Ah, the yield-bearing stablecoin market! A veritable garden of delights that has flourished in recent years, yet remains largely unnoticed by the casual investor. How curious it is that while the world busies itself with the mundane, this sector reveals its splendid potential, like a peacock in a room full of pigeons. 🦚

In this delightful discourse, we shall meander through the labyrinthine challenges that beset the yield stablecoin realm, all while the regulatory winds shift and institutional interest rises like a soufflé in a well-timed oven.

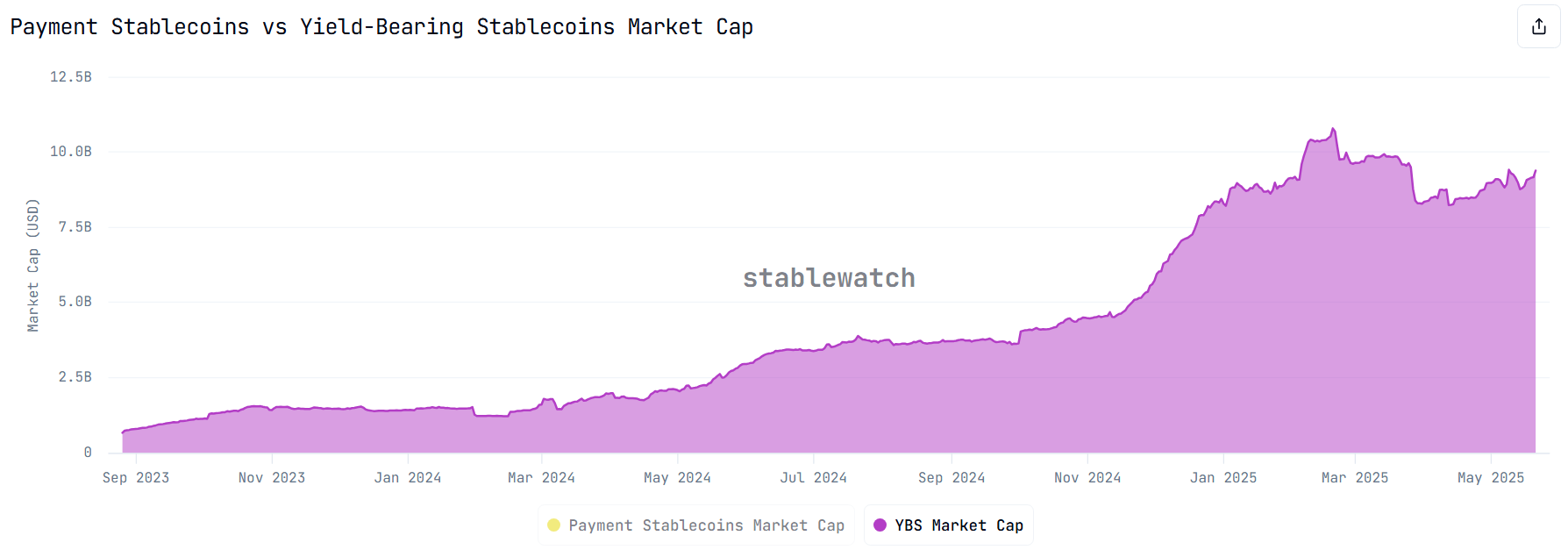

Yield Stablecoin Market Cap Surpasses $10 Billion in 2025

Yield-bearing stablecoins, those charming creatures, do not merely cling to a stable value; they also bestow returns upon their fortunate holders. These returns spring forth from investment strategies that resemble a game of poker—staking, lending, or investing in yield-generating assets, such as government bonds, which are as thrilling as watching paint dry. 🎨

According to the ever-reliable Stablewatch, the total supply of yield-bearing stablecoins has ballooned a staggering 13 times in less than two years, from a modest $666 million in August 2023 to a jaw-dropping $8.98 billion in May 2025. At one point, in February 2025, the market reached an all-time high of $10.8 billion—an achievement worthy of a standing ovation! 👏

Stablewatch further reports that the total accumulated yield paid out has approached the princely sum of nearly $600 million, with the current average payout hovering around $1.5 million per day. One might say, “What a time to be alive!”

Among the most illustrious projects, Ethena’s sUSDe and Sky’s sUSDS and sDAI reign supreme, commanding a staggering 57% of the total yield stablecoin market capitalization—approximately $5.13 billion. A veritable royal court of financial innovation!

Data from DeFiLlama reveals that the market now boasts over 1,900 stablecoin pools, scattered across 465 protocols and more than 100 different chains. These pools allow investors to deposit stablecoins and earn yield, much like a farmer planting seeds in fertile soil, hoping for a bountiful harvest. 🌾

Yet, despite this impressive growth, Jacek Czarnecki, co-founder of L2Beat, reminds us that yield-bearing stablecoins still represent but a mere morsel of the broader stablecoin feast. As of this writing, the total stablecoin market cap has soared beyond $244 billion. 🍽️

“Yield-first stablecoins are still just a small fraction (3.7%) of the general stablecoin market,” Jacek mused, perhaps while sipping a fine vintage. 🍷

Nevertheless, this diminutive share reflects the vast potential for growth that yield-stablecoins possess. More investors are now seeking passive income opportunities in the DeFi space, as if searching for hidden treasures in a vast ocean.

Challenges Facing the Yield Stablecoin Sector

According to our dear friend Jacek, yield-bearing stablecoins remain shrouded in ambiguity, lacking a standardized definition. This lack of clarity makes it as difficult to categorize and evaluate these assets as it is to define the essence of a fine wine. 🍇

Jacek has taken it upon himself to classify stablecoins into two groups: payments vs. yield. While this distinction may seem simplistic, it could pave the way for dedicated legal frameworks, much like a well-tailored suit that fits just right.

“Stablecoins are widely seen as crypto’s breakout use case. But to scale, we need a more user-centric framework. You shouldn’t buy coffee with your yield vault. Combining both types in one category (as many dashboards do) is like storing your paycheck in a hedge fund: technically possible, but it doesn’t make too much sense,” Jacek explained, with a twinkle in his eye. ☕

Lawmakers, those diligent guardians of order, are beginning to recognize this division. For instance, the GENIUS Act in the US specifies that stablecoins offering yields or interest do not qualify as “payment stablecoins.” A rather clever distinction, if I may say so!

This means these stablecoins fall outside the bill’s regulatory scope, potentially being classified as securities, subject to the watchful eye of the US Securities and Exchange Commission (SEC). A delightful game of cat and mouse, wouldn’t you agree?

Meanwhile, the MiCA (Markets in Crypto-Assets Regulation) in the European Union has taken a rather draconian stance, prohibiting interest payments on stablecoins altogether. This regulatory ambiguity and legal limitation may explain why the yield stablecoin market has yet to explode into a dazzling spectacle. So far, it has mainly attracted the attention of insiders and early investors, much like a secret society. 🤫

However, the involvement of major financial institutions in the stablecoin sector gives us reason to hope for a more lenient approach from lawmakers. To maintain momentum and ensure sustainability, projects must address key regulations, transparency, and risk management challenges, lest they find themselves lost in the fog of uncertainty.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Wuthering Waves Mornye Build Guide

- Clash Royale Witch Evolution best decks guide

2025-05-21 16:46