Cryptocurrencies, precious metals, and equities—those darlings of the modern casino—found themselves somewhat under the weather today after a week and a half of riotous exuberance. Market pep gave way to the unmistakable symptoms of ennui. Bitcoin, meanwhile, performed the financial equivalent of fainting during a cotillion, soon swooning to a debonair but dramatically low $102,622.💸

Markets Lose Their Jaunty Swagger

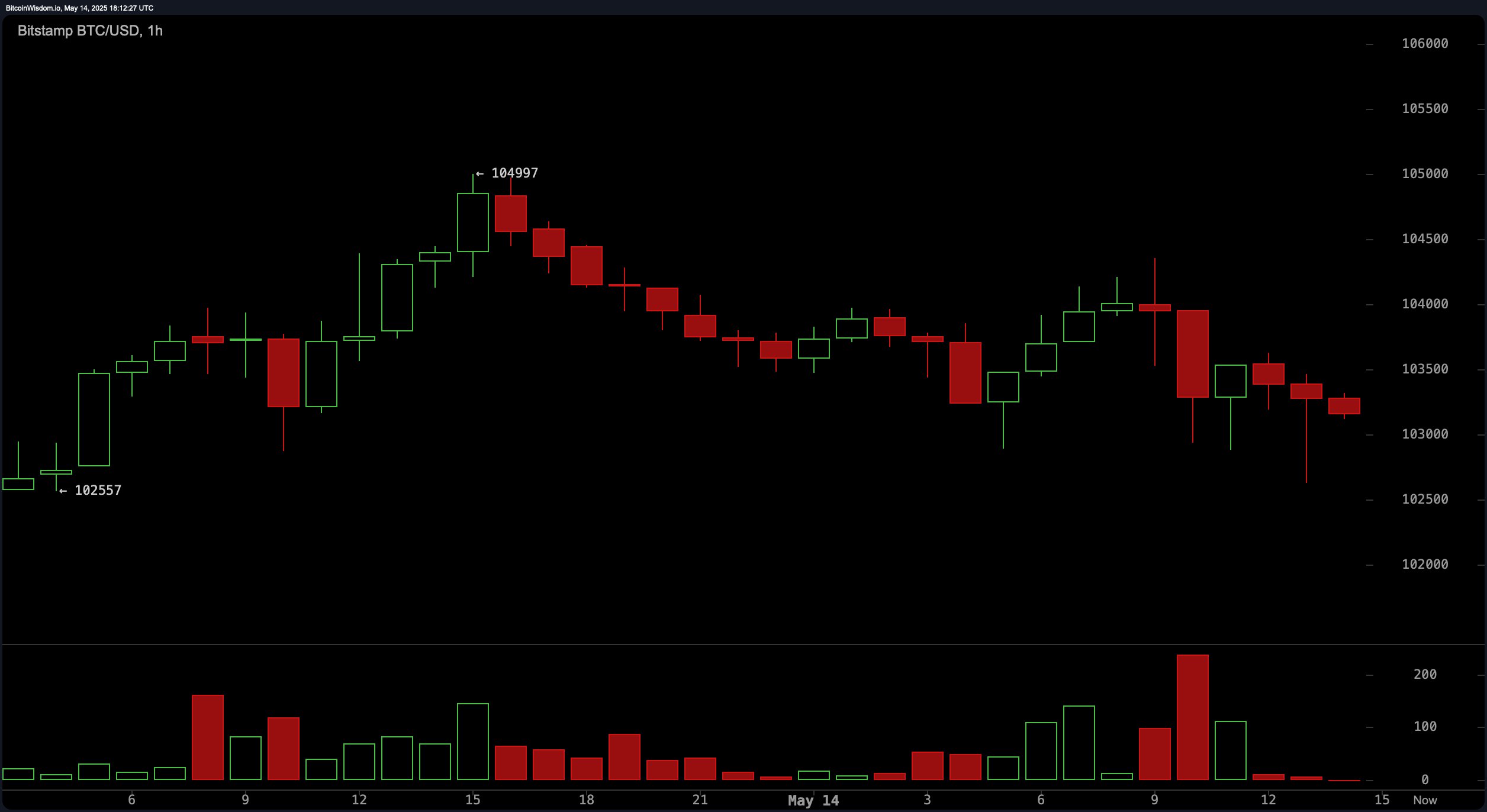

BTC, having attempted its best impersonation of Icarus and reaching $104,836, promptly remembered the sun’s heat and tumbled to $102,622 by mid-day Wednesday (Eastern time). Technical indicators—with all the subtlety of a schoolmaster’s ruler—point to “overbought” territory devolving swiftly into “oversold” malaise, after two feckless lunges at the $105,000 barricade. Both BTC and ETH resigned themselves to shedding roughly 1% of their dignity. More adventurous tokens went positively overboard.

The broader crypto bazaar took the opportunity to stumble by 1.12% in the past 24 hours—an admirable display of groupthink. Trade volume, like an enthusiastic aunt at a wedding, hovered around $146.31 billion: exactly where she was yesterday. Still, a few plucky stragglers—WAL, RAY, PENGU, and FORM—scrambled upstream, booking gains of 5-10%. By contrast, EOS, BRETT, WIF, and PI conducted their own tragic operas, losing between 9.2% and 10%. Magnificent.

Meanwhile, those venerable American equities proved themselves both lower and thoroughly mixed, like a martini with questionable gin. The Nasdaq played the part of reliable cousin by staying moderately firmer, while the NYSE Composite loosened its tie and slipped 0.55% to 19,614.91. The Dow Jones sashayed 0.28% lower to 42,022.91, and the S&P 500 executed a minute waltz down 0.02% to 5,885.17 as of 1:45 p.m. Eastern. All of this under the glowering gaze of Federal Reserve officials threatening to shut down the village fête at the first sign of fun.

Even the ancient hoards of metal suffered. Gold stumbled over 2% in one day—though it managed to avoid dropping any monocles. Silver slipped gracefully (-1.96%), trading at $32.45 per ounce and maintaining its reputation as the gentler cousin. Gold clung to $3,182, platinum limped down 0.85%, and palladium declined a whisper, just 0.24%. The euphoric chatter about trade deals appears—quelle surprise!—to be slightly exaggerated. By 2:30 p.m. (ET), bitcoin had summoned enough pluck to reacquire its footing above $103,000—if only briefly. The financial soirée, it seems, is winding down for a much-needed lie-in. 💤

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-05-14 23:27