Ah, the U.S. Department of Labor, the agency that’s like your overly cautious aunt who insists on checking the expiration date on a can of beans. Back in 2022, they issued a memo that practically screamed, “Don’t even think about putting crypto in your retirement plans unless you want to lose your shirt!” Critics, of course, had a field day, claiming the memo was as biased as a toddler at a candy store.

Fast forward to May 28, and the DOL decided to do a complete 180. Talk about a plot twist! 🎉

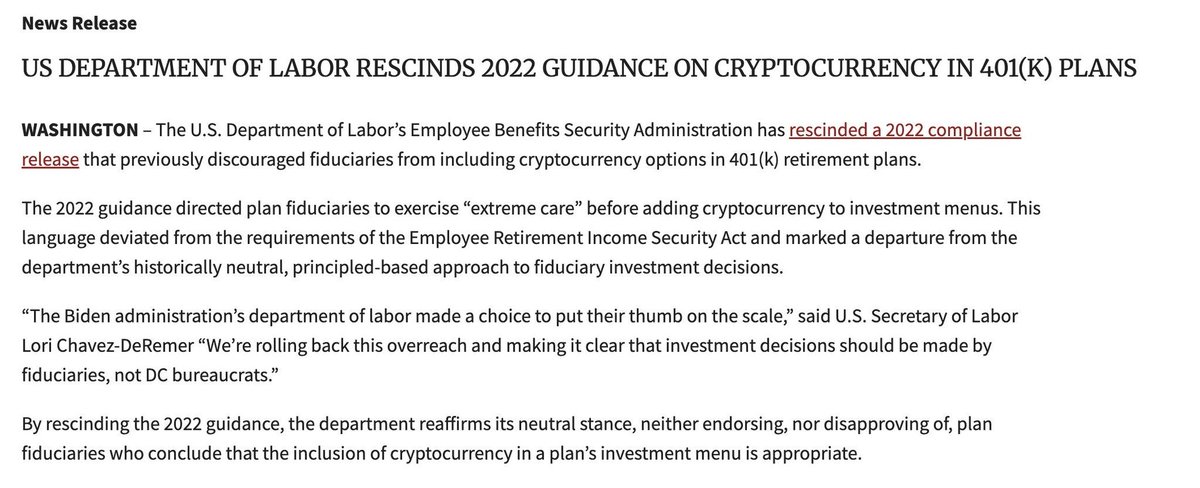

“The Biden administration’s Department of Labor made a choice to put their thumb on the scale,” said U.S. Secretary of Labor Lori Chavez-DeRemer, probably while rolling her eyes. “We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats.” Because who needs bureaucrats when you have fiduciaries, right?

A Return to Fiduciary Freedom

With this rollback, the DOL is back to its neutral stance, which is like saying, “We’re not picking sides in the family feud over who gets the last slice of pizza.” They’re neither endorsing nor rejecting crypto in retirement plans, leaving fiduciaries to make decisions based on what they think is best for plan participants—without Uncle Sam peering over their shoulders.

This move has crypto enthusiasts and DeFi supporters cheering like they just won the lottery. 🎊 It’s a step toward financial inclusion and innovation, allowing employers to reintroduce Bitcoin, Ethereum, and other digital assets into retirement portfolios—pending fiduciary approval, of course. Because nothing says “freedom” like a little bit of red tape!

Why It Matters

As digital assets become the new black, today’s decision could change how Americans diversify their retirement savings. It’s like a signal flare for regulators, hinting at a potential shift in how they treat crypto-related financial products. 🚀

As the debate rages on about how crypto fits into long-term investing, one thing is clear: fiduciaries—not the federal government—should decide what goes into a 401(k). Because if there’s one thing we’ve learned, it’s that bureaucrats and retirement plans are like oil and water—best kept apart!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-05-28 18:31