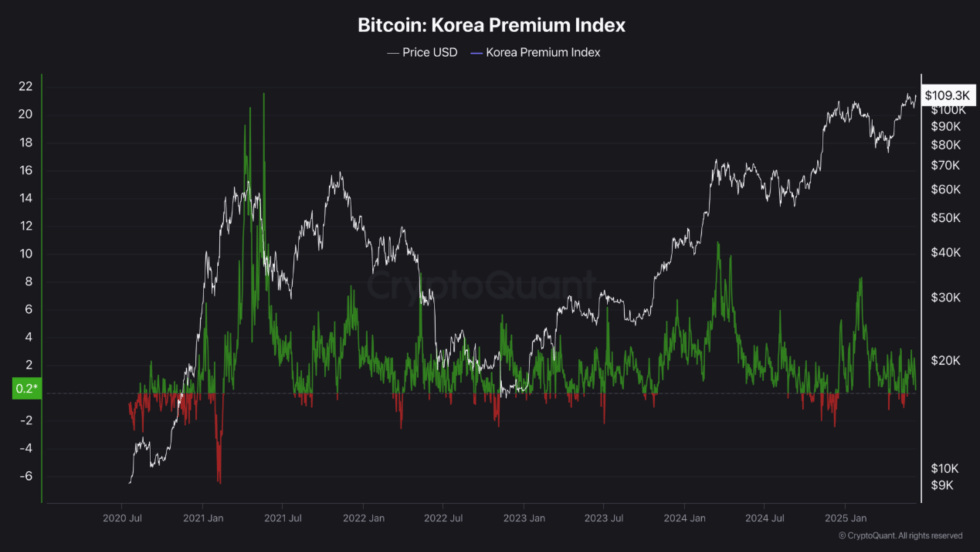

Another metric highlighting the subdued retail presence is the Premium Index across exchanges. While the Coinbase Premium is nearing levels last seen in April 2024, the Korea Premium Index remains as low as a limbo stick at a party – pointing to a distinct lack of retail-driven enthusiasm in this current rally.

Additionally, the Market Value to Realized Value (MVRV) ratio has been gradually increasing, but without the sharp spikes usually seen during overheated market conditions. It’s like a slow simmer rather than a boiling pot! 🍲

BTC May Face Some Hurdles (Oh, the Drama!)

Despite the absence of market euphoria, some indicators suggest that Bitcoin could encounter headwinds in the weeks ahead. For example, the Bitcoin RCV indicator has recently exited the “buy” zone, raising caution flags like a lifeguard at a beach party gone awry.

There are also signs that selling pressure may increase. Notably, miner-to-exchange transfers have recently surged to historic highs, indicating that BTC miners may be opting to liquidate rather than hold their reserves. At press time, BTC trades at $108,614, up a modest 0.9% in the past 24 hours. A veritable rollercoaster of emotions! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-06-11 12:35