Ah, Bitcoin! The elusive creature that dances in the mid-$100,000 range like a drunken ballerina at a wedding. Despite its apparent pause, the mystical on-chain data whispers sweet nothings, suggesting that the bullish momentum is far from a mere figment of our imaginations. Just recently, our dear BTC reached a staggering new all-time high (ATH) of $111,980, sending crypto analysts into a frenzy of predictions for even loftier heights. 🚀

Bitcoin Rally: A Never-Ending Saga

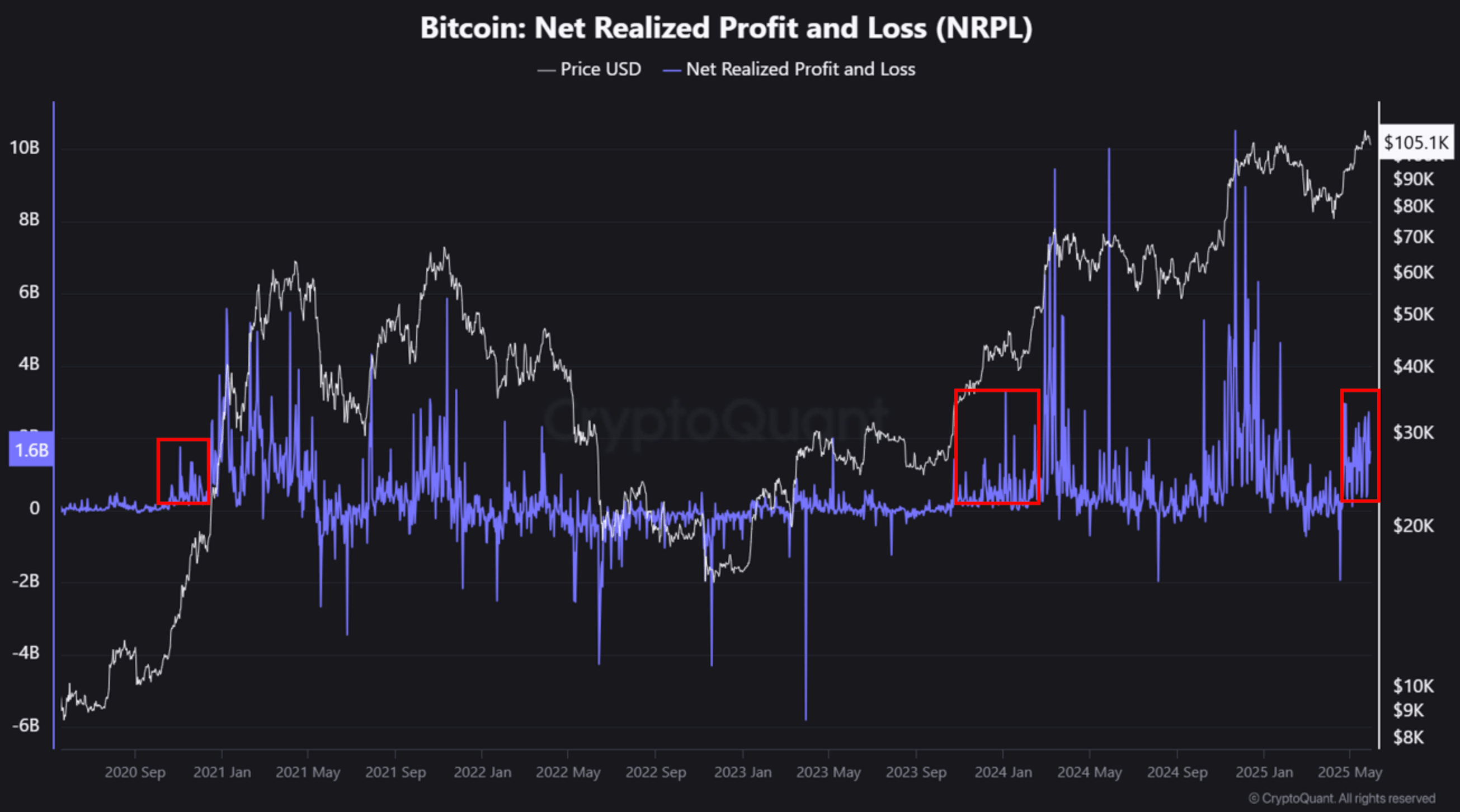

In a recent epistle from the oracle known as Crypto Dan, it was proclaimed that Bitcoin is “highly likely” to continue its upward trajectory. He even shared the sacred Bitcoin Net Realized Profit/Loss (NRPL) chart, a veritable tapestry of market emotions, to bolster his claims.

This NRPL chart, a masterpiece of financial art, reveals the grand scale of profits and losses realized by those brave souls selling BTC. A low NRPL during price surges typically signals that profit-taking is as rare as a unicorn sighting, hinting at the continuation of our beloved bullish trend.

In this chart, the current level of profit realization is highlighted in the right-most red box, a beacon of hope amidst the chaos. While the recent price surge may tempt a short-term correction, the extent of realized profits does not suggest the end of this exhilarating upward cycle. As Dan sagely noted:

“Compared to the NRPL spikes at past cycle peaks, this round of profit-taking is relatively limited. In particular, when compared to the movements at the highs in March and November 2024, the current level of profit realization is notably lower.”

Dan concluded with a flourish that the current level of profit-taking does not herald a major trend reversal. Instead, Bitcoin is poised to continue its ascent, potentially eyeing levels beyond $120,000 in the coming weeks. But hold your horses! 🐴

Despite the optimism, some market watchers, like the ever-cautious Ali Martinez, suggest that Bitcoin’s current price action might be a bull trap. Yes, a bull trap! A treacherous snare where BTC could tumble below the $100,000 threshold, leaving traders gasping in disbelief.

For those unacquainted with the term, a bull trap is akin to a mirage in the desert, where the asset briefly breaks above a well-established resistance range, leading traders to believe a breakout is occurring, only to swiftly reverse and plummet back below the resistance level. A classic case of “gotcha!”

Bitcoin: The Reluctant Seller

On a brighter note, multiple on-chain indicators suggest that Bitcoin is not yet near its cycle top. Retail investor participation in this current rally remains as limited as a cat at a dog show – a sign that the market may still have room for a second wave of capital inflow.

Moreover, Binance inflow data reveals that certain investor groups are not eager to part with their BTC, perhaps anticipating further gains. As of now, BTC is trading at $105,659, down 2.5% over the past 24 hours. But fear not, dear reader, for the saga continues!

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-05-31 06:06