Tokenized Private Credit Crushes $13 Billion—I Mean, Who Saw That Coming? 😎

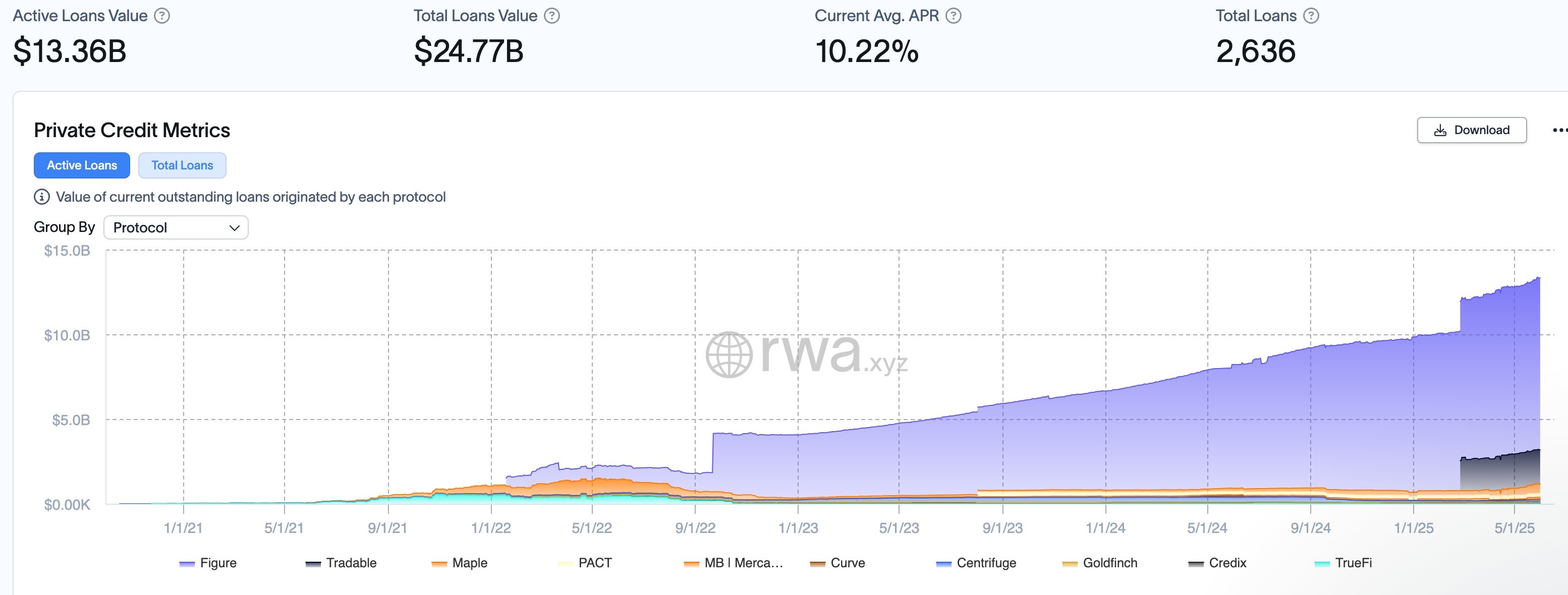

Listen well, comrades! The private credit market, that sneaky beast, is creeping out of the shadows and into the bright light of blockchain—like a thief turned hero. Over $13.3 billion of hard-earned assets now dance on chain, defying the old gods of Wall Street. Who would have guessed? Not our grandfathers, that’s for sure! 📉🚀

Once confined to the lofty towers of institutions, private credit now jostles through the digital alleyways—courtesy of platforms like Figure and Tradable—and even attracts the interest of titans like Apollo, BlackRock, and Franklin Templeton. The revolution is not just coming; it’s already here—and it’s pretty darn noisy. 📣😅

As those mighty asset managers rush to shove their illiquid, stubborn debt onto blockchain rails, they are rewriting how credit is grabbed, traded, and managed. A new door swings open—welcome retail investors, the bourgeoisie of the private credit universe, grasp the new keys to the $3 trillion fortress! 💰🔑

Figure and Tradable—The Digital Pirates

Figure, a brave vessel financed by Morgan Creek, Apollo, and Ribbit, holds over $12 billion. It sails the seas of Home Equity Lines of Credit (HELOC), helping folks borrow against their castles. Meanwhile, Tradable anchors as the second-largest ship in this digital fleet, with over $1.8 billion in offshore assets. Backed by Parafi, Matter Labs, and Victory Park, it serves the managers and the daring individuals who wish to dip into the private credit treasure chest—long kept from the common folk. 🏴☠️💸

And don’t forget the others—Maple (SYRUP!), Pact, Mercado Bitcoin, and Centrifuge (CFG)—all fighting for their share in this chaotic frenzy. Meanwhile, the big players who already own half the world’s wealth, like Apollo with over $641 billion of private credit, are jumping into the tokenized pond with their shiny new funds. BlackRock’s BUIDL alone is swimming with over $3 billion, and Franklin Templeton’s FOBXX isn’t far behind with $706 million. 🎩✨

The private credit industry, that beast of the financial jungle, is growing so fast it makes the trees jealous. Over $3 trillion of assets, and still climbing—AIMA calls it, “We’ve crossed the Rubicon and can’t turn back.” Most of this growth is happening in the United States, where companies, sick of banks, turn to private credit wizards for cash. Goldman Sachs and State Street are already launching private credit funds like hotcakes—because why not? Who needs banks when you have blockchain, right? 🍪🏦

Tokenized private credit is the new superstar in the RWA industry, boasting over $23 billion in assets with more than 113,350 brave investors. And the revolution doesn’t stop—soon, tokenized stocks might steal the show, like Kraken’s 50 stocks in May. The game is changing, comrades—and it’s messy, chaotic, and glorious! 🔥🤪

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-06-01 21:36