So, you wanna trade Bitcoin using Elliott Wave Theory? Basically, it’s like trying to predict your neighbor’s mood swings—good luck! This theory promises to decode market psychology and identify those “volatile” moves—yeah, those wild Bitcoin swings. Who needs a rollercoaster when you got crypto, right? 🎢🤪

Using Elliott Wave Theory to Navigate Bitcoin’s Cycles

Hey, I’ve already gone through the basics—oscillators, moving averages, Fibonacci retracements—like I needed a PhD to understand that. Now, it’s time to jump into Elliott Wave. It’s basically a fancy way to look at patterns in Bitcoin’s price and pretend you know what’s coming next. All driven by crowd psychology—so, basically, a bunch of hype and panic, wrapped up in some “waves.” Waves that supposedly repeat—yeah, right, just like my uncle’s bad golf swings.  .

.

Developed by some accountant in the 1930s—because who doesn’t want to trust an accountant with our financial futures, right? He studied stock market data like it was a soap opera—lots of drama, chaos, and occasionally, a miracle. He figured that prices move in these “fractal patterns”—like those Russian nesting dolls, but for markets. It’s swings between optimism and fear, or as I like to call it, the market’s mood swings on steroids. He called it “The Wave Principle”—more like “The Guesswork Principle,” if you ask me.  .

.

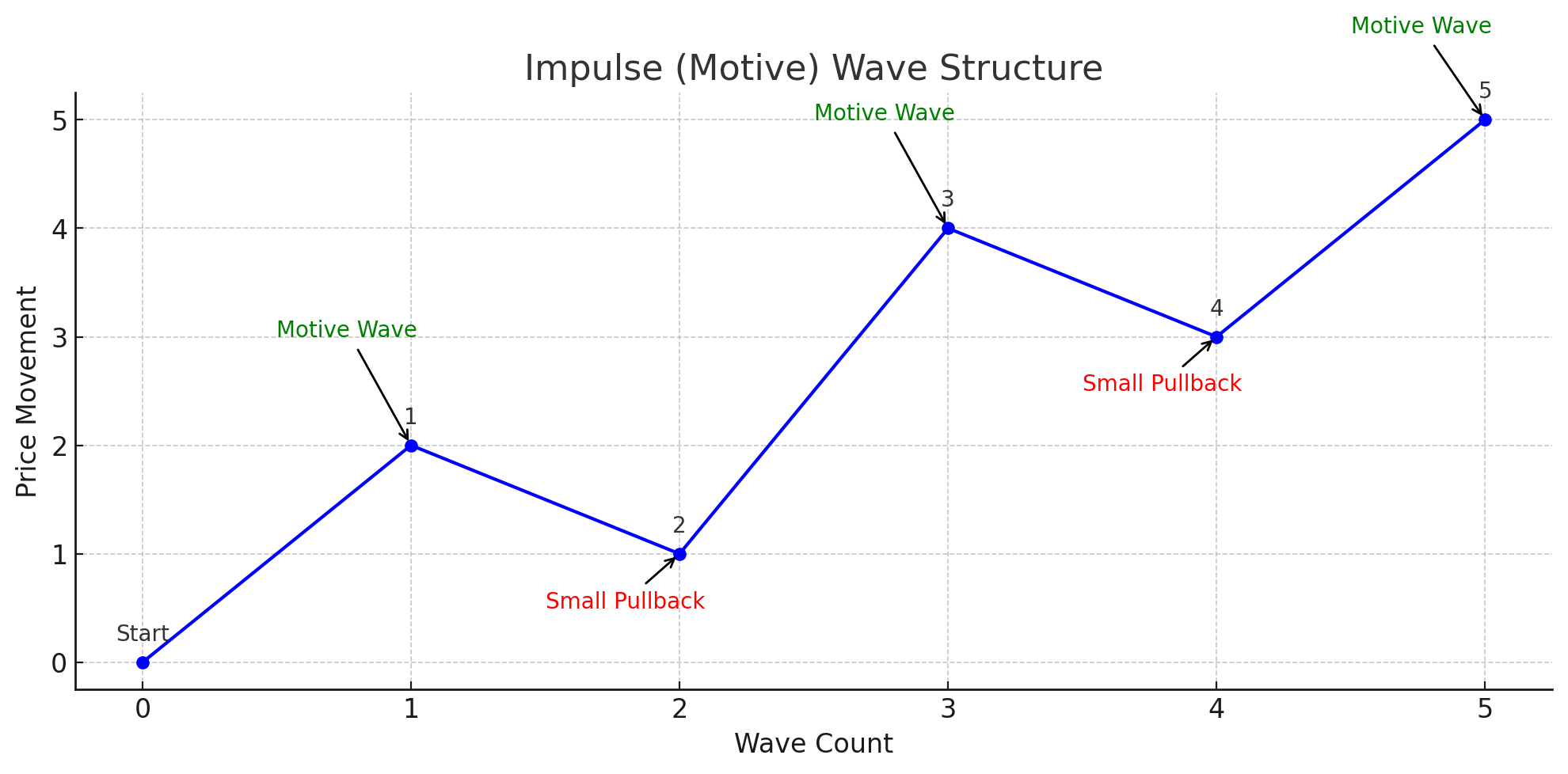

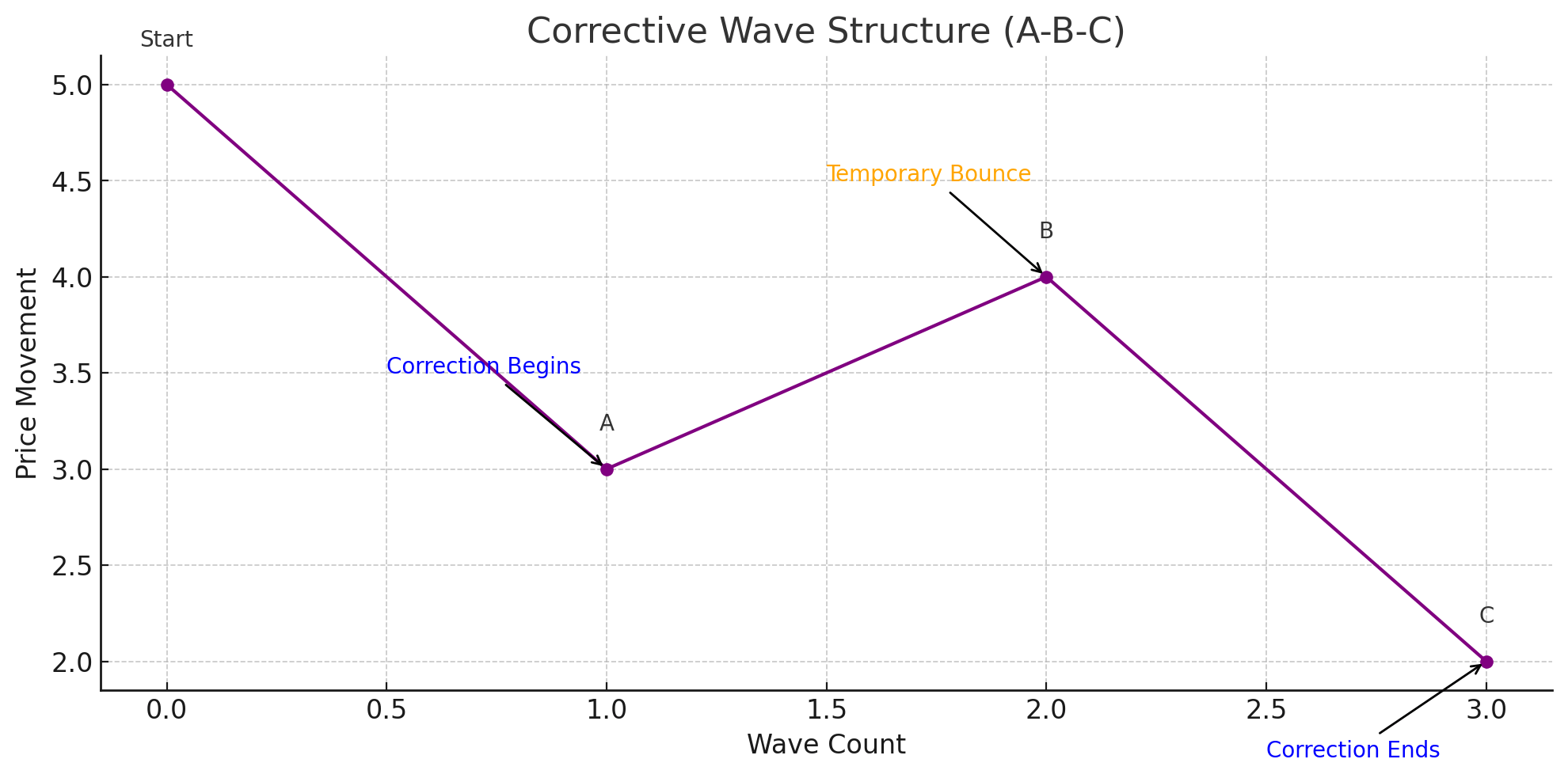

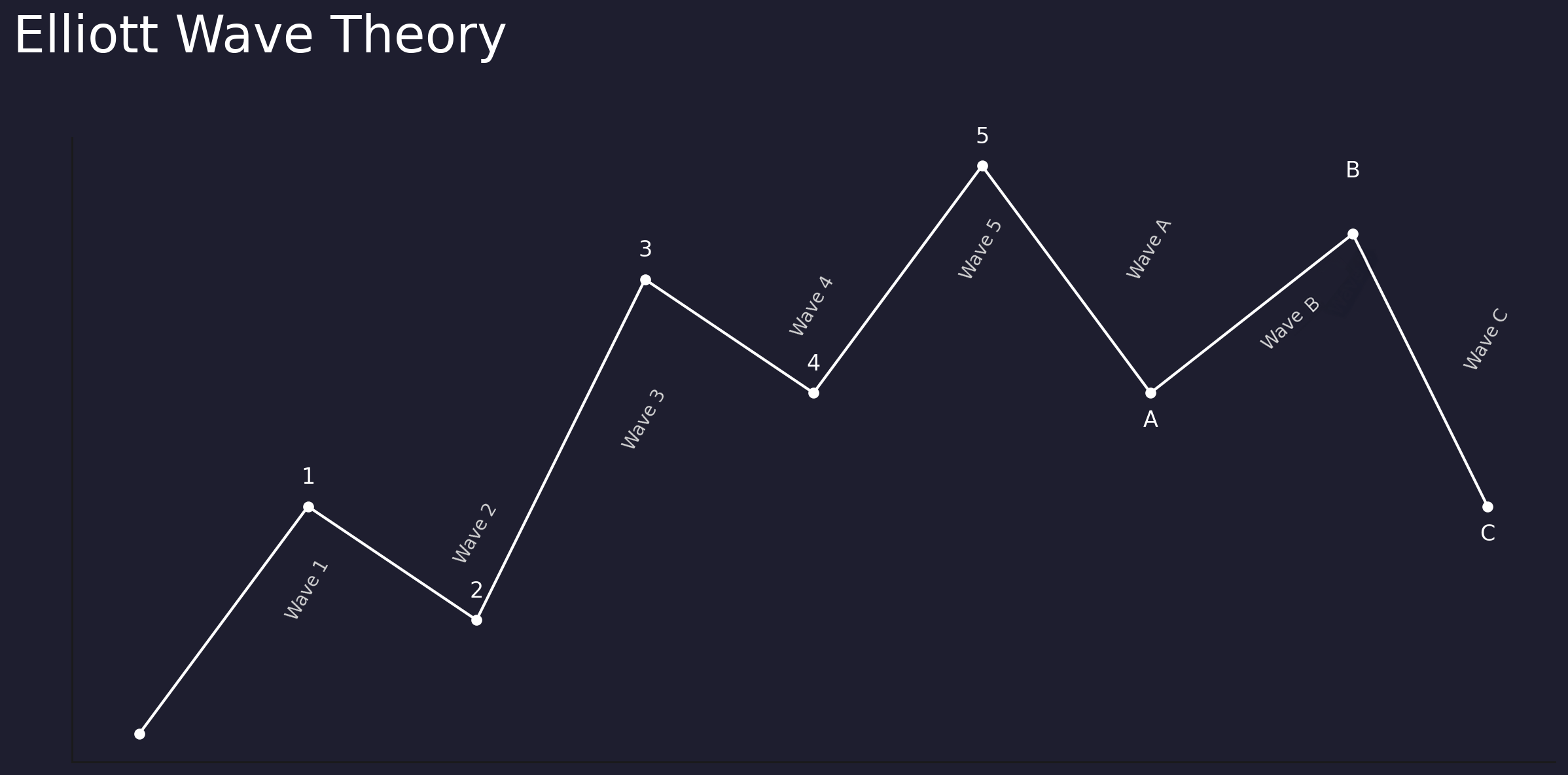

Basically, there are two types of waves. Impulse (or motive) ones—five of ‘em—think of it as the “let’s ride this train” phase. And correctives—three of ‘em—more like, “Oops, maybe not.” Impulse waves push forward, correction waves pull back—like my attempts at dieting, promising but never lasting. The theory says these waves repeat on every timeframe—so your one-minute chart looks just like the daily chart—if your eyes aren’t crossing. It’s like Inception for traders. Fibonacci ratios are often involved—because nothing says “sure thing” like a number sequence that’s been around since the pyramids. Bitcoin’s volatility makes it the perfect playground for these “waves.”

To apply this to Bitcoin, traders first pick a trend—up or down. Easy, right? Then they start labeling the waves—like a game of market charades. In an uptrend, look for five impulse waves going up, then a three-wave “oops” correction (A-B-C). If it’s going down, reverse that. Here are the basics—think of it as the “rock-paper-scissors” of trading:

- Wave 1: The baby step, starting from the bottom, with no one paying attention.

- Wave 2: A little pullback—kind of like when you realize the diet soda isn’t helping.

- Wave 3: Usually the big one, the “Katy Perry” of waves—long, loud, and volume-y.

- Wave 4: A correction, but it better not step on Wave 1’s toes or it’s a mess.

- Wave 5: The final shove—usually weak, like me trying to lift a pizza box.

- Wave A: The first dip after the uptrend—like a bad breakup.

- Wave B: The “just kidding” rally—false hope, basically.

- Wave C: The big cleanup—usually the worst of the correction, might wipe out Wave A.

And guess what? Traders look for these waves to decide when to buy or sell—like trying to catch a falling knife or wave. They hope to jump in during Wave 2 or Wave 4 pullbacks and cash out by Wave 3 or Wave 5. But, of course, timing is everything—probably why most of us just buy and pray. When the A-B-C correction starts, it’s probably time to run for the hills.  .

.

Good, it sounds simple, right? Well, not so fast. You gotta look at multiple timeframes—think of it as zooming in and out on your phone, but for waves. One minute, five waves; next minute, fifteen waves—your head will spin faster than a Bitcoin boom. And there are rules! Wave 2 can’t fully retrace Wave 1, and Wave 3 is supposed to be the “big boss.” Overlap? Nope—that’s a no-no. Violate these, and your whole wave count falls apart faster than your New Year’s resolutions.

But here’s the catch: it’s all a bit subjective—like trying to decide which cast member is the “most annoying” in your group chat. Different analysts see different waves, which makes this theory more of an art than a science. It’s like trying to read tea leaves—exciting if you believe, exhausting if you don’t. It’s more prophecy than certainty, so don’t bet your house on it. Use it with other tools—RSI, volume, whatever—you know, the usual. It’s a framework, not a crystal ball. And hey, if you get it wrong—welcome to the club of “I could’ve guessed,” my friend.

In the end, Elliott Wave is like that one friend who’s always convinced they have the secret to the market—except you’re never quite sure if they’re joking or serious. So, buckle up, do your homework, and don’t bet the farm—not unless you enjoy losing it. Happy trading, or as I like to call it, “market roulette.” 🎲

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-06-02 07:57