Ah, Bitcoin! The digital gold that has climbed to dizzying heights, reaching a new all-time high of $111,900 last week, only to settle at a modest $107,800 as we speak. Retail investors are bubbling with excitement, but let’s not kid ourselves; the real action is happening behind the scenes, where the institutions play their grand game of chess.

Enter CryptoQuant analyst Darkfost, the oracle of institutional inflows. He points out that while spot Bitcoin ETFs are all the rage, they are merely a façade, a shiny distraction. “Anyone can get exposure to ETFs,” he quips, as if to say, “But can you handle the real deal?” The true measure of institutional interest lies in the elusive Coinbase Premium Gap.

Want to know when the smart money is investing? The Coinbase Premium Gap holds the key. 🗝️

These investor groups often use Coinbase for their trades. The Coinbase Premium Gap reflects their activity.

This metric has shown a strong correlation with price movements, especially…

— CryptoQuant.com (@cryptoquant_com) February 20, 2025

This metric, comparing Bitcoin prices on Coinbase Pro and Binance, reveals the buying pressure from US-based institutional investors. Currently, the 30-day moving average of this premium sits at a staggering 55 — the highest level recorded this year. Talk about a bullish signal!

Moreover, Bitcoin’s 30-day average daily inflow is over $330 million, a clear indication of sustained institutional accumulation. This isn’t just retail FOMO; it’s heavyweight players strategically positioning themselves for the next big wave.

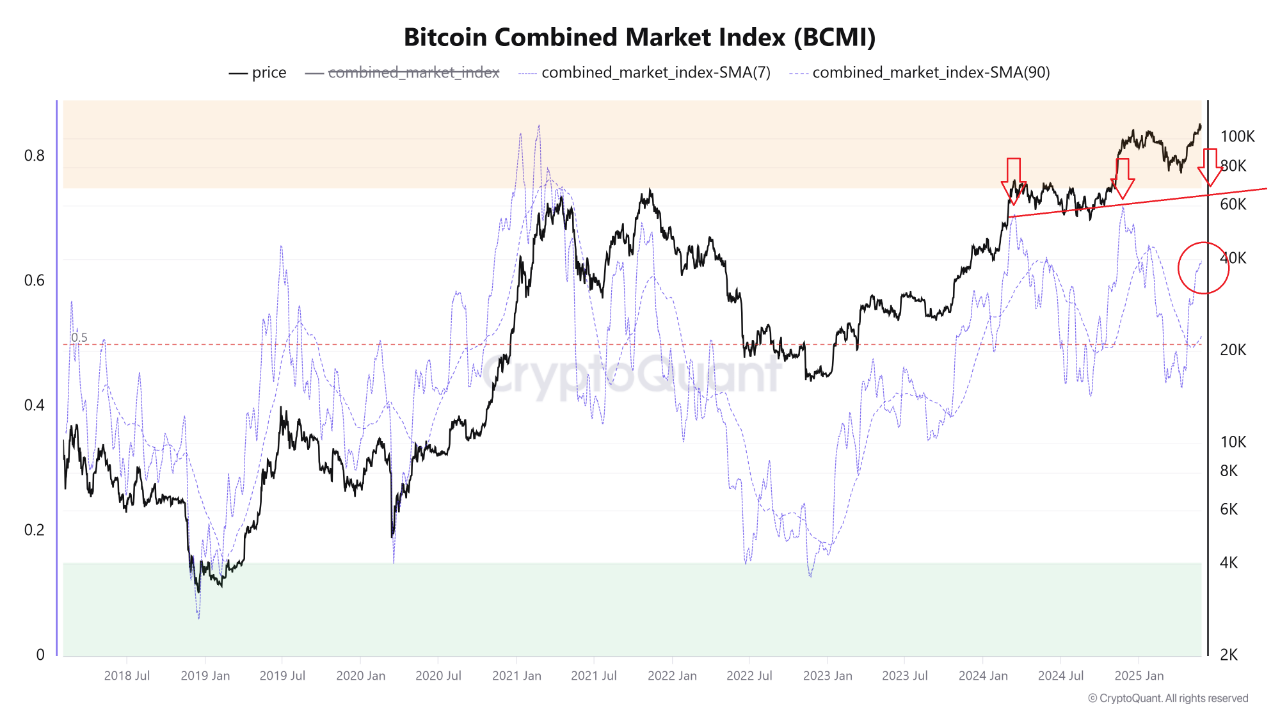

BCMI: A Bullish Pulse Beneath the Calm

Analyst Woominkyu has highlighted a sharp rebound in the Bitcoin Combined Market Index (BCMI), a composite measure that blends metrics like MVRV, NUPL, SOPR, and the Fear & Greed Index. The 7-day SMA of BCMI now stands at 0.6, signaling a shift towards early bullish sentiment. Meanwhile, the 90-day SMA remains neutral at 0.45, indicating that the market is not in a euphoric state — yet.

BCMI Chart | Source: CryptoQuant

This setup, a blend of short-term optimism within a longer-term stable trend, often precedes sustained bull runs. “With on-chain sentiment rising and profit-taking easing,” Woominkyu noted, “the market may be entering an early accumulation phase.” Sounds like a recipe for success!

A Perfect Storm of Accumulation

Santiment data reveals a sharp correlation between price and the behavior of whale wallets, specifically those holding between 100 and 1,000 BTC. Over the past six weeks, this group has added 337 wallets, accumulating a whopping 122,330 BTC. Historically, their moves often foreshadow larger market momentum shifts. 🐳

🐳 Over the past 5 years of Bitcoin’s history, no tier of wallets has been more price-correlated to crypto markets than the behavior of whales holding between 100 to 1,000 $BTC. In the past 6 weeks, this group has +337 more wallets, collectively accumulating 122,330 more Bitcoin.

— Santiment (@santimentfeed) May 28, 2025

Meanwhile, GameStop, the once-meme-stock-turned-digital-transition-player, has boldly purchased 4,710 BTC. A move reminiscent of MicroStrategy’s early ventures into the crypto realm. And in a geopolitical twist, Pakistan has announced plans for a strategic Bitcoin reserve, inspired by none other than the US government. Who knew crypto could spark international intrigue?

BREAKING 🔥

Woahhh Pakistan is launching Bitcoin Strategic Reserve @Bilalbinsaqib is bringing Pakistan to the forefront of the world map in blockchain adoption

Pakistan zindabaad 🇵🇰

— Inspired Analyst (@inspirdanalyst) May 28, 2025

“We are getting inspired by the US government,” Saqib declared at Bitcoin 2025 in Las Vegas. Who would have thought that inspiration could come from such a tumultuous place?

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-05-29 13:36