Ah, Solana (SOL), that once-mighty titan of the digital realm, now finds itself languishing, down a disheartening 5% over the past week, trading below the hallowed $180 mark for six long days. Yet, in this theater of despair, institutional interest swells like a tide, as the great players of finance accumulate and stake their fortunes, perhaps in anticipation of an elusive altcoin season. How ironic! 😂

But lo! The technical indicators, those fickle harbingers of fate, whisper tales of weakness: a negative BBTrend, a bearish Ichimoku Cloud setup, and the ominous shadow of a looming EMA death cross. These mixed signals, dear reader, suggest that while the long-term confidence may be growing like a weed in spring, the short-term momentum is as fragile as a spider’s web in a storm. 🕷️

Solana Draws Institutional Interest, But Ichimoku Cloud Signals Uncertainty

In the month of May 2025, the institutional accumulation of Solana intensifies, a beacon of confidence amidst the chaos, as if the very gods of finance have smiled upon it. Yet, despite the altcoin trading volumes languishing below their former glories, the major players stack SOL like a game of Jenga, staking vast amounts and adding to their long-term holdings. What a spectacle! 🎭

Over 65% of SOL’s supply is now staked, and the app revenue for Q1 2025 has soared to a staggering $1.2 billion, the strongest in a year. These trends, combined with positive on-chain flows and ecosystem expansion, position Solana as a potential frontrunner, should the altcoin momentum return. A glimmer of hope, perhaps? 🌟

Yet, the Ichimoku Cloud chart reveals a market indecision, a slight bearish tilt that leaves one pondering the very nature of existence. Price action hovers within the green cloud, suggesting a state of consolidation, a lack of clear direction, much like our own lives. 😅

The blue Tenkan-sen (conversion line) languishes below the red Kijun-sen (baseline), a sign of short-term weakness. The Chikou Span (green lagging line) is ensnared in the recent price action, reinforcing a neutral-to-bearish bias. Ahead, the cloud shifts to red, flat as a pancake, hinting at potential resistance and low momentum unless a strong breakout occurs. What a tragic comedy! 🎪

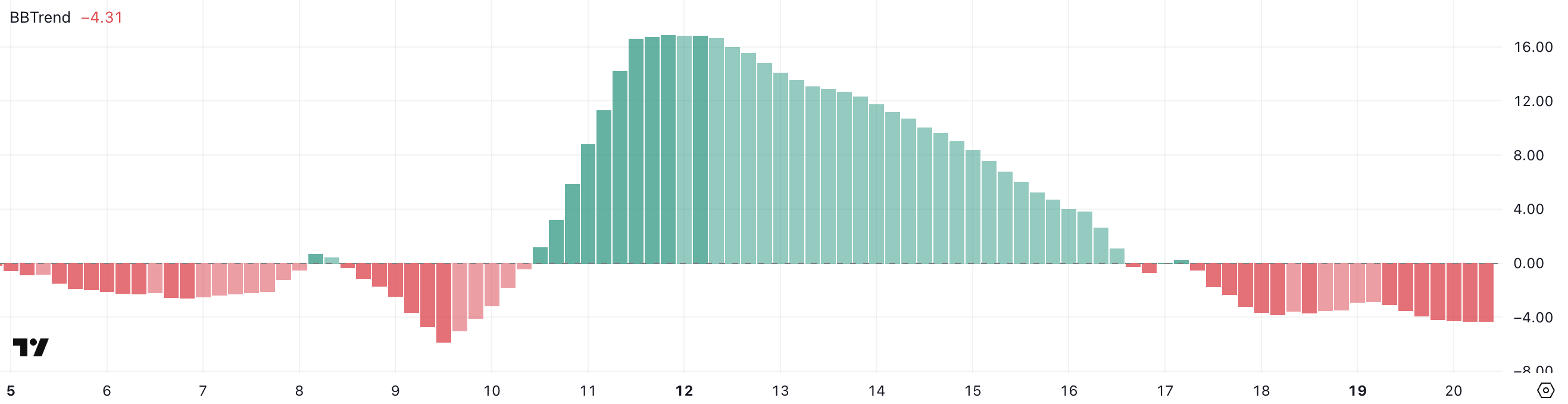

SOL BBTrend Stays Negative, Bearish Momentum Holds Below -4

Alas, Solana’s BBTrend is currently at -4.31, marking its third consecutive day in the negative abyss. Over the past several hours, this indicator has remained stable around -4, suggesting a relentless bearish pressure in the short term. How delightful! 🙄

The BBTrend (Bollinger Band Trend) measures the strength and direction of price movement relative to the width of the Bollinger Bands. Values above 0 typically indicate bullish momentum, while values below 0 signal bearish momentum. A BBTrend at -4.31 reflects strong downward pressure and limited volatility expansion to the upside. If this trend continues, it may lead to further consolidation or even a deeper pullback, unless a sharp reversal breaks the pattern. What a twist of fate! 🎢

Death Cross Setup Could Push SOL Back To $141 If $160 Support Fails

As the fates would have it, Solana’s EMA lines converge ominously, threatening to form a death cross—a bearish signal where the short-term EMA crosses below the long-term EMA. Should this occur, the SOL price may test the support level at $160. A breakdown below this level could send the price tumbling to $153.99, and if the bearish momentum accelerates, Solana may plunge further toward $141. How tragic! 😱

Yet, should Solana regain its bullish momentum, the first resistance to watch is at $176.77. A successful breakout above this level could open the door for a further rally toward the $184.88 zone. A glimmer of hope amidst the shadows! 🌈

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-05-21 00:49