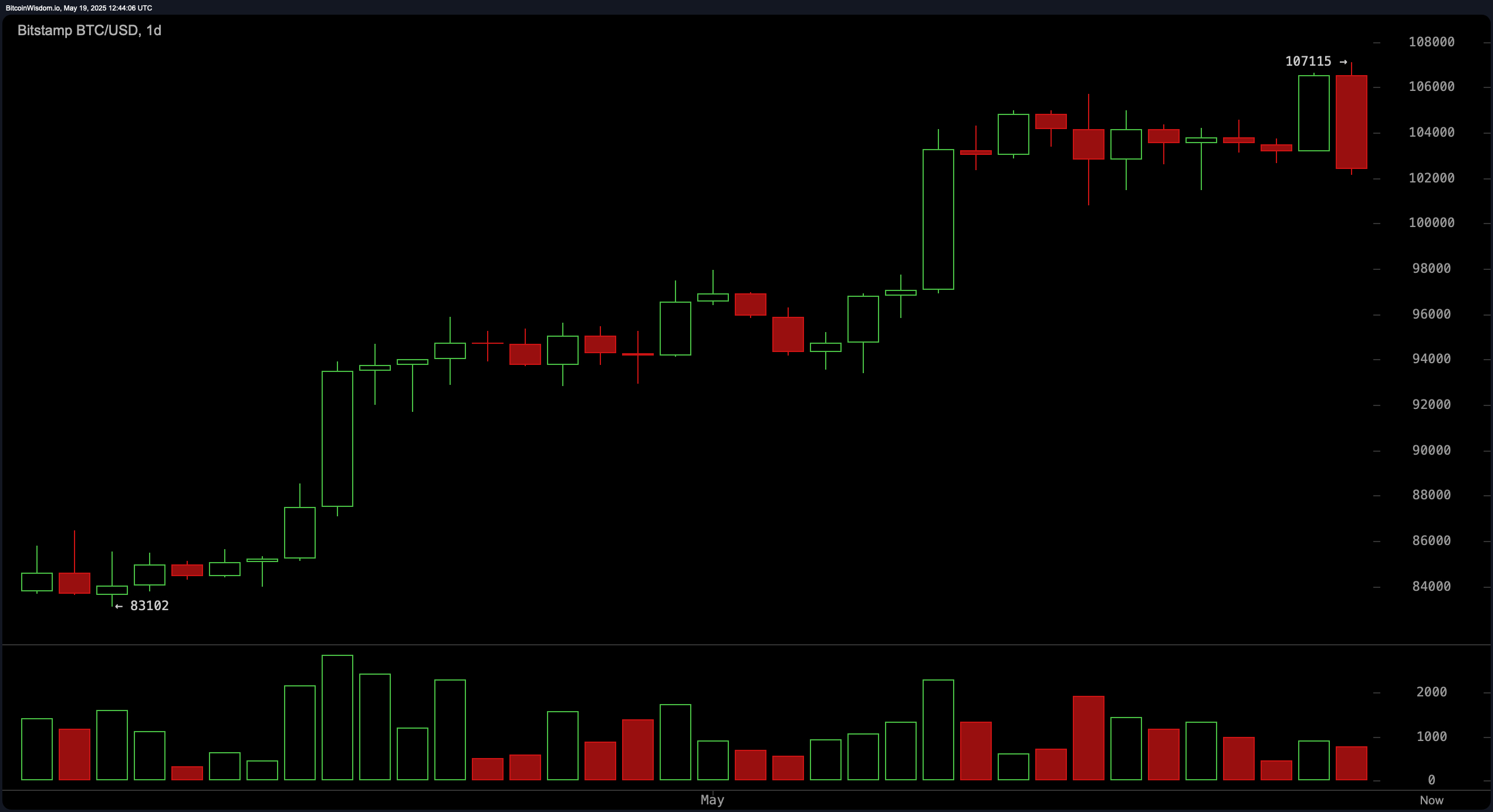

Ah, Bitcoin! That elusive digital gold that dances joyously at $102,554, boasting a market cap of $2.03 trillion. Yesterday’s volume was a staggering $47.58 billion—because who doesn’t love a little chaos—and the intraday swings flirted between $102,126 and $107,115, proving once again that the market is as predictable as a cat in a laser pointer factory. 🐱💸

Bitcoin — The Modern Midas or Just a Silver Spoon Wannabe?

Our dear crypto darling recently received a rejection at its lofty peak of $107,115—a gentle reminder that even titans stumble. The festive rally from roughly $83,000 to $107,000 has now been eclipsed by what looks suspiciously like a reversal pattern, conjuring images of bearish engulfing or a shooting star—because who doesn’t love star gazing with a side of market doom? The volume on this crimson daily candle shouts, “Sell! Sell!” loudly enough to wake the dead. Traders are now eyeing the support zone of $101,500–$102,000, perhaps in hopes of catching a falling knight, but caution is the order of the day unless that support holds firm. 🧐

The four-hour view offers more of the same melodrama—candle bodies shrinking faster than your patience during a long meeting after a strong dip, hinting that even the market’s emotional rollercoaster is taking a breather. The volume screams panic, suggesting traders are exit-stage-left with all the grace of Bambi on ice. The $102,000–$102,500 zone is being tested as support, but a slip below $101,000 might turn this tragedy into a full-blown tragedy plus plus. Until stability reigns, risk remains as skewed as a politician’s promises. 🎢

The one-hour chart is a masterclass in negativity, with each fleeting rally lower than the last, like a bad sequel no one asked for. Bitcoin is bravely attempting to rest around $102,126, but enthusiasm is as thin as a supermodel’s patience. Short-term scalping might be possible if we can get a convincing pull above $103,000 with volume to match—think of it as trying to flirt with upward momentum. But any dip below $102,000 and all hope is gently kicked to the curb.

Oscillators echo the cautious tone. The RSI at 59 whispers, “Nothing to see here,” while the stochastic at 81 shouts “Sell! Sell!” like a carnival barker. The CCI and ADX sit in the sympathy zone, neutral as a Victorian maiden. The fabulous oscillator stands at 7,833, but the momentum indicator at -663 and MACD at 3,472 hint strongly that the bearish train is still chugging along. 🚂

Meanwhile, moving averages share a mixed bag: the short-term 10 EMA (103,029) and SMA (103,871) are squeaking “Sell,” but the grander averages from 20 to 200 periods are whispering “Buy.” The overall trend, dear reader, remains ambiguous enough to give a philosopher a headache. The current price below short-term averages suggests we are in a temporary retreat—unless, of course, support levels miraculously hold, then the stage might be set for an encore at higher levels.

The Silver Lining (or just more clouds?):

If Bitcoin manages to cling to the $102,000–$101,500 zone and claims the $103,000 level with volume that screams “Look at me!”, the longer-term bullish narrative might just survive to fight another day. A solid base here could serve as a springboard for a daring push past $107,000—hope springs eternal, after all. 🌟

The Grim Reaper’s Perspective:

If the brave coin breaches the $101,000 barrier, that lovely peak at $107,115 might just be a distant memory, a bittersweet illusion. The technical indicators are saying “Beware,” and the short-term moving averages reinforce that sentiment. The brave might venture into the mid-$90,000s, but it’s a treacherous landscape—like walking a tightrope over a pit of crocodiles. 🐊

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends November 2025 Leaks: Upcoming new heroes, skins, events and more

- PUBG Mobile or BGMI A16 Royale Pass Leaks: Upcoming skins and rewards

- The John Wick spinoff ‘Ballerina’ slays with style, but its dialogue has two left feet

- Kingdom Rush Battles Tower Tier List

- Delta Force Best Settings and Sensitivity Guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Season 77 “When Hogs Fly” November 2025 Update and Balance Changes

- Stocks stay snoozy as Moody’s drops U.S. credit—guess we’re all just waiting for the crash

- ‘Australia’s Most Sexually Active Woman’ Annie Knight reveals her shock plans for the future – after being hospitalised for sleeping with 583 men in a single day

2025-05-19 16:57