Well, well, well! Bitcoin ETFs have kicked off the week with a dazzling $667 million net inflow, all thanks to the bigwigs: Blackrock, Fidelity, and Ark 21shares. And guess what? Ether ETFs decided to join the fun with a cheeky $13.66 million, courtesy of Blackrock’s ETHA. 🎉

Bitcoin ETFs Throw a Party with Four Days of Gains; Ether ETFs Join the Celebration with $13 Million!

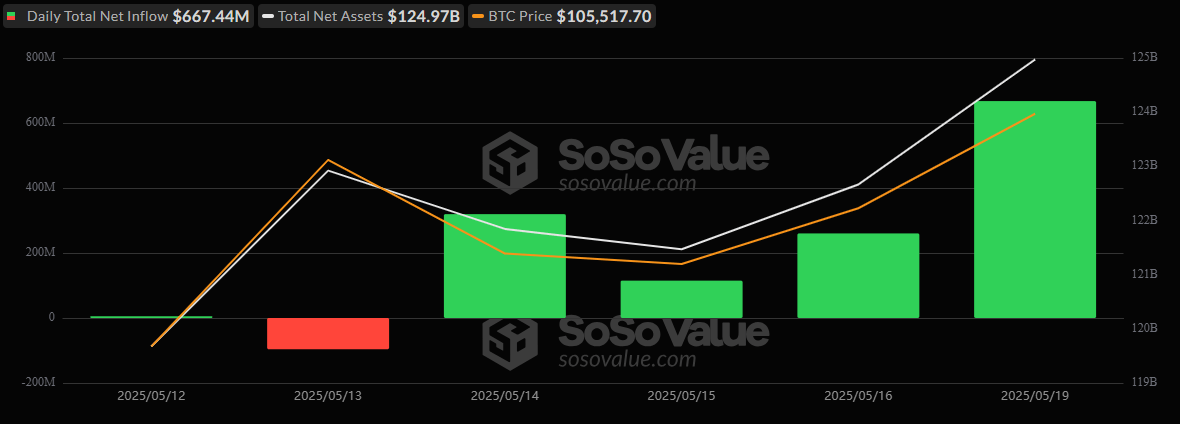

Oh, what a week it is for crypto exchange-traded funds (ETFs)! Bitcoin ETFs have strutted their stuff with a jaw-dropping $667 million in net inflows, extending their winning streak to four glorious trading days. The market is buzzing with optimism, and the only outflow? A mere blip on the radar!

Leading the charge like a knight in shining armor, Blackrock’s IBIT gallantly pulled in $305.92 million—nearly half of the total! Fidelity’s FBTC followed suit with a respectable $188.08 million, while ARK 21shares’ ARKB raked in $155.25 million, proving that institutional appetite is back with a vengeance. 🍽️

Bitwise’s BITB decided to join the party with an extra $16.02 million, while Vaneck’s HODL tossed in a modest $7.44 million. The only party pooper? Invesco’s BTCO, which saw a tiny $5.27 million withdrawal. Total value traded for bitcoin ETFs reached a whopping $3.63 billion, with net assets climbing to $124.97 billion—proof that investor confidence is soaring like a kite on a windy day! 🪁

Meanwhile, ether ETFs quietly tiptoed in, notching a delightful $13.66 million inflow, all thanks to Blackrock’s ETHA. No outflows were reported from any of the nine Ether ETF products, suggesting traders are cautiously optimistic. Total volume came in at $468.73 million, with net assets closing at $8.72 billion. 💸

With bitcoin ETF momentum soaring and ether ETFs finding their footing, everyone is on the edge of their seats, wondering how long this bullish trend can keep dancing! 💃

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

2025-05-20 16:57