In a move that can only be described as a spectacular mix of financial gymnastics and cosmic coincidence, Ethereum’s price swing in May was enough to make even the most stoic investors spill their coffee. During this whirlwind 31-day period, over half a billion dollars ($550 million to be precise — or approximately the price of a small nation’s annual budget) was funneled into ETH-backed exchange-traded funds (ETFs). Yes, it’s the biggest inflow since the dawn of the year, which is saying something because 2025 has been quite the year—full of surprises, excitement, and a touch of existential dread.

While ETH’s value decided to take a brief nap and pull back in the past week (perhaps to contemplate its existence or simply because it was tired), all signs point to a potential rebound that might make you wish you’d bought more coffee. The technical indicators are whispering sweet nothings about a near-term bounce — or maybe just a very enthusiastic shrug. Who can say, really? It’s all very mysterious and slightly confusing, but that’s part of the fun!

ETH ETFs Collect More Cash Than a Bank Robbery in May — 2025’s Biggest Monthly Inflows!

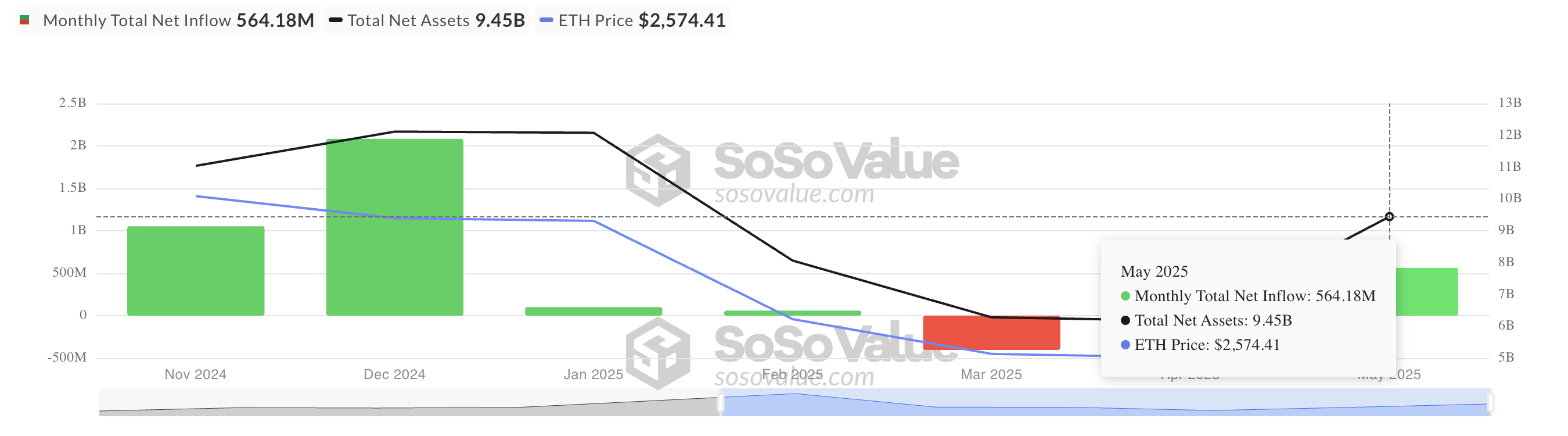

According to the ever-reliable (and perhaps slightly exaggerated) data from SosoValue, ETH spot ETFs accumulated a whopping $564.18 million in May alone — beating every previous monthly total recorded this year (a feat that makes you wonder if ETH has discovered the secret to eternal youth or just really likes money). The moon? The stars? Or perhaps the collective hope of investors staring at their screens, dreaming of a world where ETH finally breaks the naughty $2,500 barrier and throws a grand party.

Meanwhile, ETH’s performance has been so impressive that it’s practically doing a victory dance above the $2,000 mark, seemingly trying on the $2,500 outfit before heading to the proverbial ball. This renewed bullish spirit has encouraged banks, hedge funds, and that guy down the street who just learned what “blockchain” means to pile into ETFs, arms ready for what might just be a rally in the making.

Ethereum Gears Up for More Action — Hold Onto Your Hats! 🎩

Charts and graphs, those wonderful (or utterly confusing) diagrams, reveal that ETH took a 49% leap between May 8 and May 13 — enough to give anyone whiplash — and then, it decided to take a breather, form a mysterious pattern called a “bullish pennant” (like a pretty little sailboat slowly catching wind). This pattern hints that ETH is taking a moment before charging forward again — possibly with the subtlety of a charging rhinoceros or a toddler wielding a crayon.

The formation of this pennant is like Ethereum’s way of saying “I can stop and ponder my next move… or just nap a little first.” If ETH bursts out of this tiny triangle with gusto, it could ignite a rally similar to its previous 49% surge. Think of it as the cryptocurrency equivalent of a phoenix rising from the ashes — or maybe just a really energetic chicken.

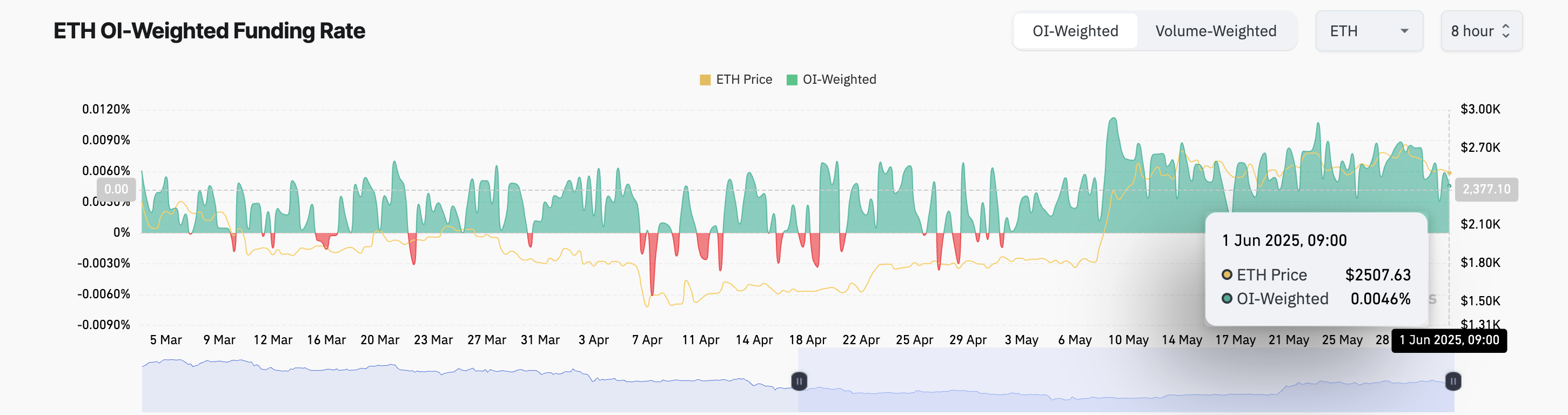

Added to the fun, ETH’s funding rate remains positive at 0.0046%, which is not only a number that sounds vaguely scientific but also indicates that traders are betting their hard-earned Bitcoin (or other currency) on ETH’s upward adventure — paying those who think ETH’s future is bright, shiny, and just a little bit chaotic.

Can ETH Reach 3,907? Or Will It Just Keep Playing Hard to Get? 💸

Currently lounging at $2,489 (a cozy spot just above the support level at $2,479), ETH is like that friend who’s just waiting for the perfect moment to make a dramatic move. If it gets its act together and breaks out of that little pennant, a 49% leap could propel it towards the mythical $3,907 — or quite possibly just make investors do a collective happy dance, depending on the day.

But beware! If things go less than smoothly and the market decides to throw a tantrum, ETH might break below support (say, to about $2,419), making everyone question their life choices and wish they’d bought more snacks instead.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-01 17:05