Cardano‘s ADA Bounces Back: A Tale of Volatility, Valour, and Vanishing Stability

What to know:

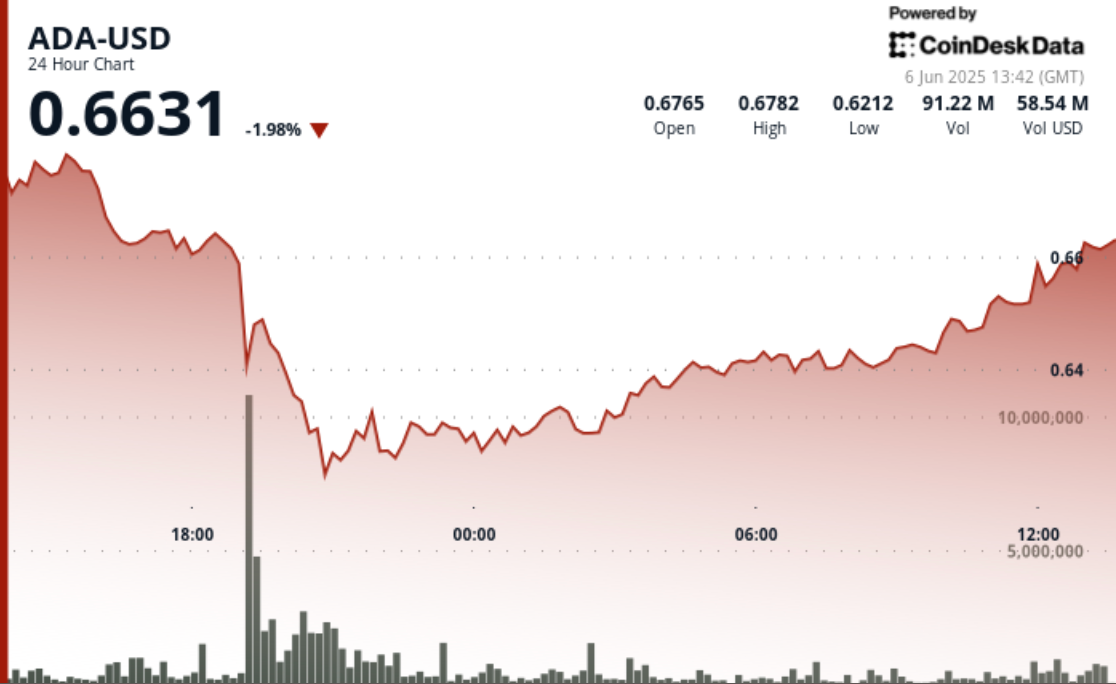

- In what can only be described as a financial soap opera, Cardano’s ADA token plunged a dramatic 10.29%, tumbling from the lofty heights of $0.688 down to a humble $0.621 — only to rally like a knight in shining armor back to $0.66 in the early US morning, perhaps dreaming of stability.

- Meanwhile, in the grand theatre of blockchain, an epochal event occurred: the first Bitcoin-to-Cardano transaction involving Ordinals. This dazzling crossover might well open a treasure chest of $1.5 trillion in cross-chain trading—if only the market could decide whether it’s a circus or serious business.

The crypto market, that unstable ballet of greed and despair, continues to twirl wildly amid an escalating feud—an erupting joust—between President Donald Trump and Elon Musk, the pantomime villain of the moment, over the efficiency of the US economy. Truly, the scene is as chaotic as a Dickensian-devil’s playground.

In these tumultuous waters, Cardano’s ADA has demonstrated its characteristic resilience—or perhaps just the penchant for dramatic swings that make stock markets look sedate. After a brutal nosedive from $0.688 to $0.621, the coin found a sturdy footing—support, some say, or perhaps only a desperate cling to hope—and rebounded, forming a slope that technical analysts call an “ascending channel,” with resistance set at around $0.644. If the indicators are to be believed, Ada might be preparing for a bullish revival—holding on to the $0.640 mark as the volatility recedes like a bad dream.

At this moment, ADA falters at $0.66, down a mere 1.8% over 24 hours, while the broader market, as represented by the CoinDesk 20 Index, dipped a humble 1%. Such is life on the rollercoaster ride of crypto; strap in, or better still, consider a career in interpretive dance.

The latest gossip from the ecosystem indicates that institutional interest continues to swell—possibly in a desperate bid to avoid the fate of their poor relatives in the equities markets. Franklin Templeton, with a modest $1.6 trillion under management—one might say an almost respectable amount—has now begun running Cardano nodes. Meanwhile, Norway’s NBX has entered into partnership, pending the usual bureaucratic delays, to explore Bitcoin-based DeFi, proving that the blockchain’s fortress is increasingly attractive for the serious investor or the slightly deranged.

Adding a touch of historic significance, the first Bitcoin-to-Cardano transaction incorporating Ordinals signals not just a milestone but an impending tidal wave of cross-chain activity—potentially unlocking the very gates of financial Pandora’s Box with $1.5 trillion opportunities awaiting the bold or the foolhardy.

Technical Analysis Highlights

- The sharp plunge from $0.688 to $0.621, with a volume so high it might have tarnished the market’s collective reputation.

- A fortress of support at $0.620-$0.623—where brave buyers threw their hats into the ring.

- The subsequent ascent shapes an elegant “ascending channel,” promising perhaps a glimmer of order in all this chaos, with resistance looming at $0.644.

- The entire saga is encapsulated within a 10.29% range, an exquisite illustration of market volatility—the very spice of crypto life.

- Possible bullish momentum, as ADA reclaims the $0.640 threshold amidst decreasing volatility, which sounds like hope—perhaps misplaced but heartening nonetheless.

- Hourly price action hints at a recovery dance from $0.641 to $0.643—like a waltz in the midst of a hurricane.

- Resistance now firmly at $0.643-$0.644, serving as a gatekeeper to further ascendancy—or despair.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Clash Royale Best Arena 14 Decks

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Witch Evolution best decks guide

2025-06-06 18:04