Old Mattsby, as he insists on being called – honestly, the affectation! – is waxing poetic about liquidity cycles. Apparently, this one is… stretching. Yes, stretching. As if a liquidity cycle could simply decide to take a brisk walk and delay the inevitable. He suggests it’s been “strong” since 2020, a timeframe where much of the world was grappling with rather more pressing matters. Six years, he claims, and no end in sight as of early 2026. A “super-cycle,” he terms it with the gravitas of a man explaining the intricacies of making weak tea. Really.

The usual method of stopping these things – central banks tightening their purse strings – is, according to Mattsby, being thwarted by a delightful mess of debt, fragmented financial systems, and a remarkable appetite for spending money on things that require a great deal of money. Data centers, he specifically mentions. One can almost smell the silicon burning through excess liquidity. It’s a terribly modern tragedy, isn’t it?

The debt, you see, is rather significant. Over 350% of global GDP, a figure that suggests a level of financial optimism bordering on delusion. Any attempt at tightening, Mattsby warns, will simply trigger a cascading collapse of economies. Naturally, the solution is… more support. Perpetual support, in fact. A bracing thought for those with an aversion to endless cycles of borrowing and bailouts.

And it’s not just the Americans anymore. Apparently, the world’s monetary system is “bifurcating.” BRICS, China, even gold – yes, gold! – are now contributing to the liquidity glut. It’s all very cosmopolitan, and yet profoundly unsettling. One imagines shadowy figures exchanging Yuan and Bitcoin in dimly lit cafes.

Further fueling the flames are “capital hogs” – AI, renewables, chips, and the ever-reliable blockchain. These things, it seems, require vast amounts of cash, and are thus quite welcome recipients of this endless fountain of liquidity. A most convenient arrangement. Small-cap stocks and innovation funds, naturally, are reaching for the heavens. As they always do.

Central banks, Mattsby notes, are “hyper-proactive” – a polite way of saying they are constantly interfering. Forward guidance, yield curve control… it’s all terribly elaborate. And naturally, geopolitical concerns – reshoring, infrastructure, the energy transition – provide ample justification for continued spending. A recession signal? Why, that’s just a mere inconvenience.

One zam, a dissenting voice in the digital wilderness, dared to suggest that the liquidity “momentum is slowing.” A heretic! Mattsby’s response was predictably dismissive: “It can rotate into other assets as long as the economy is strong.” A beautifully circular argument, really.

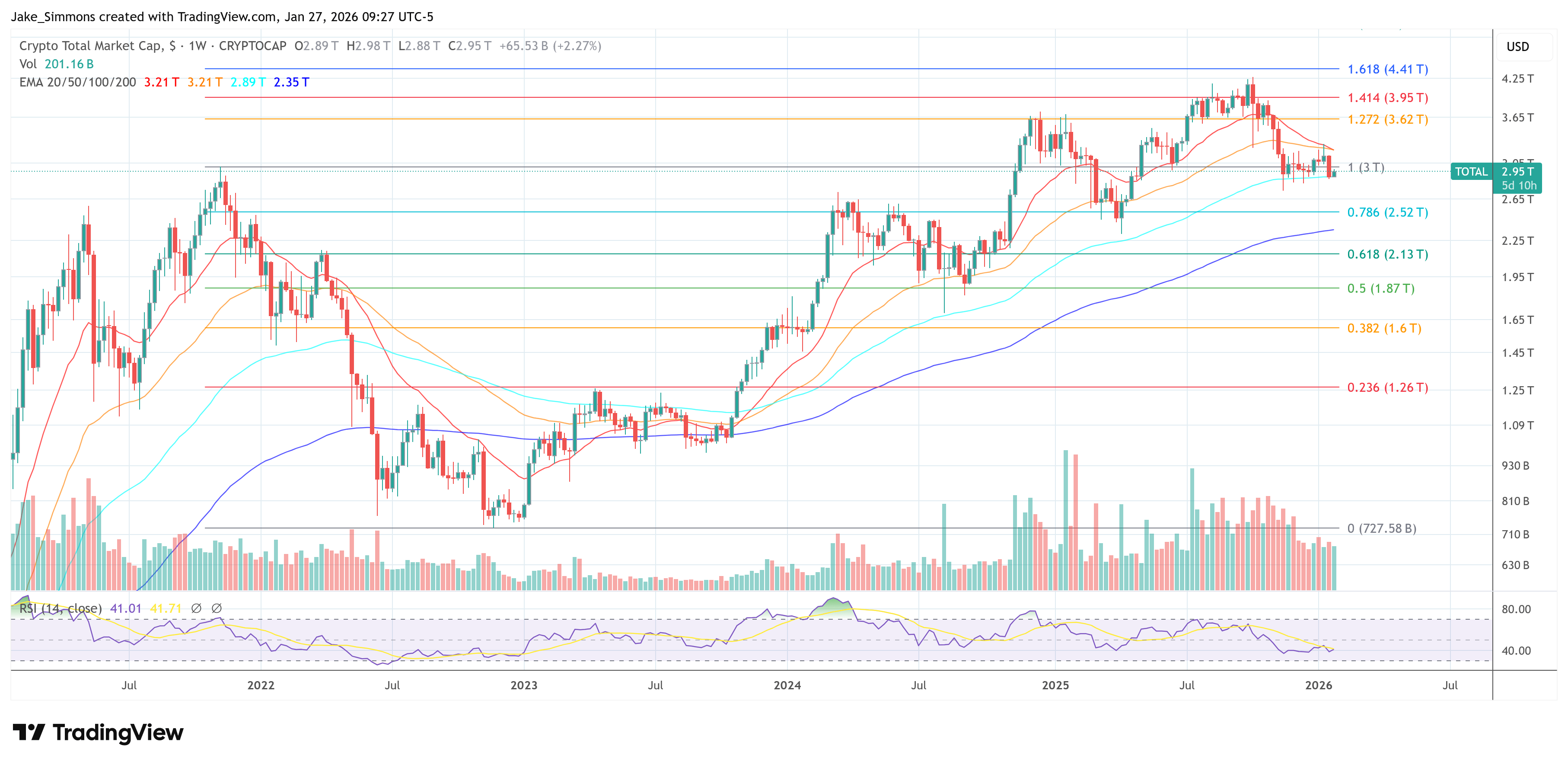

The question, then, is not whether the cycle will end, but when. Late 2026, perhaps? Or even later? The bears, Mattsby implies, will require a full-blown systemic collapse before they can rightfully claim victory. One suspects they’ll be waiting a long, long time. The crypto market cap, at last report, stood at a considerable $2.95 trillion. A truly impressive number, considering the inherent absurdity of it all.

Read More

- VCT Pacific 2026 talks finals venues, roadshows, and local talent

- EUR ILS PREDICTION

- Lily Allen and David Harbour ‘sell their New York townhouse for $7million – a $1million loss’ amid divorce battle

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- eFootball 2026 Manchester United 25-26 Jan pack review

- The Beauty’s Second Episode Dropped A ‘Gnarly’ Comic-Changing Twist, And I Got Rebecca Hall’s Thoughts

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

- Kylie Jenner’s baby daddy Travis Scott makes rare comments about their kids together

2026-01-28 09:14