Bitcoin‘s Latest Skid: Is it Just Sitting There Waiting for a Miracle? 🤔

- Bitcoin took a nosedive of 7.21% from its all-time glory, now hanging around $102K, probably contemplating its life choices amid a retail traffic jam.

- BTC is now playing hard to get at $103.5K (Fib) and $107.4K (SAR), with bullish mojo fading faster than a summer fade in Brighton.

Our beloved Bitcoin [BTC], that fickle digital darling, drifted away from its recent flirtation with $111K, settling comfortably at $102,994 as the curtain fell. This nearly 7.21% dip has left the retail crowd looking as jittery as a cat on a hot tin roof. 🐱🔥

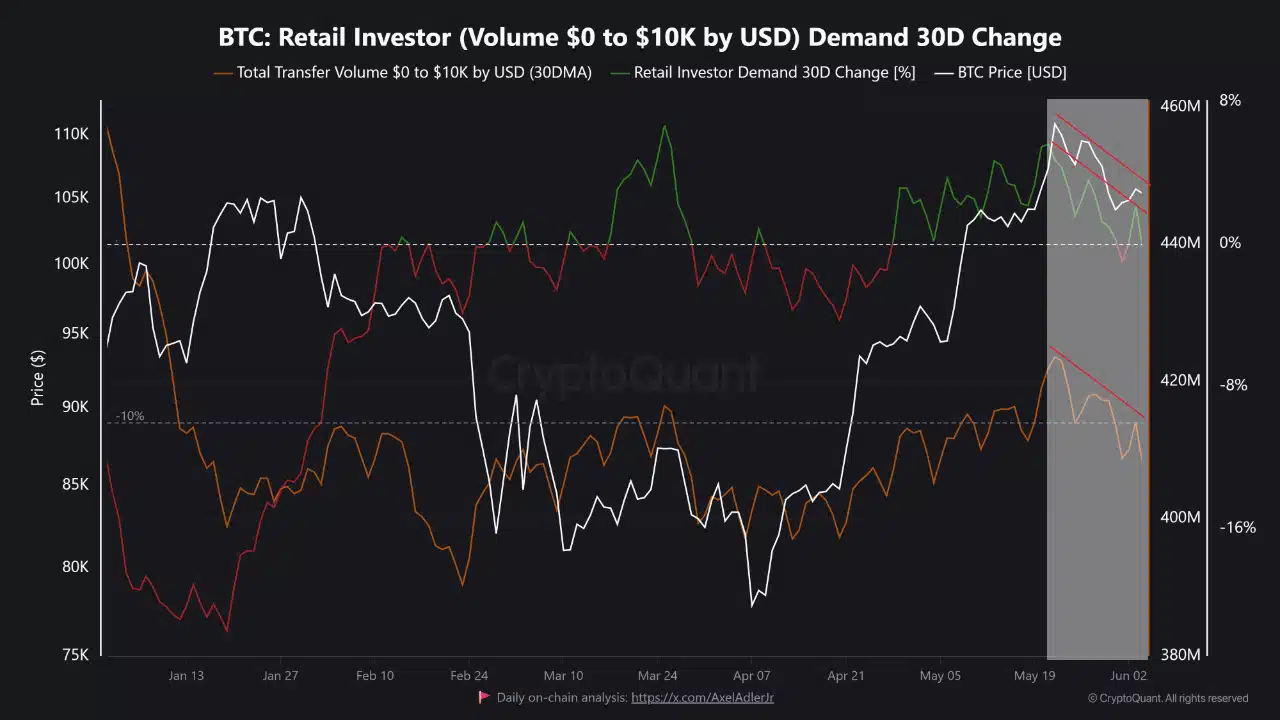

Speaking of which, the Total Transfer Volume, that old chestnut, slipped from $423 million to a leaner $408 million. Meanwhile, Retail Investor Demand 30D Change dropped from +5% to a soggy -0.11%. Looks like the small fry are losing their taste for this rollercoaster.

This waning enthusiasm from the wee guys spells trouble — without a fresh batch of retail love or a solid rebound, bitcoin might just sit tight, pondering its next move.

Buyers playing it as cool as a cucumber 🥒

Strangely enough, the Exchange Reserve took a little dip of 2.16%, now snug at $244.01B, implying fewer coins are lounging on trading platforms. Perhaps they’ve been sent to their cozy wallets, away from temptation.

But, and here’s the kicker, despite this reduction, prices continue to twerk downward. So, the buyers aren’t exactly rushing in with open arms. Apparently, sellers are giving the silent treatment, but demand remains as muted as a Sunday sermon.

Long story short: reserves dropping alone aren’t enough to turn the tide. Bitcoin’s big comeback needs fresh inflows and some lively buying — but at the moment, it’s as elusive as the remote control in a room full of toddlers.

Wallets are dozing off while volatility makes a comeback

Supply-Adjusted Coin Days Destroyed (CDD) nudged up a mere 0.29%, whispering that long-term hodlers are just chilling, not panicking or panic-selling. They’re confidently twiddling their thumbs, waiting for the rocket to lift off.

This calm, almost Zen-like approach means fewer fireworks now, but also less risk of a sudden blowout — although, mind you, no support means no party.

SAR’s signal flashing red—Bitcoin’s trying to catch its breath

Bitcoin couldn’t even cling to the 0.236 Fibonacci retracement at roughly $103.6K, trading just shy at $102,994. Meanwhile, the Parabolic SAR resistance looms overhead at a hefty $107.4K, like an unscalable mountain.

These twin gatekeepers have thwarted every recent attempt to revive the old glory. The trend’s weakening faster than a flirtatious dame at a garden party, with bulls struggling to stay above key technical thresholds.

Until Bitcoin can jolly well leap back above $104K, the short-term chaps will keep control. A big push above this hurdle is the only way to crystalize confidence and, perhaps, get the Bulls roaring again.

Liquidity’s limp: Can Bitcoin bounce with such feebleness?

Demand’s taking a little nosedive, reserves are falling without much fanfare, and long-term hodlers are just idling about. So, unless retail gets its act together or long-haulers decide they fancy a bit of excitement, Bitcoin’s range-bound lifestyle will persist.

Reckon the recovery hinges on more than just sellers taking a breather. It demands crowd-pleasing volume, fresh conviction, and a punch of demand that truly sparks joy.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-06 11:47